Accounts Receivable Software

Save time and improve cashflow with accounts receivable automation

Stop chasing invoices. Let automation do the heavy lifting for you and slash your invoicing time by up to 80%.

How it works

From invoice creation to payment collection, Maxio’s accounts receivable software makes every step of the collections process a breeze.

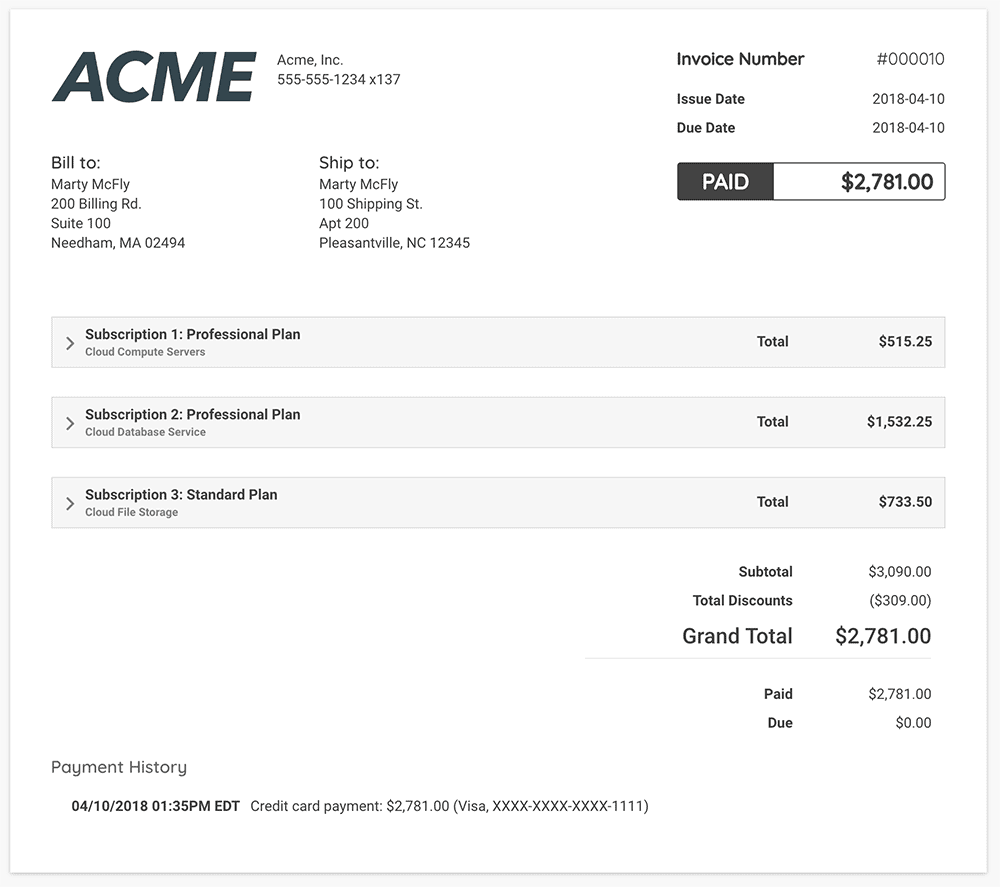

Process sales orders and automatically generate invoices

Create branded invoices automatically with our bi-directional CRM integration syncing data directly to Maxio. Send invoices directly to customers with 1-click payment options.

