Over the last few months, we’ve been hard at work building the architecture needed to provide accurate, insightful analytics for subscription businesses. In January we rolled out Monthly Recurring Revenue (MRR) Analytics followed by Revenue Retention Analytics in February.

Today we’re happy to announce two more analytics views added to Maxio’s arsenal of insights – Subscriber & Churn Analytics. Both of these new reports are focused around providing deeper visibility into the movements and health of your customer base.

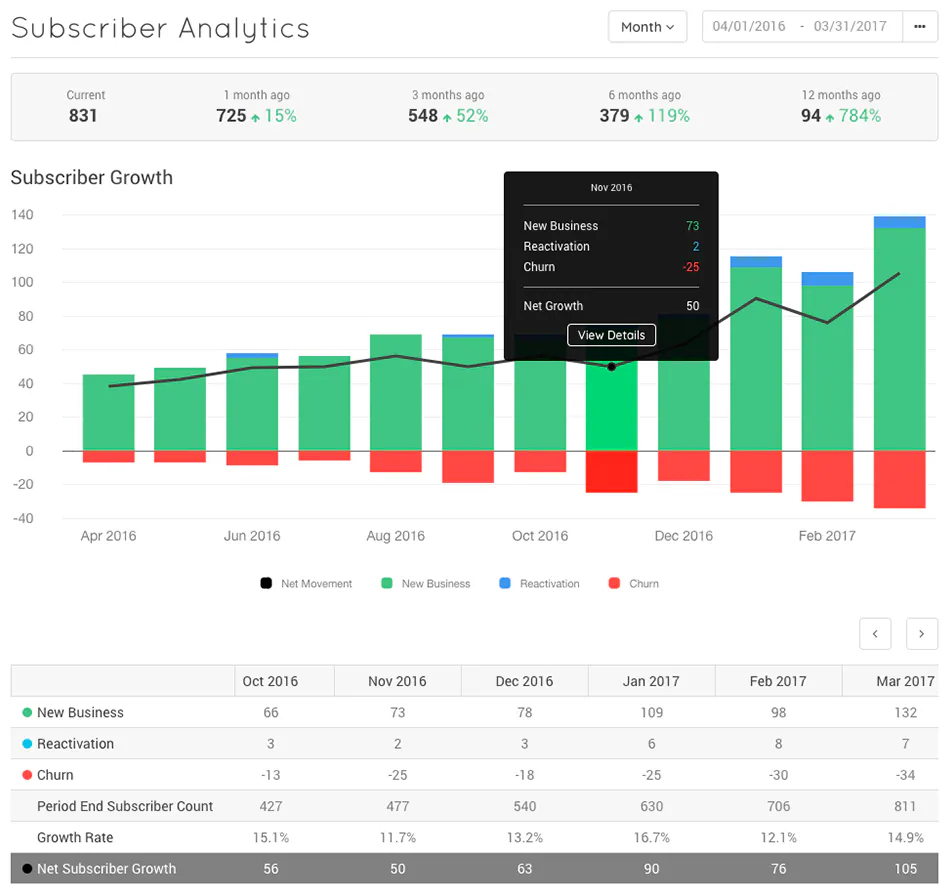

Subscriber Analytics Overview

This report provides a 10,000 foot view into changes of your customer base, a.k.a. your “subscribers.” The format may look familiar since the layout mimics the MRR report, but displays movements in relation to count instead of revenue.

At the top you’ll see a historic record of movement over the last 1, 3, 6, and 12 months followed by a tableview of Net Subscriber Growth derived from:

