Billing and Financial Operations for B2B SaaS

Power your monetization engine with Maxio, the only billing and financial operations platform purpose-built for B2B SaaS. Let us handle billing, collections, and reporting so you can focus on what’s next.

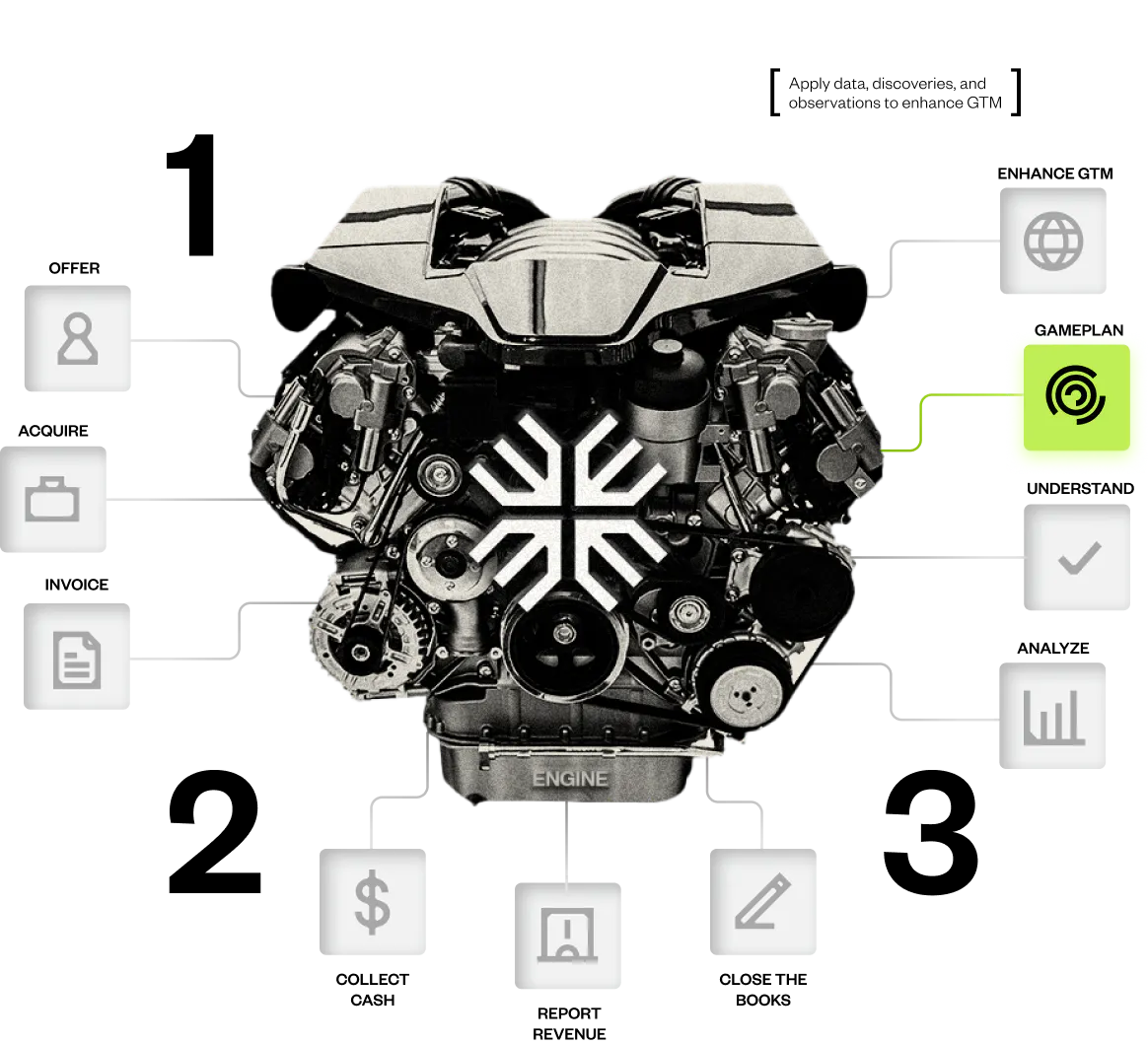

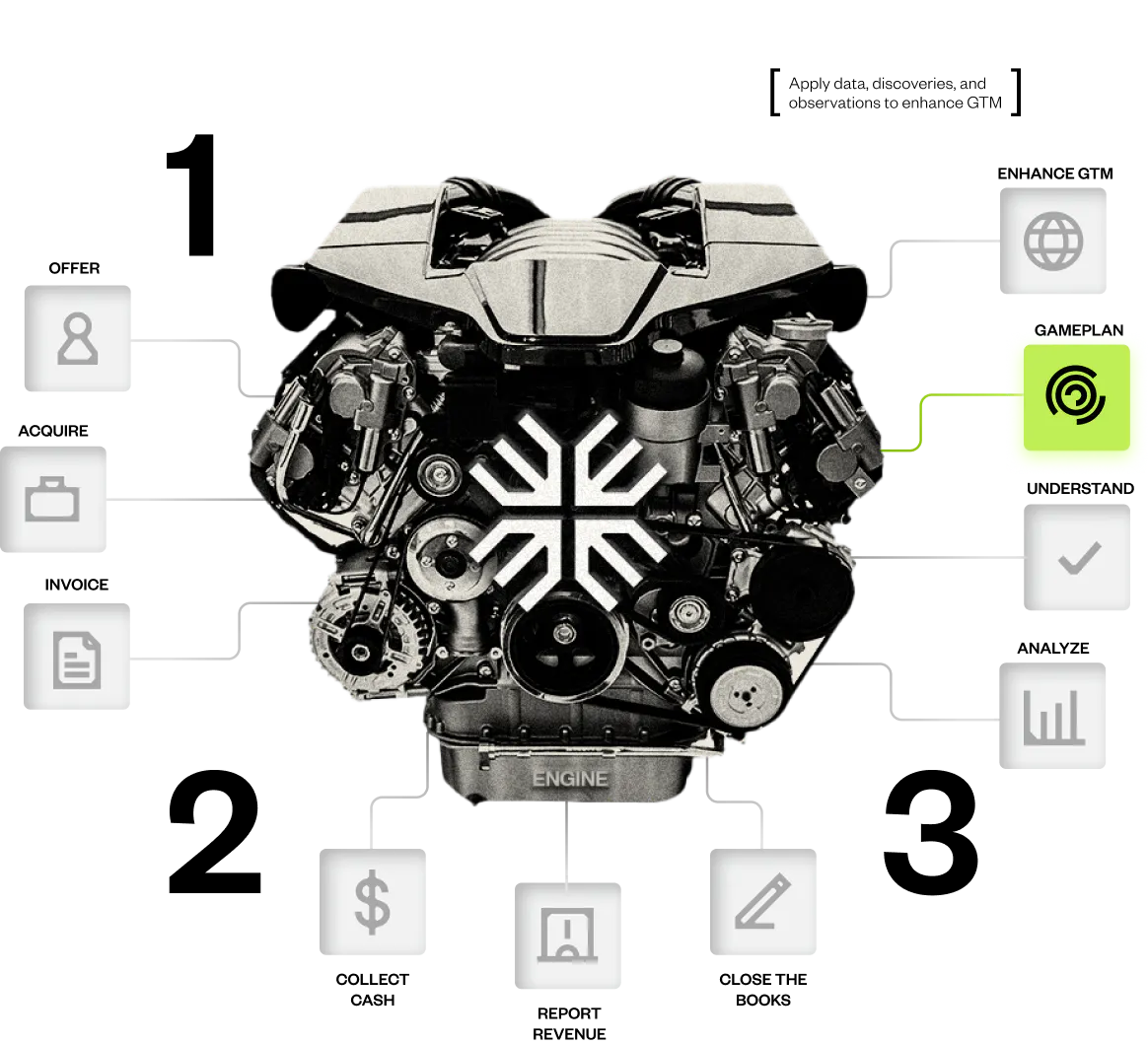

The billing and financial operations platform at the heart of your B2B SaaS monetization engine

Every B2B SaaS company needs a core set of people, processes, and technology to power their monetization engine.