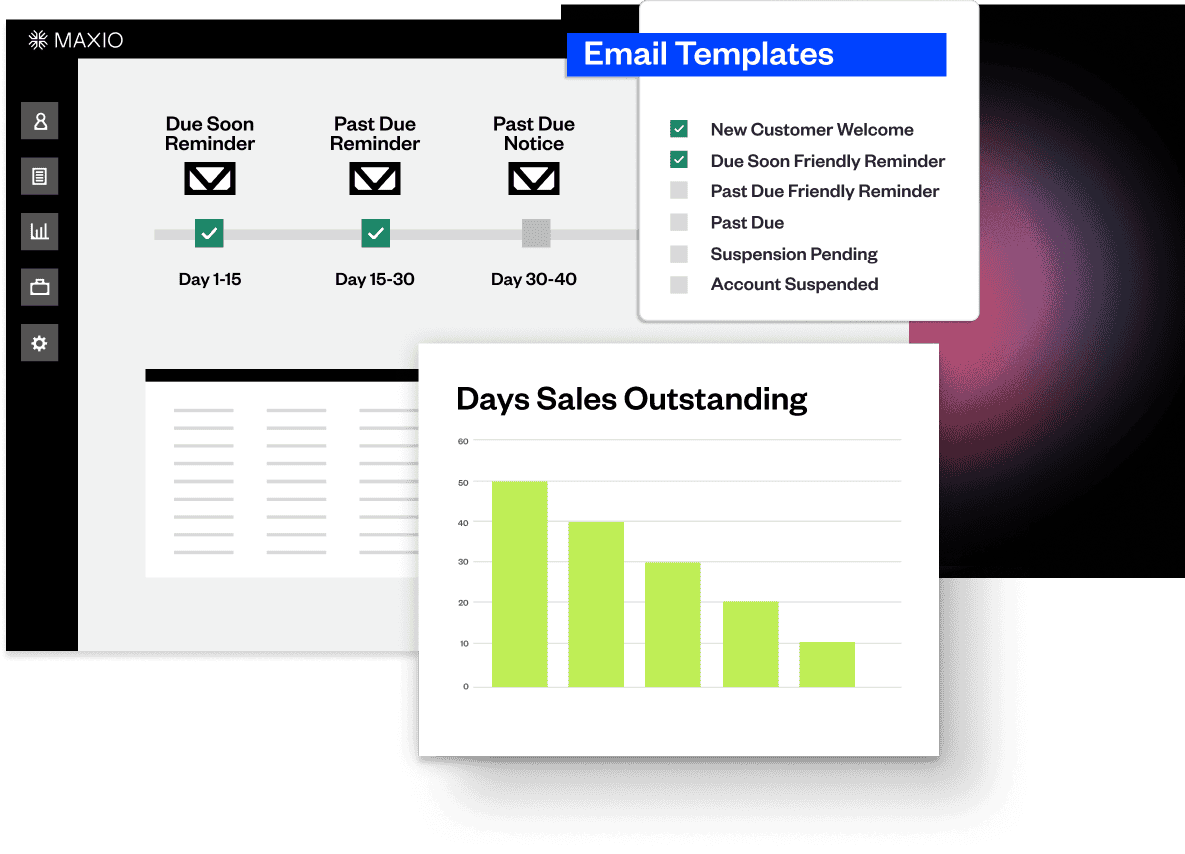

Leverage custom dunning and collection cadences

Automate or manually follow up on outstanding invoices with a powerful dunning feature set. Ensure invoices never fall through the cracks again.