- New Business: New paid conversions

- Reactivation: Previously paying customers that churned and then reactivated

- Churn: Paying customers that have canceled or downgraded to a free plan

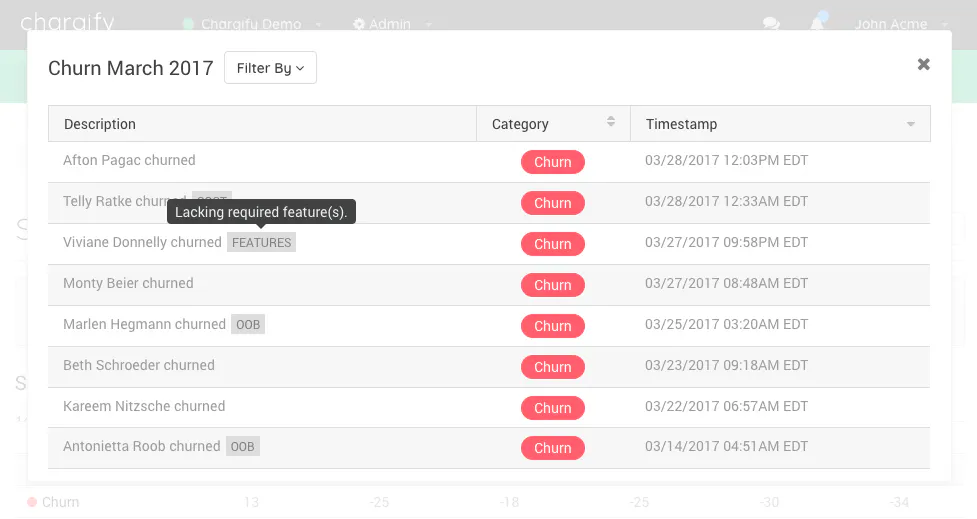

Clicking any of the movement cells zooms into a breakdown of the subscriptions that contributed to the change. If you use Churn Reason Codes, the churn breakdown also displays the reason code for each churn event.

Filter each view by the amount or date by clicking in the top cell. If you want to further investigate an event, click on the customer to go directly to their Maxio subscription summary.

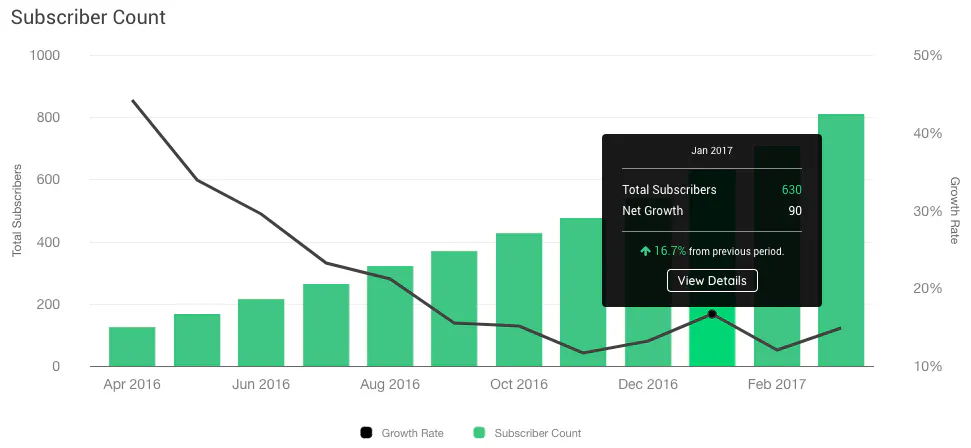

At the bottom of the report is a visual snapshot of the total subscriber count and growth rate.

Churn Analytics Overview

Churn plays a key role in the long term health of any subscription business. We could write a whole post on why churn is such an important metric to understand (and improve), but some key points includes:

- Provides visibility into the number of customers and revenue that you’re losing

- Creates a baseline to track if customer retention is improving

- Is a key variable in determining your Customer Lifetime Value (CLV)

- Helps identify who your most successful customers are (those that stick around)

- Allows for more accurate financial forecasting

There are many ways to look at churn, and we’ve organized our Churn Analytics to provide an intuitive, easy to digest view of all the key churn numbers and rates that impact subscription businesses.