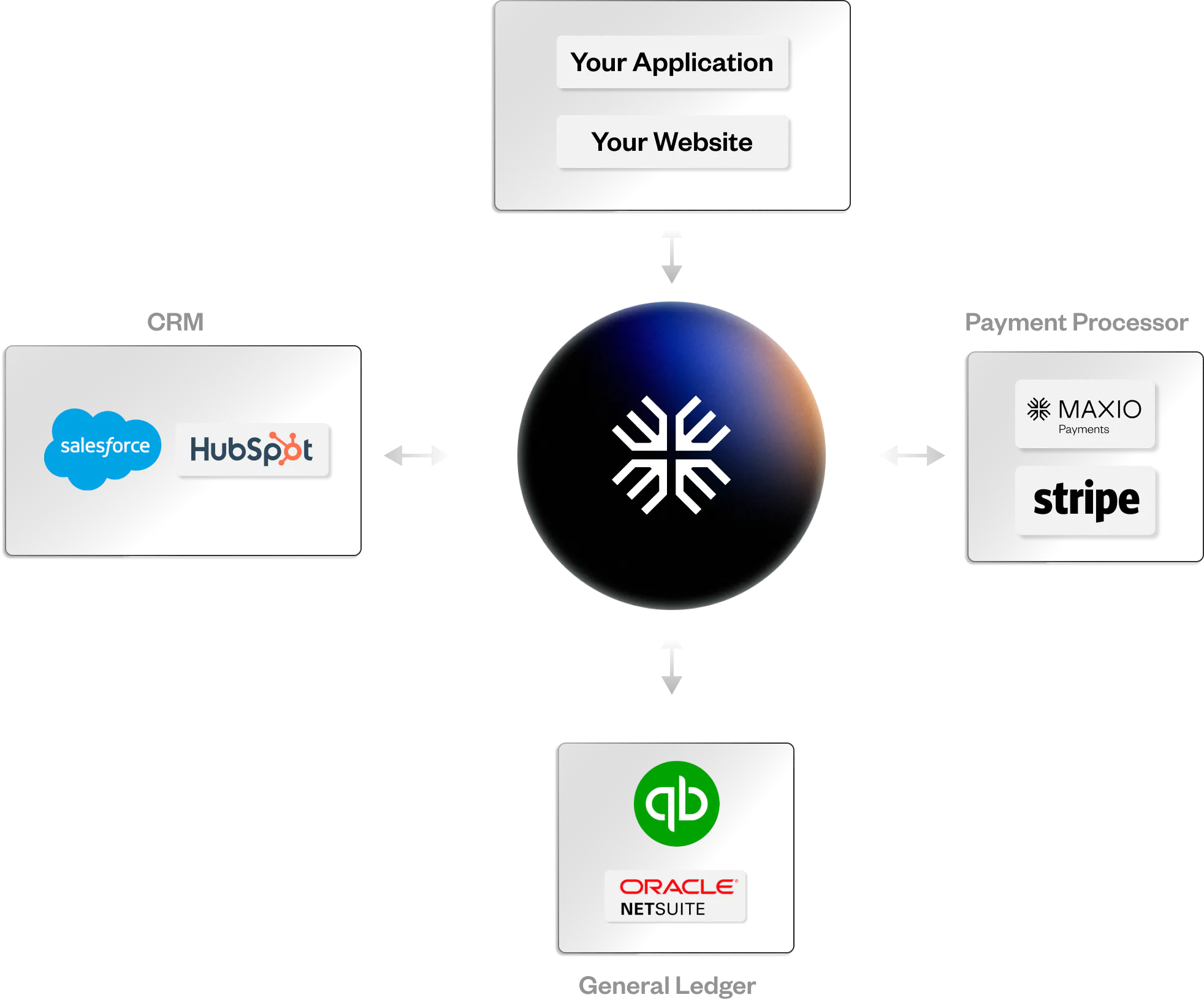

Maxio sits between the CRM and General Ledger, automating the order-to-cash process and allowing you to bill customers, collect cash and report on the metrics that matter to your business.

