Many of you reading this blog weren’t even alive in 1968 when a piece of legislation passed, giving rise to something that costs businesses billions every year.

That piece of legislation is the “Truth In Lending Act” (TLA) which includes the Fair Credit Billing Act that gives consumers the right to dispute and correct credit card billing errors. Don’t get me wrong, there are great protections from this legislation, but it was also the origination of chargebacks.

And chargebacks are on the rise, especially for subscription-based businesses with recurring billing.

Here’s why: The continued growth of “friendly fraud.” We could write a whole blog just on this, but the short version is “friendly fraud” describes consumers who make a legitimate purchase, receive the product or online service, but then file a chargeback in order to get their money back. They’ve then received the product or used the service for free, but their fraudulent chargeback costs the merchant more than just the refund.

“The added insult to the injury of losing principal amount in a chargeback, there is also some form of chargeback fees and overhead from responding to the retrieval request. And finally there is the dreaded 1% rule where if >1% of your monthly volume is in chargebacks, there are escalating fines that run into the tens of thousands of dollars,” explains Pay Finders founder Brian Roemmele.

While chargebacks afflict more B2C businesses, it is important to note that B2B businesses are also impacted by chargebacks.

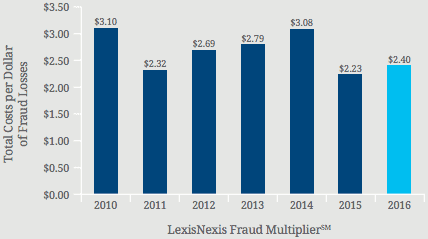

According to a LexisNexis report, merchants lose $240 for every $100 in fraud losses.

With friendly fraud and subscription businesses, there is no proration for a chargeback. The subscriber can be well into their subscription period before requesting the chargeback, and then you’re not only out the chargeback-specific fees, but also the costs related to the product/services/support already provided.

Thankfully, there are some time frames put into place. Generally, a subscriber has 120 days from the day the original transaction was purchased to request a chargeback. Times may vary slightly by specific card and reason for the chargeback.

The time limit helps prevent a subscriber from using a Netflix subscription for a year, for example, and then claiming they didn’t know they had been charged and filing chargebacks for the last 12 months.

“Most recurring payment chargebacks are due to friendly fraud, so it’s easy to imagine the considerable potential loss of revenue chargebacks can wreak on the bottom line of a company offering membership or other recurring services and products,” says B2B marketing consultant Ben Bradley.

Don’t worry, you don’t have to be completely at the mercy of chargebacks!

In today’s blog, you’ll learn 10 actionable ways subscription businesses can avoid chargebacks (or at least protect against them).

First, a quick look at why chargebacks are on the rise for subscription businesses…

Why subscription businesses are plagued by chargebacks

“Set it and forget it”

One of the reasons the subscription economy has taken off is the convenience subscription products and services provide consumers. A consumer simply purchases the subscription and then can forget about it.

Unfortunately, for subscription-based businesses, the “forget it” part of that convenience is a large part of recurring billing chargebacks.

Once they’ve signed up, subscribers often forget they made the purchase and request a chargeback when they are billed from a subscription they don’t remember purchasing.

The problem is exacerbated by longer subscription periods such as annual subscriptions — when the subscription renewal comes up, the subscriber has had a year to forget they bought the subscription in the first place. If you have a subscription product the subscriber interacts with on a consistent basis, such as Netflix, this is less of an issue. But if your customer doesn’t need to interact with your product on a regular basis, you may find yourself besieged by recurring billing chargeback requests.

Subscribers forget to cancel…until after the due date

You know those things on your to-do list that you keep meaning to do but haven’t had a chance yet? Well, that happens to your subscribers, too.

Subscribers may have good intentions of cancelling the subscription before their next billing date, but they forget. Then they’re billed for their new subscription period and the billing is a reminder that they meant to cancel.