Report on your collections efforts

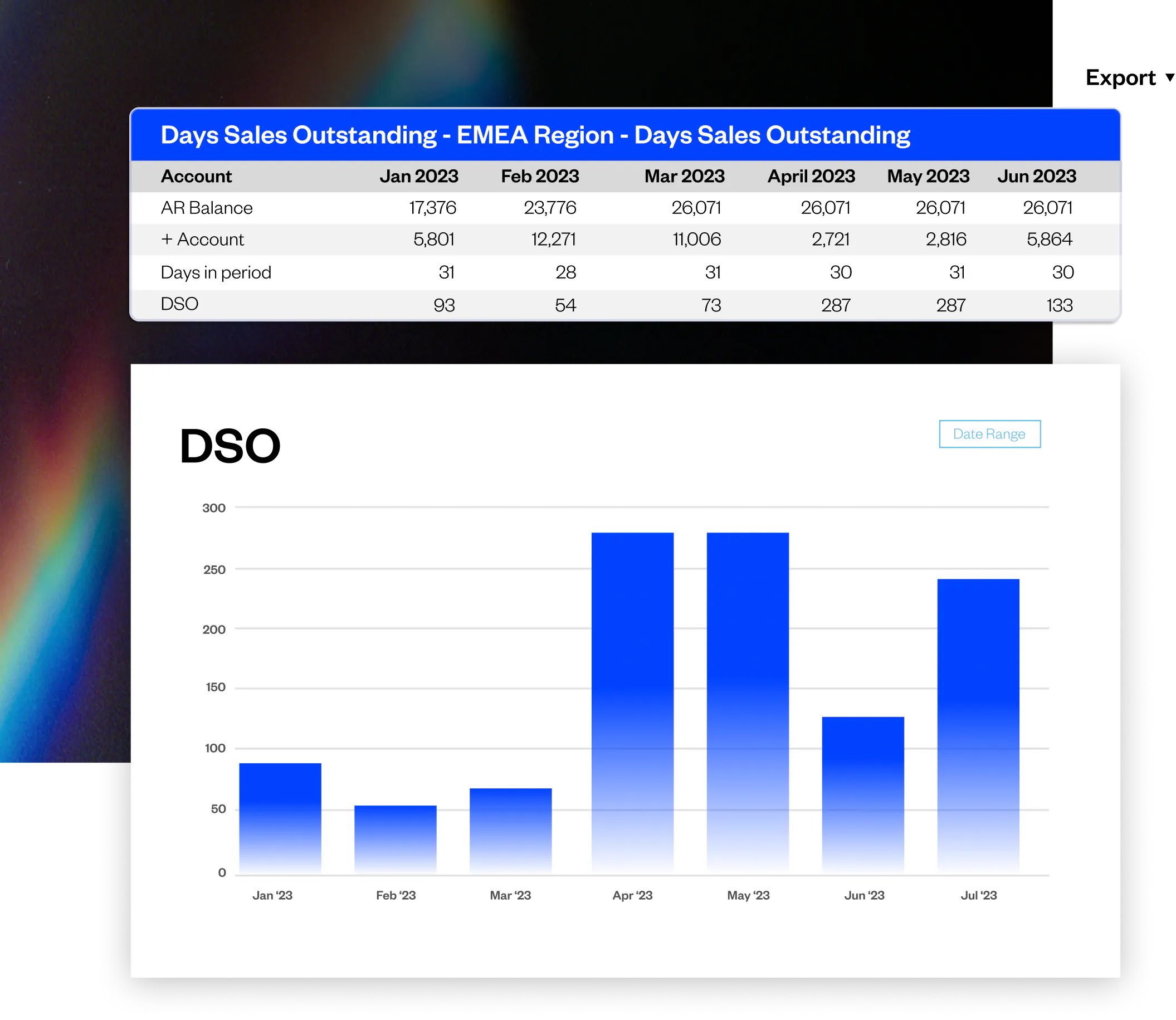

Measure the success of your collections strategy with DSO reporting and AR aging reports. Easily visualize your metrics and inform strategy with data.