Maxio powers your monetization engine at every step

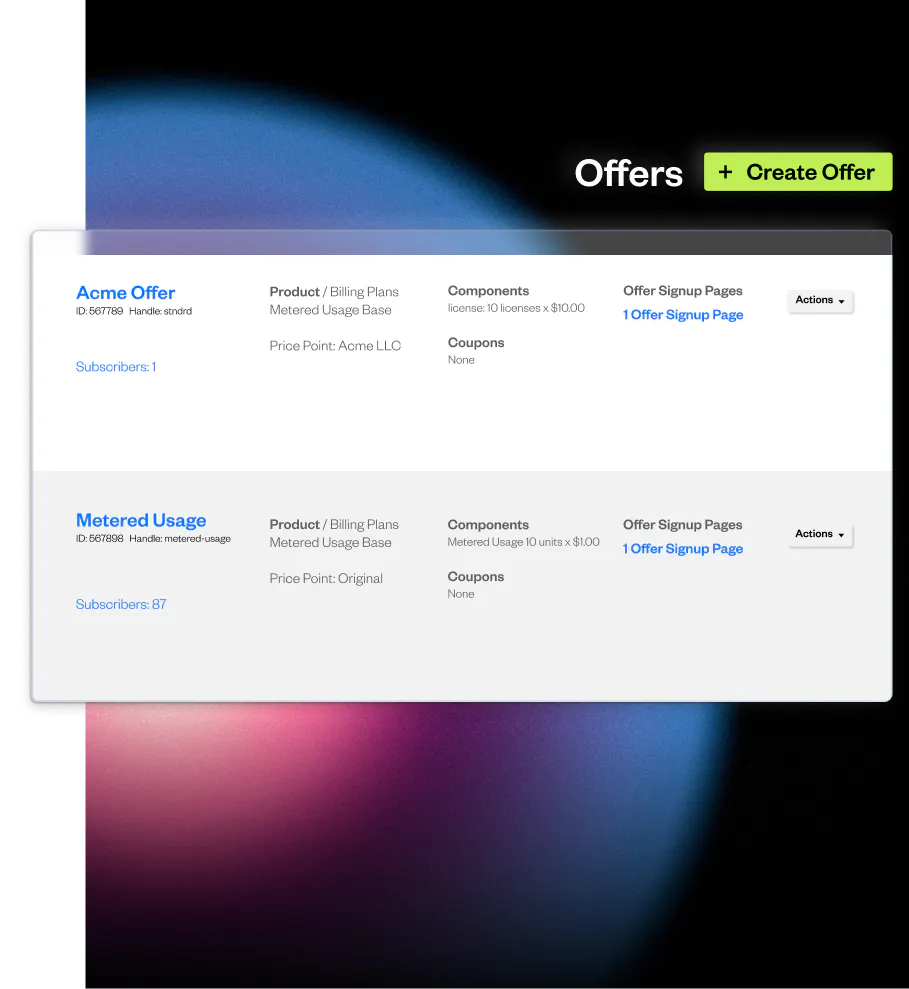

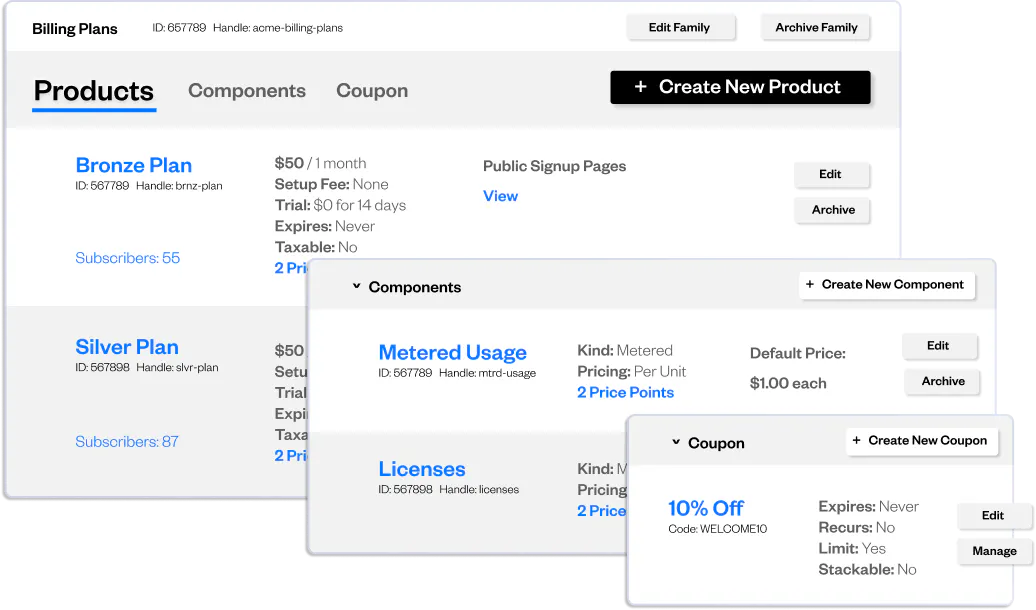

Offer

Curate custom offers for your customers composed of different products, components, and coupons. Bill and price the way you want.

Within Maxio’s Advanced Billing module, you can define your product catalog inclusive of:

Items your customers will subscribe to, including price, recurrence, taxation, and an optional trial period.

Line items which can be added to a product as needed, such as add-ons, upsells, and usage-based pricing options.

Standardized discounts you define to personalize offers and close deals faster.

The amount you charge customers for products and components.

Combinations of the essential product catalog building blocks (products, components, and coupons) into packages that are easier to bring to market.

