Let’s be honest. The cloud of fear and uncertainty hanging over 2020 didn’t get any lighter with the FASB’s announcement that 606 compliance for revenue recognition is now mandatory by the start of 2021.

However, we here at Maxio want to help distinguish fact from fiction when it comes to the drama and hype produced around achieving 606 compliance. Depending on how your business is run, the new rev rec standard could have a huge impact on your day-to-day business operations, or it could simply be a matter of putting better documentation in place around your current practices.

While ASC 606 and rev rec hygiene, in general, are not things you can afford to ignore in your SaaS business, there are many practical measures you can take to achieve compliance and alleviate the associated headache. In this post, we’ll focus on one way to better button up your revenue recognition practices: creating a revenue policy.

What is Revenue Recognition?

We use the term “Revenue Recognition” to refer to both the accounting principle and the process by which you claim, and in the case of a Financial Audit, defend the revenues your business earns.

In a typical SaaS business, for the recurring subscription elements of your contracts this is done monthly over the contract term as the service is performed (non-recurring elements may sometimes need different treatment). Conceptually, it seems easy enough, but rev rec can get complicated because standards boards and regulatory agencies like the FASB, have established some very thorough and important rules and guidelines for companies to follow.

In B2B SaaS, the Revenue Recognition portion of your SaaS Accounting can become more complex still when you do things like bundle services or support with your subscription, commit to the delivery of any non-standard functions/capabilities, or when you factor in other considerations common in sales negotiated deals like discounts on some or all of the elements of the contract.

These can give rise to the need to do Carve-Outs, revenue reallocations, determining implicit and explicit Performance Obligations, and Standalone Selling Prices.

What is ASC 606?

Most recently, the FASB set forth new standards for revenue recognition outlined under the ASC-606 requirements (internationally known as IFRS 15), which are set to take effect in 2021. 606 is here for all of us, but depending on how you do business, these new standards may have a minimal or major impact on you. You’ll need a CPA to ensure you’re compliant, but software like Maxio can help. The place to start is your Revenue Recognition Policy. A thoughtful, well-documented policy helps all parties align and allows you to put your best foot forward when undertaking a Financial Audit or Due Diligence.

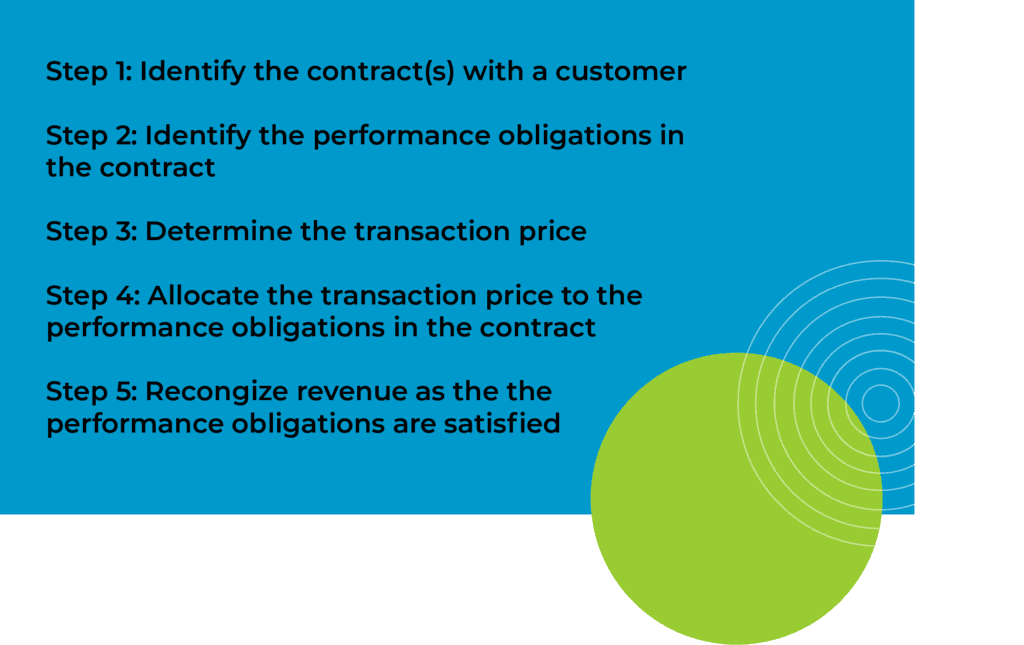

5 Steps of ASC 606

What is a Revenue Recognition Policy?

A revenue recognition policy is a single document that summarizes your processes and methodologies used to recognize revenue. Your rev rec policy is where you establish the rules that govern the consistent application of the ASC 606 framework at your company.

According to a study conducted by The CPA Journal, revenue recognition issues were the leading cause of financial statement fraud in 11 out of 15 years from 2000 to 2014.

Further, here at Maxio, we speak to many veterans of Financial Due Diligence (either for Fundraising or M&A). We always ask, ”What is the biggest deal-killer you see?” So far, we have a 100% response rate of “Revenue Recognition issues.”

Because revenue recognition issues are the leading cause of financial misstatements, auditors require lots of documentation to ensure accuracy. Having a solid revenue recognition policy in place saves you from the wild goose chase of producing contract after contract to account for specific line items in your financial statements.

Revenue Recognition Policies are Not Static

Don’t expect that creating and documenting your Revenue Recognition Policy is a one-time effort. It’s not. Growing SaaS businesses are extremely dynamic with frequent experiments in Pricing and Packaging (“Let’s Bundle Support with the Subscription,” etc.) and Sales processes (“Let’s offer Discounts on implementations, but not on the Subscriptions.”) These choices can inject volatility into your Revenue Recognition process requiring you to update your Revenue Recognition Policy to keep pace.

Get Our Free Rev Rec Policy Template Today

To aid in our customers’ 606 adoption, we have put together a comprehensive revenue recognition policy that you can download and adapt to your business.

Download the revenue recognition policy template today.