Ideally, your customer would contact your support team to discuss cancellation and refund options available at that point. Unfortunately, many subscribers simply request a chargeback.

It is common for recurring revenue businesses to see a spike in fraudulent chargebacks at the beginning of new billing cycles.

Understanding why your recurring billing business is hit harder with chargebacks that other industries is only a small part of the bigger issue: how can your business avoid chargebacks in the first place?

10 ways to protect against and avoid chargebacks

Transparency

Well before a prospect converts to a paying customer, they’re interacting with your company’s marketing. Make sure your product or service matches what is promised in your marketing to help protect against chargebacks.

Write transparent policies that make the terms for subscribing and cancelling VERY CLEAR.

“Your sales receipt will need to include the phrase ‘recurring transaction,’ and it should also specify the timeframe and frequency of charges from a certain account,” advises the Chargeback Gurus company.

The cancellation policy should be clear, easy to understand, and included in the terms and conditions of the subscription.

Make cancelling easy

When the cancellation process is complicated, your customer is likely to become frustrated and decide it is easier to just request a chargeback.

Basically, your cancellation process should be less painful for your subscriber than calling the bank and filing a chargeback.

With that in mind, never hide or bury the “I want to cancel” buttons or links on your website, within the subscriber’s account, etc.

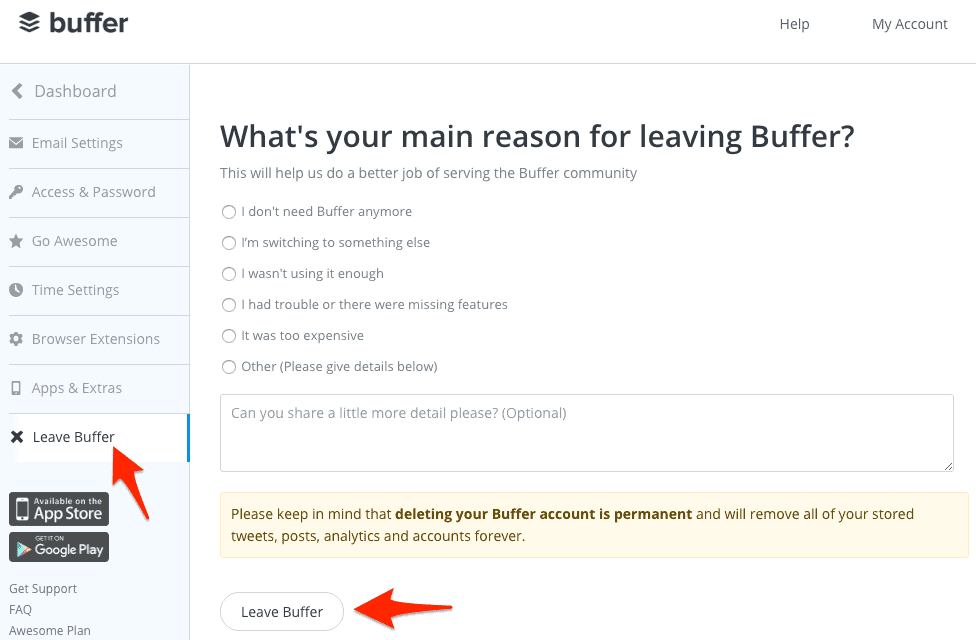

Buffer is renowned for their transparency, so it’s no surprise the option to cancel is easy to find. You can see in the screenshot above, while Buffer makes the cancellation possible with only a couple of clicks they also take the opportunity to include an exit survey.

Consider providing the option for subscribers to speak with an actual person when cancelling, which also gives your support staff the opportunity to address underlying issues related to their decision to cancel.

Encourage subscribers to contact you directly

This ties in with the points above. Whether your customer has a concern, complaint, general questions, questions about billing, or wants to cancel, you should encourage them to contact you directly and make it easy to do so.