Offers can be presented as a quote to a prospective customer using offer signup pages.

Acquire

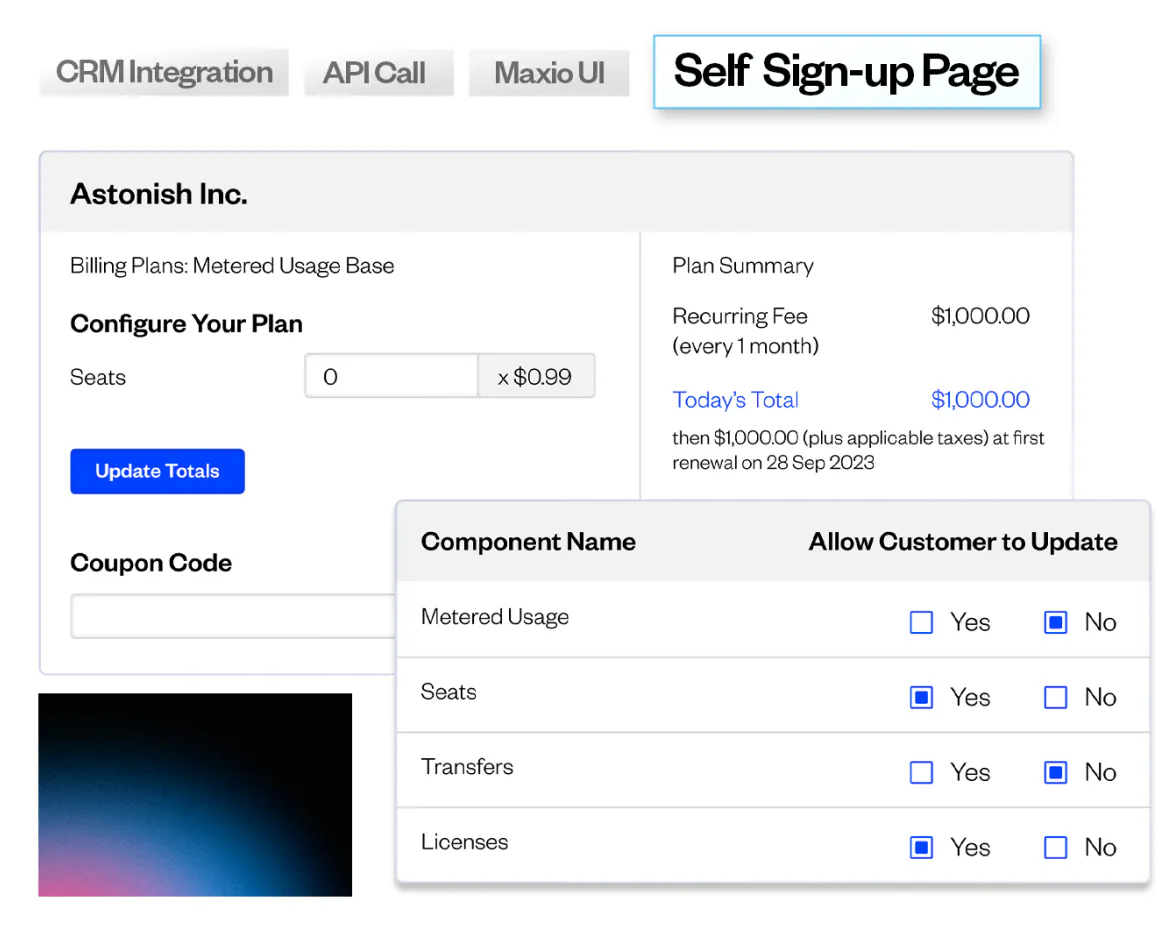

Pipe your customer and order data into Maxio via a CRM integration or allow your customers to purchase through your website or application. There are multiple ways you can acquire customers and get customer and order data into Maxio:

- CRM integration: Maxio integrates with best-in-class CRMs, such as Salesforce, HubSpot, and Pipedrive.

- API call: Maxio’s Advanced Billing module offers a robust API, meaning you can bill directly from your application.

- Maxio UI: Create customer records and subscriptions within the Maxio Advanced Billing user interface.

- Self-service pages: Create customizable, branded sign-up pages for products or offers and enable your customers to self-service.