Drive down DSO

- Create custom collections cadences

- Manage manual and automated reminders

- Establish pre-defined escalation paths for past-due invoices

Generate, view, and prioritize invoices in one place

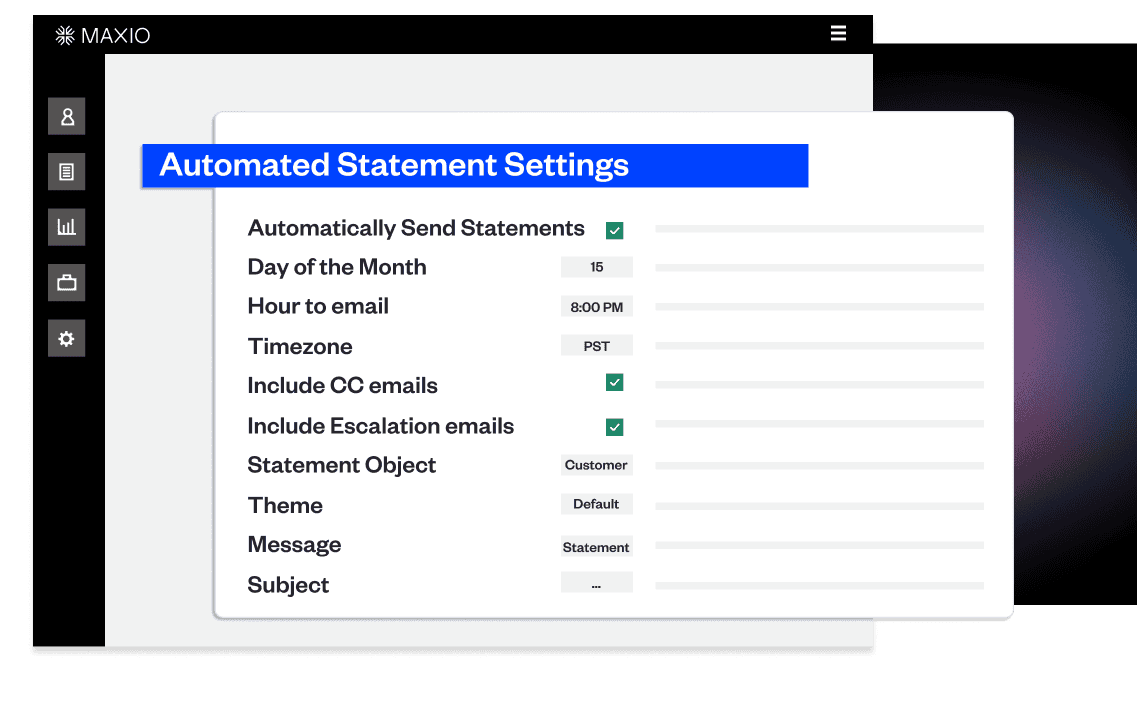

- Automatically generate monthly statements

- Organize and track every invoice by status

- Add context to invoices with collections notes

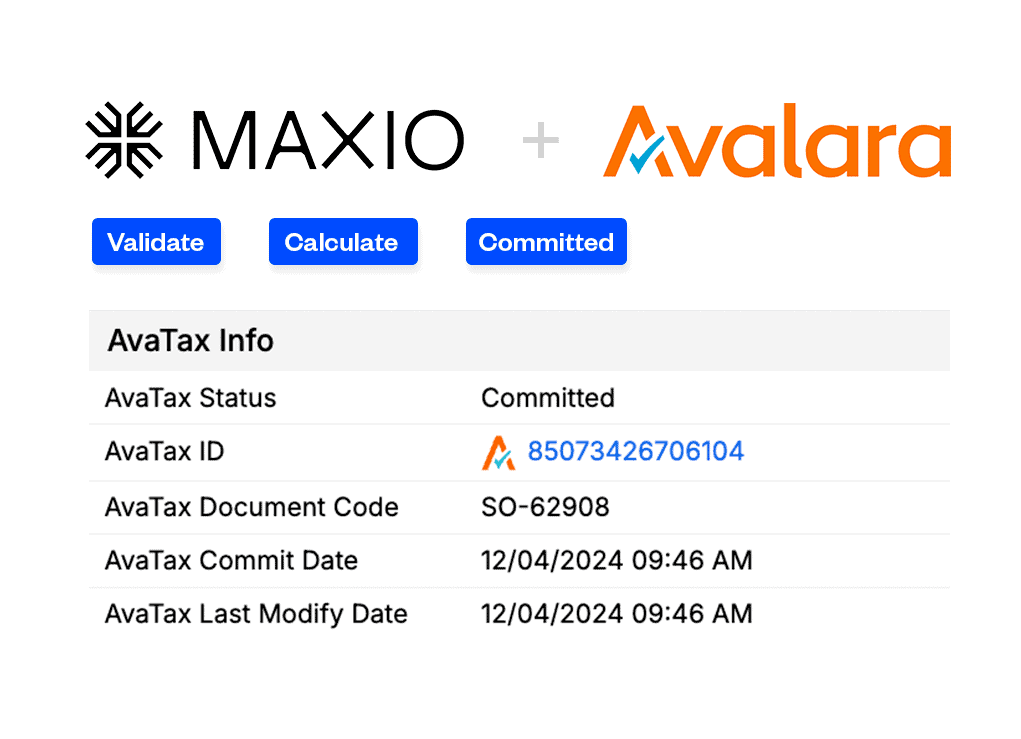

Automate sales tax compliance

Make sales tax compliance a breeze with our native integration with Avalara’s AvaTax.

- Bulk validate business addresses or validate addresses as you create new customers.

- Automate tax caluclations based on local tax codes for every invoice.

- Pass sales tax line items from Maxio to your general ledger or CRM.

Report on your collections effort