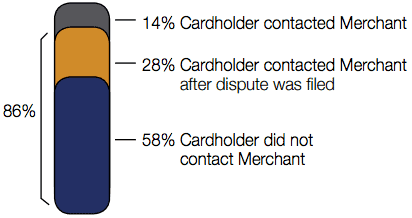

According to Verifi, 86% of consumers who filed chargebacks went directly to the card-issuing bank without ever contacting the merchant or only contacted the merchant after filing the chargeback.

When subscribers contact you directly, you have the opportunity to mediate issues and prevent the need to file a chargeback. Make sure support contact information is prominently displayed on your website and consider having in-app support for customers’ convenience.

While these measures won’t impact consumers intent on engaging in friendly fraud, they can give you the opportunity to address legitimate concerns with ethical customers.

Make sure your billing descriptor matches your company or product name as closely as possible

The billing descriptor (sometimes called the “credit card statement identifier”) is the company or product description that will show on the consumer’s credit card statement. The field is usually limited to 25 characters, plus your phone number.

If your company DBA is the brand consumers are familiar with, but the billing descriptor is the name of your incorporated company, you’re likely receiving many chargebacks as a result.

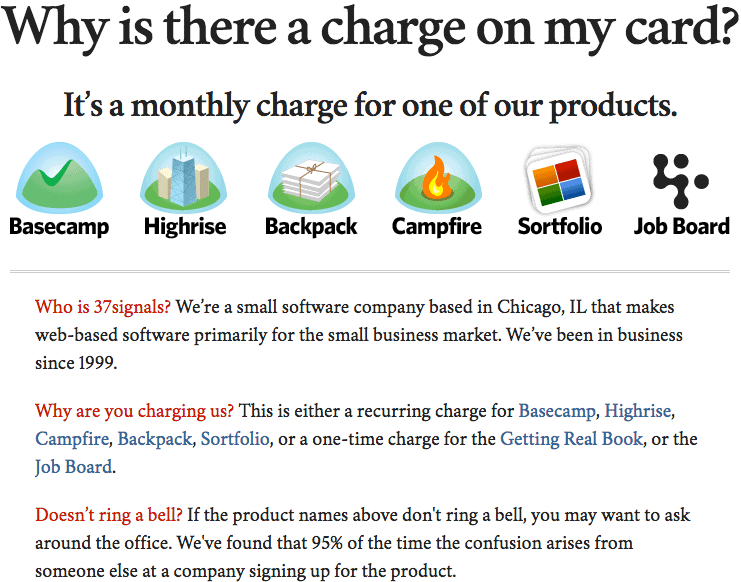

37signals experienced this exact issue:

“One of the issues we have at 37signals is that many people know our product names better than they know 37signals. They sign up for Basecamp or Highrise without knowing that there’s a company called 37signals behind the product,” explained co-founder Jason Fried.

Fried took a unique approach and set the billing descriptor as 37signals-charge.com. You can see what the billing descriptor looks like on their customer’s credit card statements, above. Then he created a corresponding landing page (screenshot below) for that url that explains “the charge, the products, some suggestions if you don’t recognize the products, and a link to our billing support form [if] someone needs additional help.”

This was done back in 2008, but the results are still worth sharing today: “chargebacks as a percentage of total sales were down 30%.”

Make the order summary clear for customers before they finalize the purchase

You’ll want to provide a summary of the order, making the terms of the subscription crystal clear to the customer, before they finalize the purchase. Include on the summary:

- Reminder that it is a recurring transaction

- If the recurring transaction amount is variable or fixed

- The exact amount that will be billed for each recurring transaction

- The exact amount being billed on this initial purchase

- Date of the transaction

- How you’ll be communicating with the subscriber (email is usually the communication method of choice)

The summary gives the customer the opportunity to confirm all the above information, and their confirmation of that information can help protect you if a chargeback is filed. You may also want to have a separate check-box indicating the subscriber’s agreement to the terms of service. Many subscription businesses require such a check-box to be checked in order to complete the purchase.