Invoice

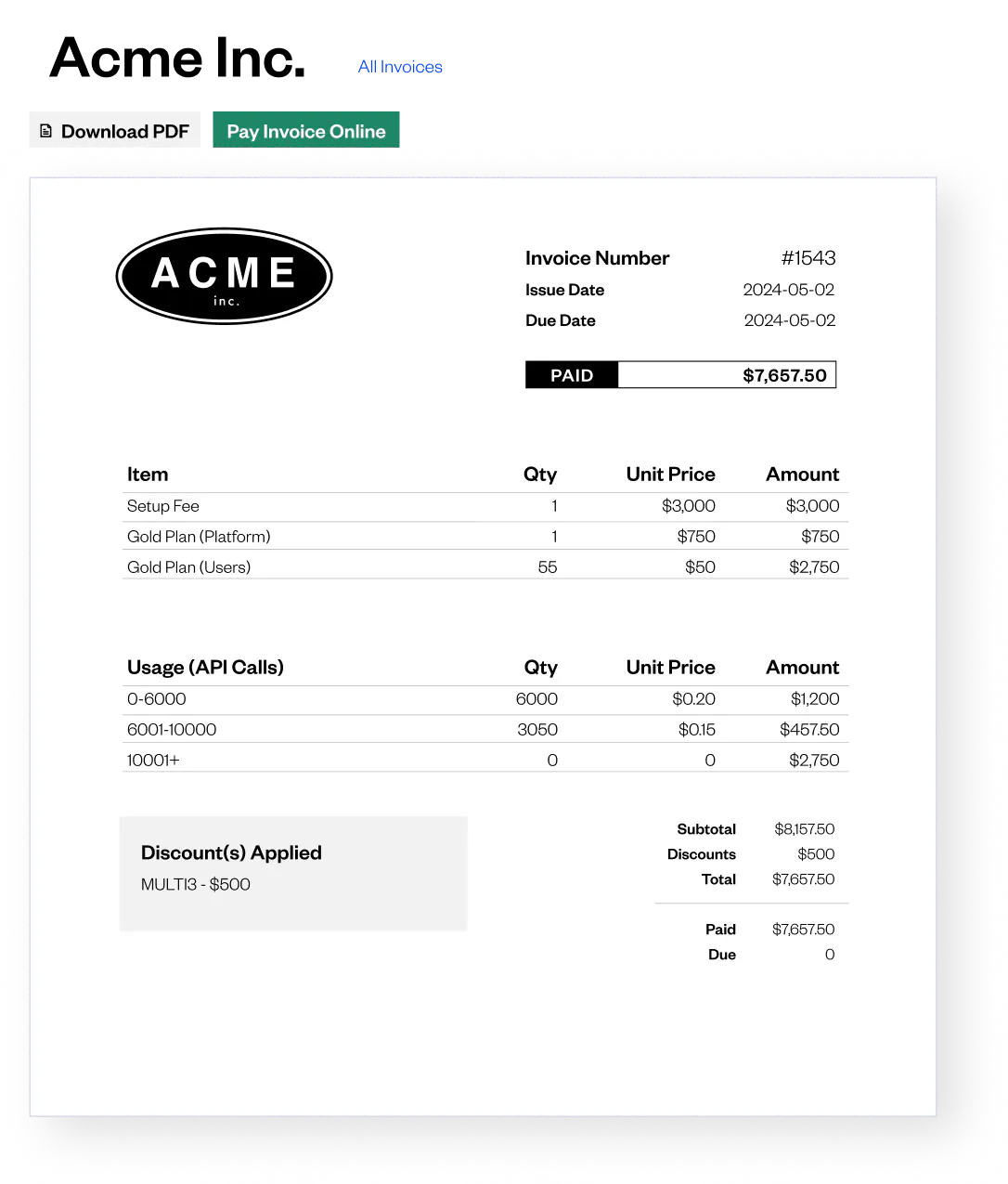

Enrich your customers’ billing experience with customizable invoices. Allow your customers to pay and track historical invoices via a billing portal.

Maxio Advanced Billing invoices can be generated either automatically or manually. Invoices will fall into one of the following statuses:

Draft | Pending | Open | Processing | Paid | Voided | Canceled

Discounts on a line item derive from your coupons. Coupons don’t necessarily apply to all line items, as it’s possible to apply a restriction by product or component within your product catalog.

Credits are captured in credit notes. A credit note is like a “reverse invoice” — it contains line items representing the amount credited to specific items (products and components).

