To paraphrase Chris Rock, “you can drive a car with your feet, but that doesn’t make it a good idea.”

Similarly, sure, you can run your SaaS financial operations with spreadsheets, but if you do, you are injecting risk into your business.

To be clear, spreadsheets are hugely powerful tools. We use them frequently, but they should be a complementary “tool” and not viewed as a “system” nor a “system of record.”

How Many SaaS Companies Are Using Spreadsheets in Their Financial Operations

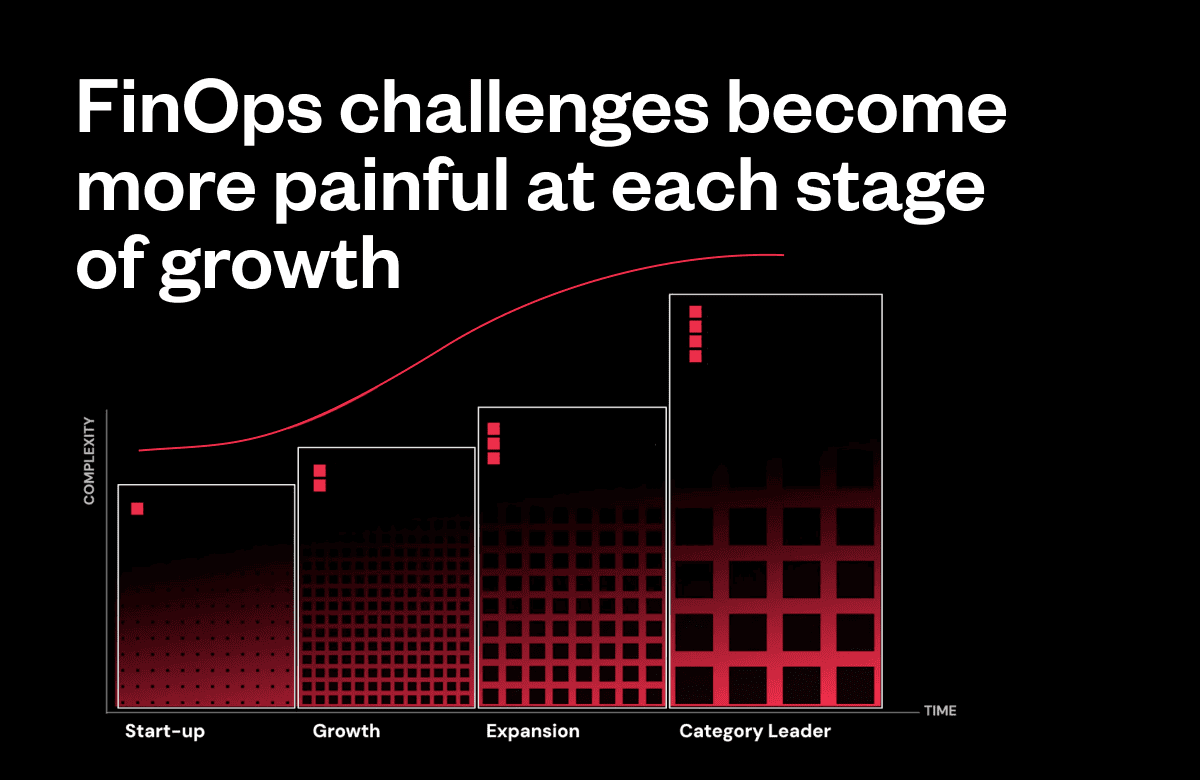

First, the cause: Despite being suboptimal, spreadsheets frequently end up at the heart of SaaS financial operations because most robust finance systems that address 100% of the needs of SaaS businesses are very expensive and simply out of reach for early and emerging stage SaaS businesses.

Many SaaS/subscription businesses use spreadsheets for order management, contract management, revenue recognition, invoice tracking, renewal management, analytics/metrics and general reporting. This is what we mean when we say “at the heart of your SaaS financial operations.” Little or nothing happens in the finance function that is untouched by a spreadsheet.

For many SaaS businesses, this is the unfortunate, frustrating reality. And, while you can function this way for some time, eventually the spreadsheet must be ditched or your business will suffer.

