It’s not often accounting folks get to wear a cape and be the hero of the story. There just aren’t many fairy tales where a Big 4 CPA turns business operator, revolutionizes the collection process, and gets a day named after them in their hometown.

But make no mistake, if you see the cash conversion cycle in action – I mean truly RIPPING – it’s nothing short of magic.

Maybe I shouldn’t say “see.” The CCC is something you have to “feel” to truly understand. I experienced its wonders first hand last year. I’m the CFO at a company where we got our Days Sales Outstanding (DSO) down from 55 days to 37 days in the course of a year. That’s an 18 day improvement, or 33%.

And through some shrewd negotiating, we got our Days Payable Outstanding (DPO) up from 35 days to 47.

And as a company that doesn’t produce physical widgets, we had no inventory. Our Cash Conversion Cycle was now negative 10 days.

From Tactical Changes to Real Results

What’s the net of it all? As a cash-burning company, this allowed us to hire three more people over the course of 12 months. Those three people happened to be developers, who helped us get new products to market faster, and increase revenues.

OK, so let’s get tactical. How did we do it?

1. Adjusting Customer Agreements

First, we simply changed our “off the shelf” customer agreement. Every company has one. And it probably hasn’t been updated for… well, a long time.

Instead of 45 days, anyone new was handed a template that had 30-day payment terms penciled in. If they accepted the terms as they were, boom. We were already in the money by 15 days.

We had long accepted that 45 days was industry standard. It sounds dumb – but we let inertia hold us back. We finally said, damn the torpedoes. Let’s just try it and see who pushes back.

The result: Only 5 out of 20 new customers said something.

The lesson: Change it and see who complains. It’s never as loud as you think.

2. Encouraging ACH Payments

Next, we tried to convert customers who sent us physical checks each month to put down the pen and start paying us online via ACH.

This was a pain, I’ll admit it. It involved conversing directly with the payables teams of about 50 customers via email and phone. Just finding the right person was often difficult, especially when you are dealing with multinationals who have massive billing departments. I’d say half we sorted without picking up the phone, and the other half we had to have (SCARY) a real-life conversation.

What I discovered was the person on the other side either kicked it up to their boss, causing a bit more back and forth, or really didn’t care to make a fuss and agreed. We did have to send over a few W-9 forms again (they seemingly always get lost. If you know, you know.) and sign a few papers. But hey, it was well worth it.

After that, we took inventory (no pun intended) of who was left paying us with paper checks (dinosaurs!). In the background, we set up a lockbox run by our bank in a central location in the US. This is a small thing, but we are located in MA and most of our customers were sending checks from their HQ in the Midwest or South. We were able to pick a lockbox closer to them to cut down on mailing “float” by a day.

We notified them that we had set up a lockbox with our bank, and provided them a new address to send the checks to going forward. This also meant we no longer had to go to reception at our shared office space each week, fish through the myriad of envelopes and junk mail, open the letters, and deposit any checks via mobile. This part of the process was a self-inflicted wound we were determined to rectify.

The days of losing checks were over! I hate to admit it but it does happen. At the time we were receiving more than 50 checks a month, which was a headache to keep track of and scan. It gave back at least half a day per week to a member of our accounting team.

As luck (or math) would have it, the interest we made on the account from deposits easily made up for the fees associated with the lockbox. Checks were getting deposited on average four days earlier, and cleared our bank account about a day faster than mobile, since it was the bank doing it on our behalf.

So that’s how we systematically changed our collections.

The result: We dropped 18 days like a bad habit.

The lesson: Never underestimate the power of small operation changes.

But we didn’t stop there.

3. Renegotiating Payables for Better Terms

The next element of the cash conversion cycle we attacked was payables. The majority was tied up in software we paid other tech companies for, which we used to either build our product, market our product, or communicate with other employees internally. The good thing about software is that if you are on annual contracts, each year you have a built in chance to “play ball” and renegotiate terms. So upon renewal, I started asking for quarterly payments on every software contract I signed. Most of the reps I spoke to had a much easier time pulling this lever internally than price. We went from having 80% of our contracts billed annually and upfront, to more than half being quarterly… a few even in arrears!

The biggest contract I renegotiated was Salesforce, moving a massive up front annual payment to quarterly payments. This alone was a game changer. A big whack of cash no longer vanished from our account each year. It went in drips.

And remember, interest rates were also rising at the time. So the cash I kept on hand longer collected interest longer which helped pay off the lockbox fees and more. The interest that year helped pay for 4 more developer salaries. But that’s for another day…

The result: We improved our DPO by 17 days by asking for quarterly payments at renewal.

The lesson: Payment terms are an easier lever to pull than pricing asks in a negotiation.

A Note on Inventory Management

There’s a conspicuous part missing from my CCC story: inventory. You can’t touch the products that my company builds – they’re bits, not bites (or whatever the saying is). But don’t forget that for the majority of companies in the world, managing inventory is a massive headache.

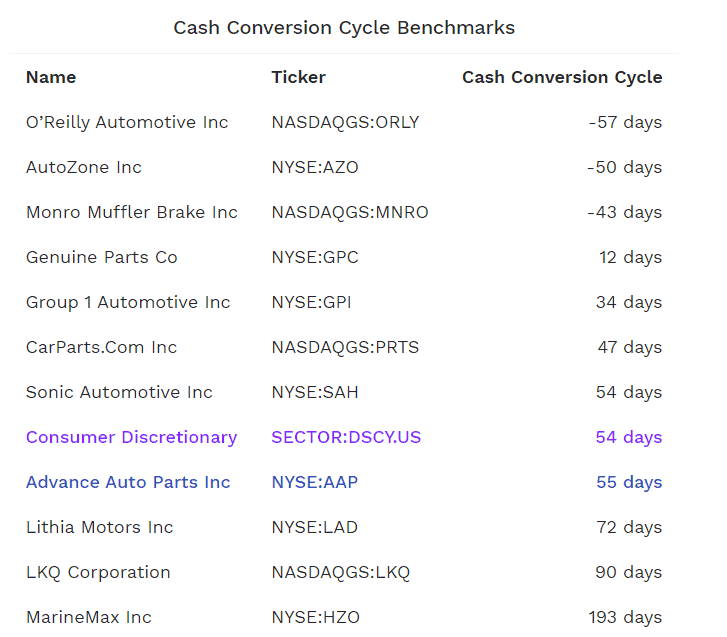

Much like the saying “planes don’t make money on the ground,” you could say that “clothes in a warehouse” or “car parts on a shelf” don’t make money either. I’ve taken some snapshots below of auto and apparel industry cash conversion cycles to give you a peak into who’s winning their CCC battle. The amount of cash tied up in inventory can seriously constrain growth.

I’ve anecdotally heard that some of the major auto suppliers don’t pay their suppliers until stuff has actually been purchased off the shelf. That’s the ultimate test of power in the relationship.

The result: Growth can actually kill a company with inventory management problems.

The lesson: Inventory management terms are a true test of power in a vendor relationship.

Trust the Process

Overhauling my company’s cash conversion cycle was a journey – not a one time “event.” It was more tactics than strategy. And it wasn’t without its frustrations. For example, some suppliers continued sending paper checks to our old address for five more months. But if you trust the process and remain consistent in your communications and negotiations, it proves out in the numbers.

My favorite email I sent all year was one to my CEO, congratulating my controller on this overhaul and explaining how it freed up resources for growth. And he agreed – our accounting team was nothing short of heroes.