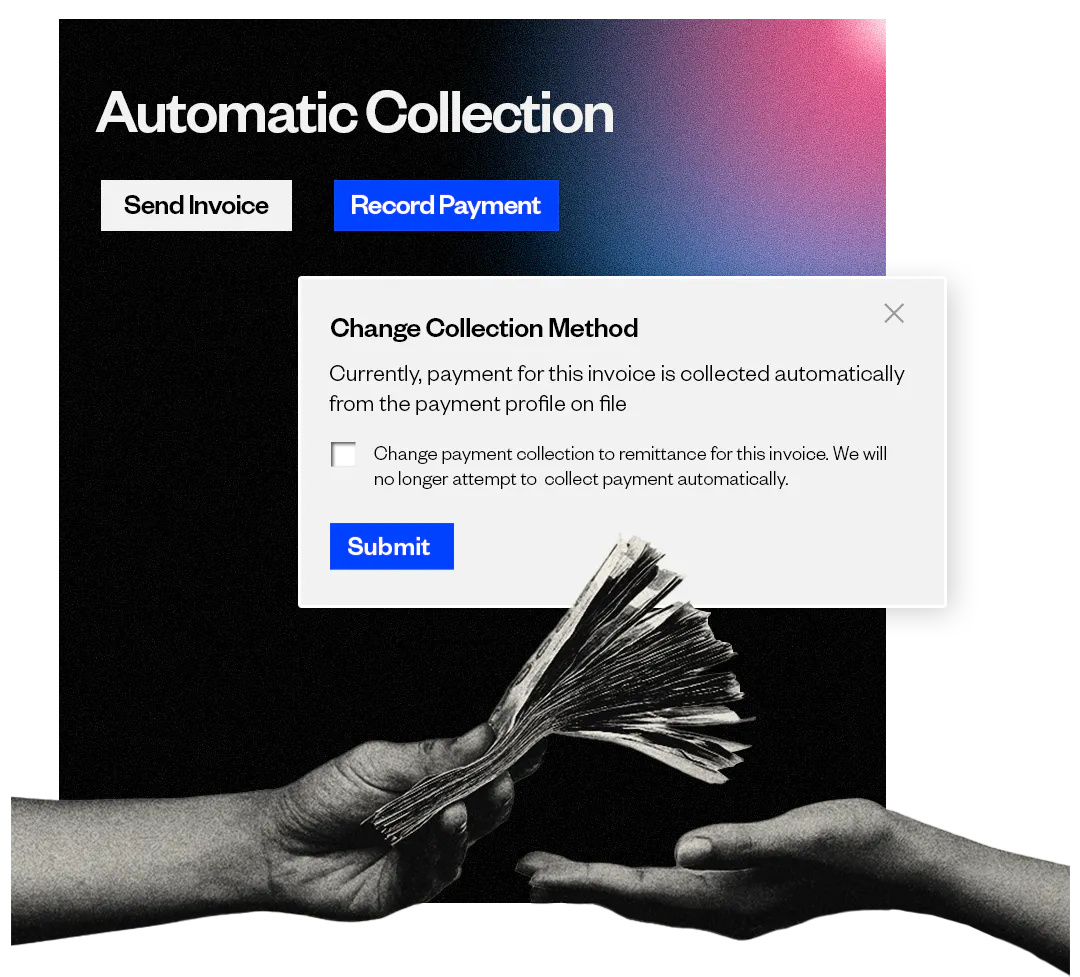

Collect Cash

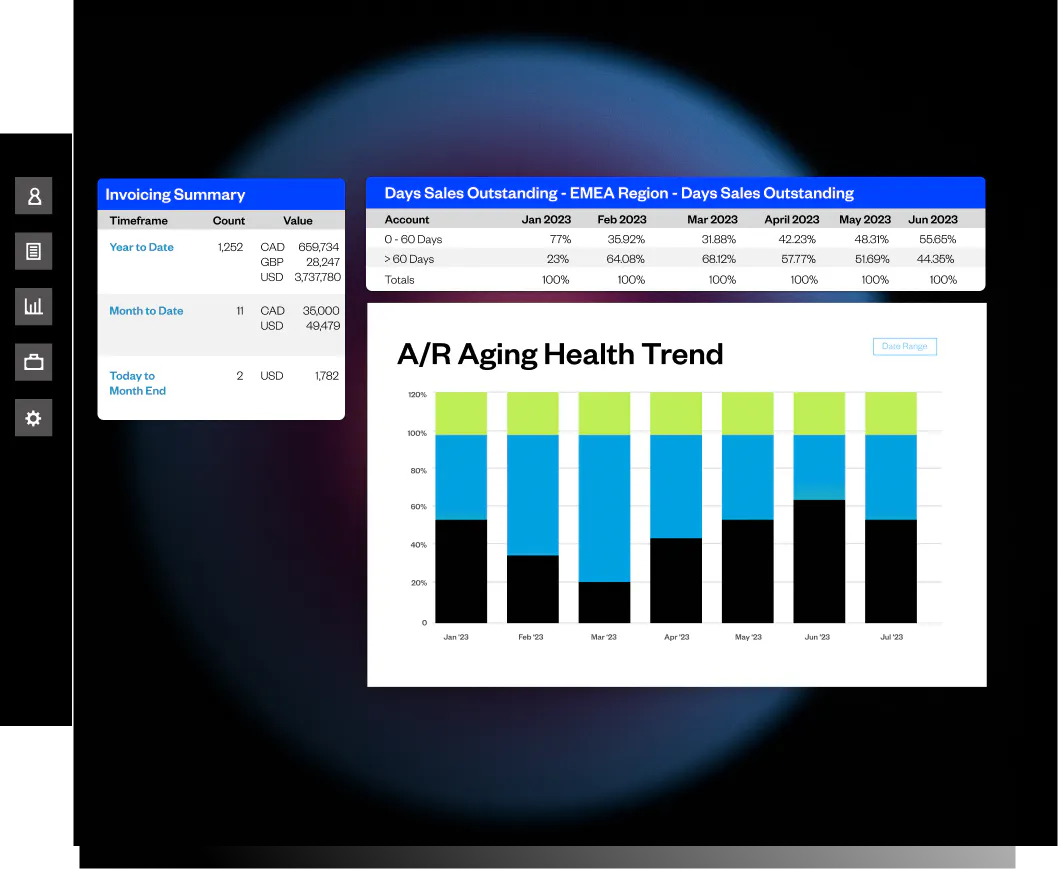

Drive down DSO, extend cash runway, and mitigate your risk of non-payment with Maxio’s collections and dunning capabilities.