Get visibility into how long it takes on average to collect payments. Tracking DSO in real time helps you spot trends and address issues before they affect cash flow. A shorter DSO indicates healthier AR practices, freeing up more working capital for your business.

Maxio provides detailed trend analysis of your AR aging over time, letting you compare historical data to current periods. These insights help identify troubling patterns, like increasing late payments, that could indicate a need for adjustments in collections strategy or payment terms.

Report on outstanding invoices as of today or a historical point in time. Drill into customer details, invoice notes, and more to contextualize your overdue invoices.

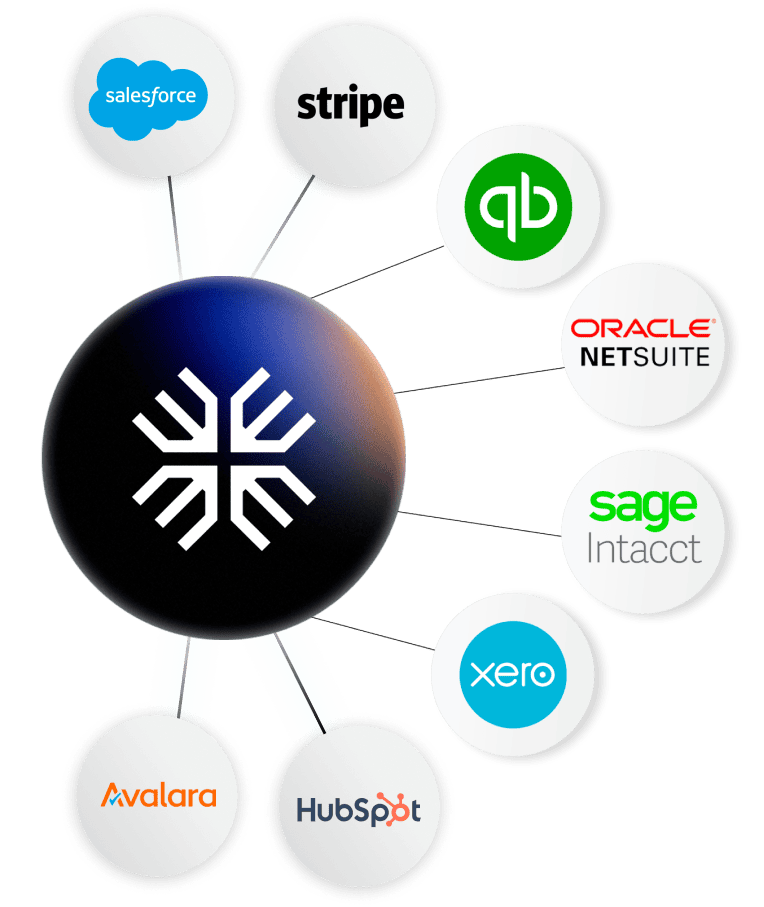

Integrate your financial tech stack with 60+ integrations

From CRMs to payment gateways and general ledgers, make sure data flows between your critical systems with out-of-the-box integrations.