Here are the three main reasons it is a bad idea to have a spreadsheet at the heart of your SaaS financial operations:

1. No Data integrity

Spreadsheets are the wild west of financial management. There are no rules. Spreadsheets are great for calculations, but they are terrible at managing SaaS recurring revenue data.

I know what you are thinking, “I can use Excel formulas to create some data rules.” This is true until you or someone on the team incorrectly edits the spreadsheet and blast your formulas into dust.

Or, “I can use conditional formatting to change the colors of my cells that meet error conditions.” Also true, but that also leads to issues as you can see in this nearly unreadable spreadsheet.

It is easy to have data issues even while the business is small.

A simple example: Your sales rep just closed a deal and emails you a $1200 order. In your spreadsheet, you copy and paste the information from the email to set up the contract as $1200 for 1 year on the contract management tab. Then, on the revenue recognition tab, you amortize the revenues over the term as you should ($100/month), and you set up and send the invoice ($1200 paid up front in this case) in QuickBooks.

Then the customer calls and says the invoice was wrong. Your rep forgot the $100 discount. You adjust and re-send the invoice, but because you are busy, you forget to update the spreadsheet. Now, by definition, your revenues, bookings, and subscription metrics are wrong. This scenario is even more likely if you have one person doing invoicing, and another doing revenue recognition and metrics in the spreadsheet, as is often the case.

Data integrity issues worsen once customers start doing mid-term upgrades, downgrades, extensions and (oh yes) early terminations. All of these events require the spreadsheet to be updated to properly reflect the revenue recognition, metrics and contract/renewal management.

Before long, you end up with a lot of data chaos that spreadsheets are poorly suited to manage.

2. Massive Inefficiencies

Over time, the spreadsheet gets more bloated and fragile, yet continues to be relied upon for financial operations. Despite being under strain, it is still edited frequently, and because you have grown, you may have multiple people editing. That forces you into a clunky and inefficient system of file sharing and/or communications to make sure you aren’t harming each other’s work.

Sometimes businesses try to work around this by splitting their monolithic spreadsheet into multiple files. This simply trades one problem for another because now you have multiple things that are bad at managing data instead of just one and multiple points of possible failure.

Before long, the spreadsheet becomes a giant consumer of your limited time and a dreaded burden for anyone who tries to make sense of it. At this point, the problems caused by the spreadsheet begin to both accelerate and multiply. You have a bottleneck in the middle of your financial operations that not only causes inefficiency and overhead for your staff, but also begins to inject risk into your business.

3. Risk & Untrusted Data

Data integrity issues make it difficult to trust your numbers, or worse, you could be making decisions based on bad data or inconsistently defined metrics. By definition, decisions based on bad data are bad decisions.

Data integrity issues worsen once customers start doing mid-term upgrades, downgrades, extensions and (oh yes) early terminations. All of these events require the spreadsheet to be updated to properly reflect the revenue recognition, metrics and contract/renewal management.

Before long, you end up with a lot of data chaos that spreadsheets are poorly suited to manage.

Inefficiency and bottlenecks cause most financial teams to eventually designate one person to mind the spreadsheet. If that person quits (or even just goes on vacation), you could have a serious problem. The vast majority of your financial intelligence is encapsulated in one file, and the person who understands it is now unavailable. Couple this with an impending audit or road show to raise money, and you’ve got a mad scramble on your hands.

If, however, you choose to continue using spreadsheets, we suggest getting your finance team together and coming to agreement on:

- Spreadsheet hygiene (number formats, tabs, named variables, colors, numbering schemes, unique identifiers, etc.)

- Definitions of metrics (MRR, churn, renewals, Customer Lifetime Value, Bookings, etc.)

- How to share files to protect the hard work that goes into the spreadsheets (e.g. file naming conventions, division of labor, etc.)

- A documented process to QA the spreadsheet that becomes part of your monthly close (e.g. EVERY time we close the month, we are going to check x,y,z to try to catch problems)

These steps may seem very tedious (because they are), but they aren’t remotely as tedious or risky as finding a two-month-old problem in a spreadsheet and trying to reconstruct what happened so you can adjust your revenues and metrics accordingly. And they are far less painful than finding out you forgot to invoice a $50K renewal!