Within Maxio’s Advanced Billing module, there are three methods for invoice collection:

- Automatic: Advanced Billing attempts to collect payment automatically from a payment method on file (credit card or ACH) when the invoice is issued.

- Remittance: Advanced Billing does not attempt to automatically collect payment. Instead, your customer remits payment on the invoice, often in the form of a check or bank draft, in response to receiving the invoice.

- Prepaid: Advanced Billing collects an initial prepayment which is used to fund a usage-based subscription. Further usage will pull from the prepayment balance until it reaches $0 and suspends, or auto-replenishes. The renewal invoice is marked as “automatic.”

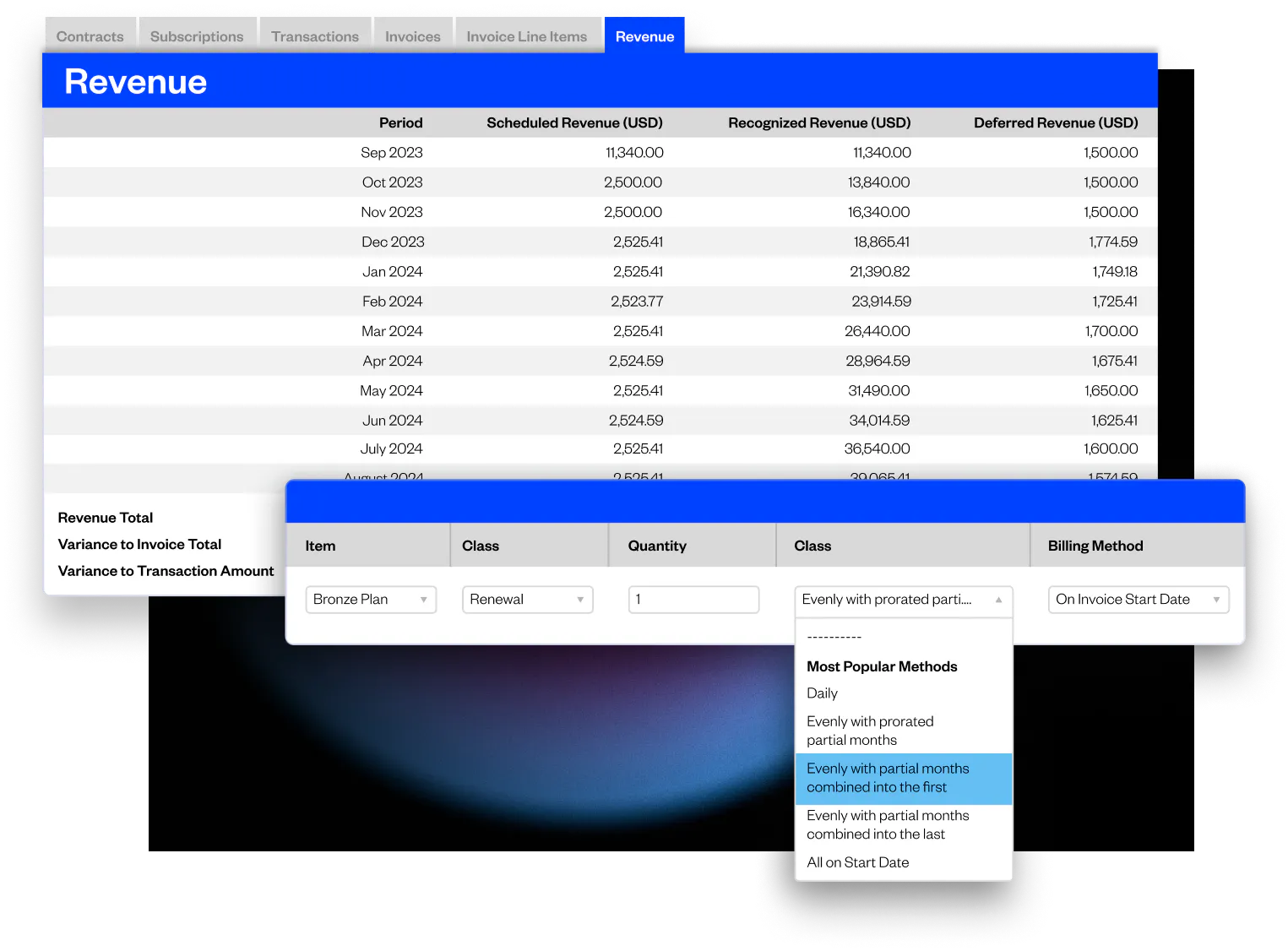

Report revenue

Ace your audit in record time and retire your rev rec spreadsheet for good with GAAP/IFRS-compliant revenue recognition, automated for you.

Maxio’s revenue recognition capabilities allow you to:

- Apply recognition rules consistently Apply your revenue policy automatically, consistently, and accurately across your entire customer base.

- Recognize revenue deviations Deal with revenue recognition caveats directly in Maxio. Easily modify revenue recognition schedules for individual customers, contracts, or transactions as needed.

- Consolidate journal entries Maxio’s Advanced Revenue Summary report offers an aggregated view of recognizable revenue for all customers within a chosen period.

Close the books

Automatically generate journal entries at month’s end and squash reconciliation issues as they arise.

Maxio allows you to close the books faster by integrating bi-directionally with popular GLs and ERPs, such as QuickBooks and NetSuite. The key data objects that flow back and forth between Maxio and GLs/ERPs are customers, invoices, credits, refunds, items, and payments.