Built to support scaling B2B SaaS companies

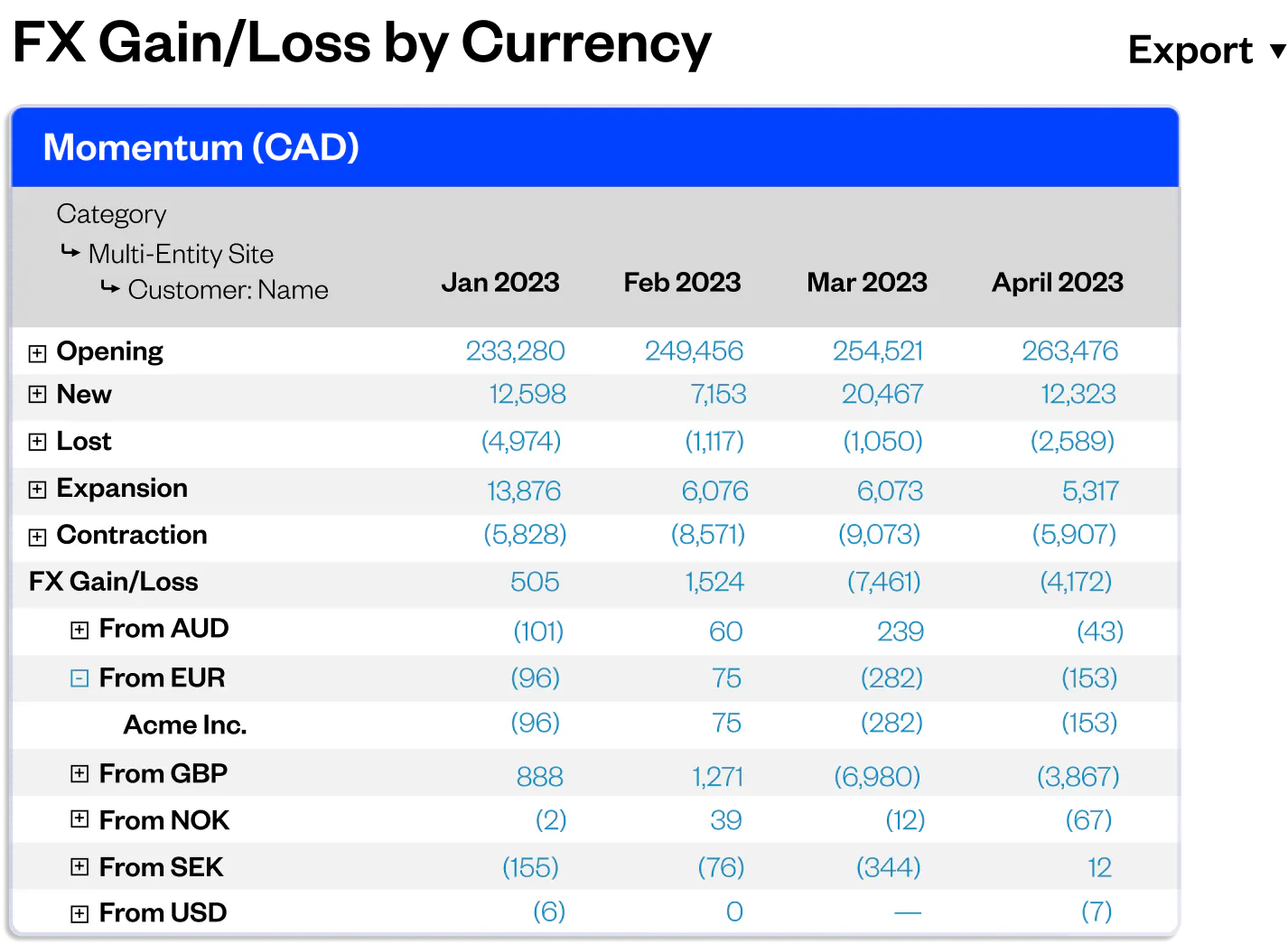

Grow internationally

- Handle global transactions with multi-currency support

- Report real time FX gain and loss

- GAAP and IFRS-compliant FX reporting

Support complex parent-child billing requirements

- Flexible invoicing capabilities without sacrificing accurate sales tax calculations or reporting visibility

- Report revenue and create metrics on the parent or child level.