Make sure your users understand how your free trial works (and at what point they’ll be charged)

First, make it very clear to users exactly how long the free trial is. Then, when the trial is ending, reiterate the end of the trial is coming up.

If you’ve asked for trialers’ credit card information at trial sign up, you should still make sure users understand they’re automatically being moved to a paid plan at the end of the trial.

You should also look at whether asking for credit card information prior to trial is even necessary.

In our blog “Top 5 Ways To Improve Free Trial Conversions & Revenue,” we discussed study results that revealed trial signups and conversions were more successful when credit card information was not requested during the trial signup.

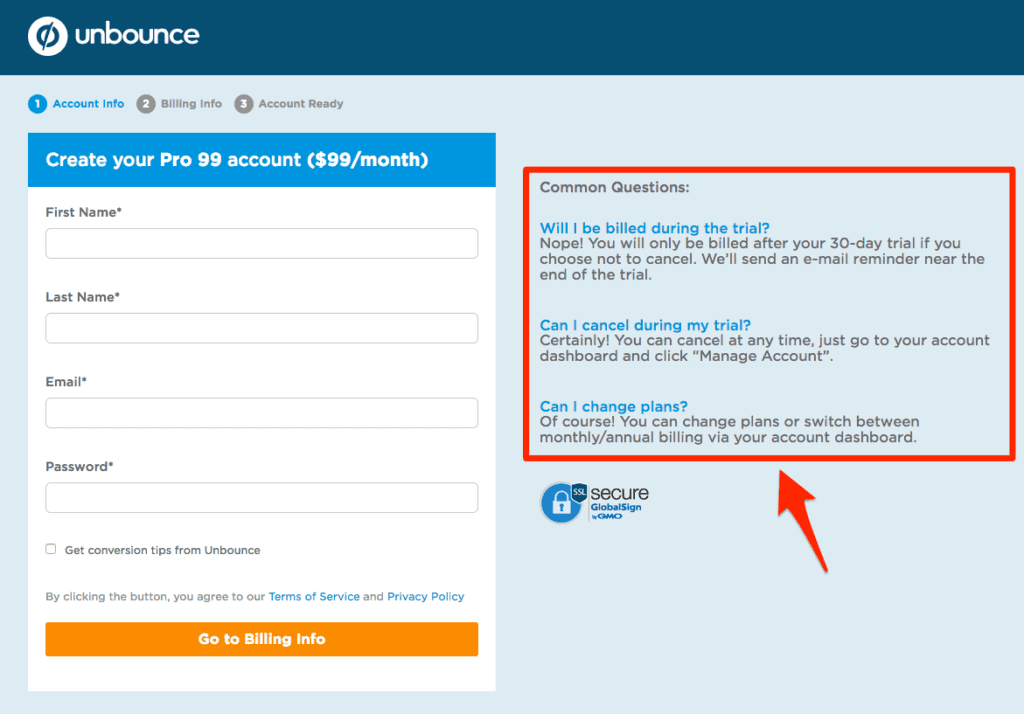

Unbounce does a great job of addressing common questions right at signup for their free trial. Having trial FAQs on the same page as the signup is a great way to ensure trialers understand how the trial works and at what point they’ll be charged.

Notify the customer prior to each recurring billing

Yes, they confirmed at the time of purchase that they’re agreeing to the recurring billing, but to protect against chargebacks it is worth notifying the subscriber before you bill them at the renewal of each subscription period.

“As a best practice, routinely notify cardholders of regular recurring transactions charged to their Visa account at least ten days in advance. The advance notification should include the amount to be charged to the account and where necessary, alert the cardholder if the transaction amount exceeds a pre-authorized range. Local law may impose specific requirements for this notification,” according to Visa guidelines.

Always notify the customer if the amount they’ll be billed exceeds the pre-authorized recurring billing amount!