Analyze

Dive into business performance with investor-grade SaaS metrics and analytics, trusted and relied upon by top-tier firms.

Maxio’s metrics and analytics connect all of your customer, contract, invoice, revenue, and payment data together into a single source of truth. This allows you to:

- Reduce time spent on manual reconciliations

- Create ARR/MRR waterfall views in seconds

- Access dozens of out-of-the-box SaaS metrics

Understand

One of the most powerful things about Maxio is the depth and breadth of our metrics and reporting functionality. With Maxio, you can:

- Slice and dice data by custom objects from your CRM: Popular views are ARR/MRR by ICP score, account health score, and sales rep.

- Drill into customer/transaction-level details: All Maxio reports are clickable/drillable so you can see exactly which customers and products are driving underlying momentum.

- Enrich your data with our complimentary Clearbit integration: Maxio offers a complimentary Clearbit integration allowing you to pivot SaaS metrics by Clearbit data such as industry, employee count, and more.

Gameplan and enhance GTM

Learn from the insights you can only get in the Maxio platform. Test, iterate, and enhance your GTM engine.

Because of the cyclical nature of monetization and GTM efforts, the data you glean from Maxio’s metrics and analytics capabilities will power your future business strategy.

Optional modules

Support more complex business needs with advanced workflows.

Advanced Billing

Ultimate billing flexibility designed to support even the most complex pricing strategies.

- Metered and usage-based billing models

- Developer-friendly SDKs and API connection

- Self-service billing portals and public signup pages

Payments

Manage billing and payments in one platform. Get to the bottom of payment issues quickly.

- Deposit reconciliation

- Chargeback management

- Advanced reporting options

Advanced Revenue Management

Automate complex revenue recognition scenarios in accordance with GAAP/IFRS standards.

- SSPs and revenue reallocation rules

- Ability to see and report on the impact of multiple rev rec methods

- Carveouts

Accounts Receivable

Automate collections and dunning at scale.

- Collection cadences and escalation templates

- Understand your A/R health and reduce DSO

- Dozens of payment options

Expense Amortization

Capitalize, recognize, and report on certain types of expenses.

- Generate consolidated expense journal entries

- Handle commission calculation and accounting

- Forecast more accurately with detailed margin analysis

Milestone-Based Projects

Bill/invoice and recognize revenue on yet-to-be-determined future events.

- Templates for milestone-dependent scenarios

- Billing and rev rec actions triggered by milestone completion

- Accounting for delayed or accelerated revenue schedules

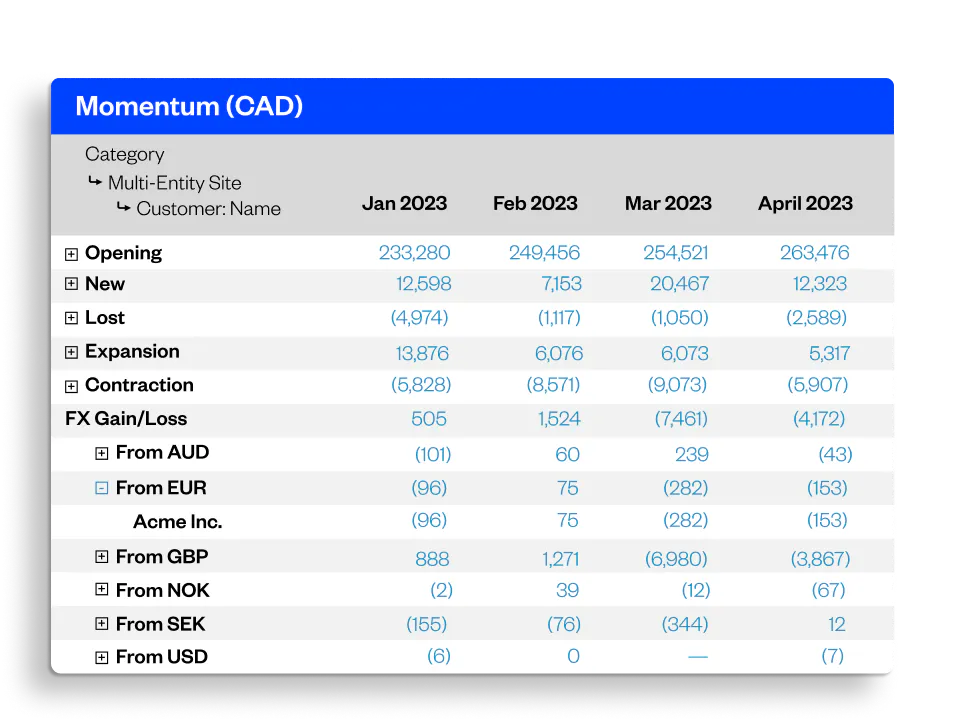

Multi-Entity

Consolidate financial and SaaS metric reporting across different business units or legal entities.

- Real-time FX gain/loss reporting

- GAAP and IFRS-compliant FX reporting

- Ability to segment SaaS metrics by entity

Add-ons

Events-based billing

Event streaming for real-time metered and usage billing models.

ERP integrations

Bi-directional syncs with NetSuite and Intacct.

EU Hosting

GDPR-compliant with in-region data hosting.

CRM integrations

Bi-directional integrations with Salesforce, HubSpot, and Pipedrive.

Best-in-class integrations

Ready to power your monetization engine?

Discover why 2,000+ B2B subscription businesses and $24B in investor capital partner with Maxio for their monetization engine

Schedule a demo to see how Maxio can handle billing, collections, and reporting for your business.