- Create consolidated invoices with total flexibilty on payment options

Ready to take your collections process to the next level?

Ever since implementing Maxio, our ability to collect on outstanding invoices has improved significantly. The amount of time it takes has dropped, and it saves our collections team so much time, energy, and stress.

Gabrielle Lucero, Limble Solutions, INC

Revenue Manager

Learn more about AR best practices

September 24, 2024

Retention

What Is Dunning Management, and How Can It Increase SaaS Customer Retention?

“Here, we’ll cover the basics you need to know about the dunning process in a SaaS model, including dunning management best practices.”

July 19, 2024

Cash management, Financial Reporting

Accounts Receivable Aging Report: What It Is And How To Use It

“Learn all about the one tool companies use to manage delayed payments and mitigate potential damage to their cash flow: the Accounts Receivable (AR) Aging report.”

July 29, 2025

Billing & payments

What is the Order-To-Cash Process? A Complete Guide

“The order-to-cash cycle is crucial for SaaS businesses. Explore how to streamline it to boost cash flow and enhance operational efficiency.”

Accounts Receivable Automation Software FAQs

Accounts receivable (AR) automation software is an accounting solution that streamlines the A/R process for finance teams. This type of software automates invoicing, payment reminders, cash application, and other critical A/R tasks. A/R automation also provides accurate visibility into receivables aging and customer communications.

In terms of pricing, A/R automation software varies based on features offered and number of users supported. Overall, A/R automation software saves finance teams time on routine A/R duties so they can focus on more strategic initiatives.

Small businesses and enterprise companies alike can track accounts receivable and the A/R process through proper bookkeeping and setting up reliable accounting systems. Maintaining organized records of customer invoices, payments, credits, and aging summaries provides visibility into the full receivable process.

An accounts receivable aging report outlines unpaid customer invoices by time periods, highlighting slow payments. For a detailed guide on managing accounts receivable aging as a small business, check out our accounts receivable aging guide. This resource explains how to run A/R aging reports and use them to improve your receivable process.

There are a few key ways companies can collect accounts receivable faster. For example, implementing a customer portal with invoice tracking can help customers see balances and pay online. Cloud-based A/R automation software connected to the general ledger can also expedite cash application and reduce bad debt.

Your Controller should then analyze accounts receivable aging reports to identify where bottlenecks occur in the collections process. Setting clear credit terms and following up on past due accounts also keeps cash flow healthy. Overall, A/R automation, online payments, and proactive collections optimize how quickly businesses collect what they’re owed.

Maxio’s advanced accounts receivable management software streamlines accounts receivable management by automating customer payments and collections management.

It allows users to customize invoicing, implement automated dunning processes to recover past due payments, and manage customer accounts efficiently. These features help businesses reduce the time and effort spent on manual collections and improve cash flow.

Maxio’s integrations include key accounting and ERP systems like QuickBooks, NetSuite, Sage Intacct, and Xero. Our platform also integrates with popular CRM systems to enhance your customer relationship management and streamline the order-to-cash process. Maxio’s robust APIs facilitate seamless connectivity with various software solutions, ensuring efficient data flow and streamlined operations across your business ecosystem.

See what Maxio can do

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

SaaS reporting tools

Never lose sight of your business performance with accurate, reportable SaaS metrics.

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond.

Subscription billing

Manage complex billing scenarios without cluttering your product catalog.