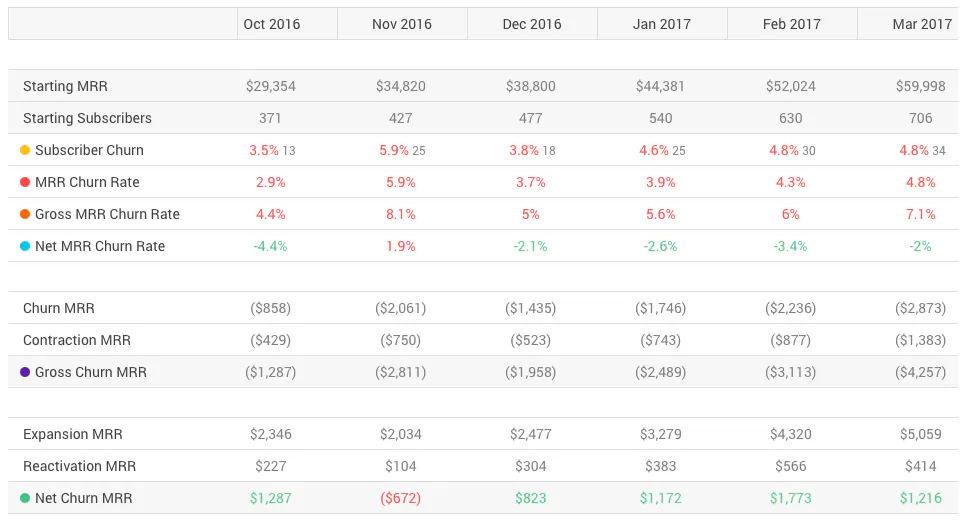

Before digging into the report, let’s look at the various churn metrics and how they are calculated. It is important to note that churn only looks at your existing paying customer base, excluding new business.

- Subscriber Churn Rate: The rate at which your customers are cancelling their subscriptions.

- Calculation: Subscriber Churn Count / Start of Period Subscriber Count

- MRR Churn Rate: The rate at which MRR is lost from canceled subscriptions.

- Calculation: Churn MRR / Start of Period MRR

- Gross MRR Churn: The sum of MRR lost from both canceled subscriptions and contraction (downgrades).

- Calculation: Churn MRR + Contraction MRR

- Gross MRR Churn Rate: The rate at which MRR is lost from both canceled subscriptions and contraction.

- Calculation: (Churn MRR + Contraction MRR) / Start of Period MRR

- Net Churn MRR: The sum of MRR lost from canceled subscriptions and contraction (downgrades) plus gained from expansion (upgrades) and reactivation (cancelled accounts that come back).

- Calculation: (Churn MRR + Contraction MRR) + (Expansion MRR + Reactivation MRR).

- Note: Net Churn MRR includes losses and gains from your existing customer base, which means it can be positive. Positive Net Churn MRR indicates the value of your existing customer base is growing without factoring in any new business.

- Net MRR Churn Rate: The rate at which MRR is lost (or gained) from canceled subscriptions and contraction plus gained from expansion and reactivation.

- Calculation: Net MRR Churn / Start of Period MRR

- Note: Because Net MRR Churn Rate is calculated using Net Churn MRR (above), it is the only churn rate that can be negative—commonly referred to as “negative churn.” Negative churn indicates the value of your existing customer base is growing without factoring in any new business.

At the top of the report you can toggle in between charts to visualize each of the key churn metrics above.

All the data that powers the charts is displayed in a table view for easy analysis.

Retention Cohorts

At the bottom of the report is a cohort that looks at retention over time. You can toggle between MRR retained as a either a percentage or dollar amount OR subscribers retained as either a percentage or number amount.

This is an extremely insightful view to understand retention over a 12 month window.

- You can compare the value at the end of any month to the total value of the month. For example, you may have had an amazing month with $20,000 in New MRR, but if the value of those signups is only $10,000 at the end of the first month, half of the New MRR was almost immediately lost to churn.

- As you get further out in the columns, you can see how sticky retention is over time for any given month. This helps to understand what were the best and worst months for retention as it correlates to initiatives. For example, did you run a marketing campaign that resulted in a lot of New MRR for a month, but those subscribers quickly fade out? Did you release a new feature that seems to have increased retention by decreasing churn over time?

Maxio’s new analytics provide visibility into the past and present health of your customer base, while providing baseline metrics to set goals, execute, and track progress against initiatives.

We’re thrilled to have rolled out our Monthly Recurring Revenue, Revenue Retention, Subscriber, and Churn Analytics over the last few months, but we know there is still work to be done. What other analytics views would you like to see in 2017? Let us know in the comments below.