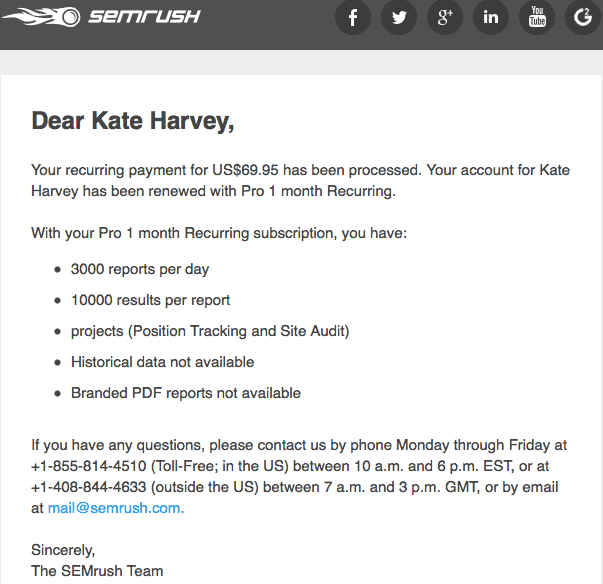

You may also want to send a confirmation of payment to the subscriber (below is the payment confirmation email I receive from SEMrush). It may seem like overkill, but having an additional alert to the subscriber regarding a charge they’ll be seeing on their credit card statement is just one more way to help protect against recurring billing chargebacks.

Be proactive with anti-fraud steps

The tips mentioned thus far for chargeback prevention have centered on the premise that the customer is a legitimate customer. Another important part of protecting your business from chargebacks is to prevent fraudulent transactions.

While it can be tempting to ask for only the most basic billing information to reduce friction and improve conversion rates, doing so leaves your subscription business more vulnerable to fraud and fraud-related chargebacks. In addition to the basics:

- Ask for the Card Verification Value (CVV) code from the credit card being used for the purchase. The CVV code is a 3 or 4 digit number that only the cardholder should have.

- Use the Address Verification System (AVS) to compare the credit card billing address being provided to the address on file with the credit card company. This can usually be enabled through your payment gateway provider.

Offer refunds

This isn’t a popular option among subscription businesses, but if a subscriber is unhappy enough they’re going to want their money back one way or another — better to give them a refund than have them file a chargeback.

This doesn’t mean refund anyone and everyone who asks. You’ll want to look at the subscriber’s history with your company and pay special attention to signs of problematic or irate customers.

“In the end, refunds don’t matter in SaaS. Because it’s all about recurring revenue. Once they cancel, they’re a write-off no matter what the refund is, unless you can get them back later (which you may) … so don’t sweat the small stuff here and treat people the way you’d want to be treated. Maybe they’ll come back later,” advises Jason Lemkin.

While Lemkin specifies SaaS businesses, his point applies to all subscription-based businesses.

Offer tiered pricing plans

Tiered pricing plans offers subscribers the option of upgrading or downgrading to fit changing business needs versus having no other option than to cancel when a one-size-fits-all subscription plan no longer fits their needs. If your customer can retain access to your product/service at a lower cost moving forward, they may find this satisfactory enough to put them at ease and not get irate.

When a chargeback does happen, respond promptly

What to do once a recurring billing chargeback is filed is a subject for another post, but we do want to include in today’s blog how important it is to respond in a timely manner to chargebacks:

“It is absolutely important that the Retrieval Request is responded to in less than 48 hours. I am aware that you may be told you have 15 or so days, just answer in 48 hours or less. You are fully able to contact the customer and to negotiate a solution that does not involve the chargeback and ask the customer to see if they are willing to rescind the chargeback. This may not stop chargeback fees from the Acquiring bank, but it will limit the number of chargebacks attributed to your business,” says Roemmele.

Final thoughts

Yes, as a subscription business you’re likely plagued by more chargebacks than other types of businesses, but there are a number of things you can do to protect your business from recurring billing chargebacks.

What steps or methods have you found to be most effective in preventing chargebacks for your subscription business? Let us know in the comments below — we always appreciate your feedback.