RevOps vs. FinOps: there are too many abbreviations and acronyms out there. This is true across all industries, but it’s especially true in the SaaS world. While it can certainly seem daunting to keep up with the never-ending iterations of job titles and organizational frameworks, some are actually worth taking the time to familiarize yourself with. In this article, we’ll dive into some of the most hotly debated abbreviations out there–RevOps, short for Revenue Operations, and FinOps, short for Financial Operations.

What You’ll Learn:

- Definitions of both FinOps and RevOps

- Where each lives in the business

- When you should implement each

What is RevOps?

Revenue Operations, or “RevOps,” for short, refers to the optimization of process and technology across all stages of the customer lifecycle including marketing, sales, and customer success.

RevOps was really born out of sales operations, but it has morphed over time to encompass operations touching all phases of the customer life cycle. The purpose of RevOps is to streamline operational processes across departments in order to enable cohesion amongst different departments and allow for better decision making based on data sets that are unbiased and agreed upon by all parties.

In that sense, RevOps really functions as the settler of all bets within an organization. In a recent webinar co-hosted by Maxio and Sonar, Sonar Co-Founder and CEO, Brad Smith, walked through the following scenario, which I’ll paraphrase here: Imagine for a moment you walk into a board meeting and are asked to present some numbers to the board. Your CMO asserts that the marketing team created $10M in pipeline for the quarter, woohoo! Next up, your VP of Sales, scratching his heads, remarks, “Huh. I only have $4M in open pipeline recorded for this quarter, of which we closed $1.5M.”

Sound familiar? This is the point when your board members exchange sidelong glances. What is going on here? This is the crux of the problem with individual departments owning their own reporting functions. By design, it opens up opportunities for bias. And why shouldn’t it? If you report to the CMO, you’re going to spin the numbers in such a way that favors the marketing department. Same goes for sales, CX, and any other department.

The solution? Independent Revenue Operations teams. Typical responsibilities of RevOps teams include, but aren’t limited to, operations, enablement, insights, and tooling. In separating out your operations team from any specific department, you remove the bias associated with individual reporting and allow for independent oversight of things like reporting, tooling, communication of process changes, and enablement.

For more information about RevOps specifically, check out this article from Sales Hacker.

What is FinOps?

FinOps, while less established than its RevOps counterpart, is equally as important to the vitality of a SaaS business. Finops is the intersection of people, process, and technology as it relates to managing the financial operations of a business.

While RevOps focuses on getting business transactions in the door, FinOps focuses on properly converting those business transactions into financial transactions.

A good litmus test for understanding who might qualify as FinOps in your company? Ask yourself, “Who, or what tools, did I go to to understand the impact that COVID-19 would have on our business?” Whoever comes to mind, maybe it’s your CFO or Controller–or maybe it’s an accountant you have on staff, is likely the FinOps arm of your business.

FinOps teams can include a wide range of titles, including financial analyst, bookkeeper, accountant, CFO, or Controller. These responsibilities may even fall to the founder or broader executive team in smaller companies. Titles are less important than the functionality of the role.

Some common responsibilities of FinOps teams include managing the general ledger, establishing an order-to-cash process, overseeing and supporting financial audits, and reporting on key financial metrics to boards, executive teams, and potential investors. This is by no means an exhaustive list of responsibilities that fall to FinOps, but it should start to give you an idea of the kinds of things these teams oversee.

In contrast to RevOps, where FinOps lives in the business is not as hotly contested as RevOps has been. Generally speaking, FinOps sits in its own department, sometimes called Finance or Accounting, and usually reporting directly to the CFO or CEO.

While the org structure has not historically been as divisive, the consequences of a siloed FinOps function are just as problematic as those of RevOps. Without consistency in how basic SaaS metrics, like ARR,MRR and Churn (both logo and dollar Churn) are calculated, you leave yourself vulnerable to not only investor scrutiny but also ill-informed decision making.

Where should FinOps live within the business?

The reality is, there’s no one-size-fits-all approach to organizational structure when it comes to RevOps and FinOps.

While it’s generally accepted that RevOps should live independently from sales, marketing, and customer success, FinOps’ place in the org chart is less clear.

Because FinOps (and RevOps for that matter) is more of a framework than a job title, there are a variety of ways you could structure your organization to incorporate these frameworks.

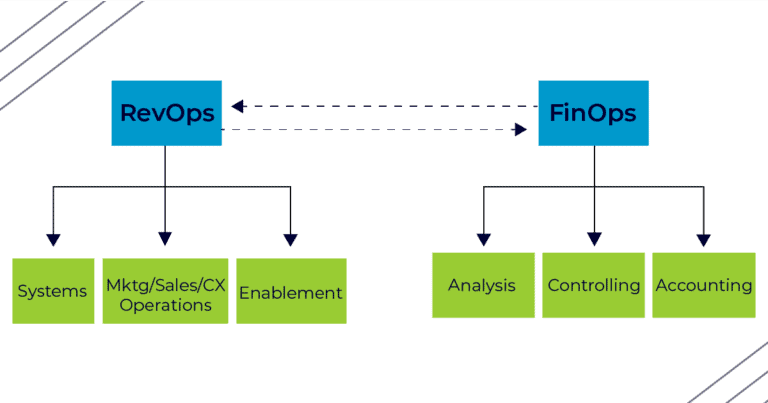

The nature of FinOps deals with the financial arm of the business and not the revenue generating side, it should really live independently of RevOps but with dotted lines between whoever sits at the head of RevOps and FinOps respectively in order to ensure the standardization of the shared reporting function.

An independent FinOps team can function as the settler of all bets when it comes to critical SaaS metrics. After all, there is only one definition/calculation for ARR, Churn, etc. This frees FinOps from the pressure to report metrics in a way that sheds the best light on a specific department. Once metrics definitions/calculations start getting skewed, they no longer mean much. Only finance can hold the line on the true calculation.

With that in mind, a solid org chart might looks something like this:

More often than not though, growing organizations necessitate that the respective RevOps and FinOps functions be run by a single person.

This is certainly true at Maxio, a B2B SaaS business with around 90 total employees. Internally, our org chart looks more like this:

RevOps:

FinOps:

This might seem daunting at first glance, but with the right tech stack and processes in place, you can easily empower a lean team to wear multiple hats inside of both RevOps and FinOps, bypassing the urge to add headcount for the sake of adding headcount.

When should I implement RevOps vs. FinOps

Again, there really isn’t a one-size-fits all approach to the incorporation of these frameworks into your SaaS business, but there is a strong case to be made that the earlier you incorporate these functions, the better.

Ben Fuller, Manager of Strategic Systems at Maxio, noted some of the consequences of waiting too long to implement RevOps.

Chief among these consequences was in regards to tooling specifically. According to Fuller, siloed tool ownership often leads to overlapping tool functionality. Further, employee turnover can make the succession of tool ownership unclear, leading to headaches for those trying to gain admin access. The sooner you have an independent RevOps function in your organization, the less likely you are to accumulate costly shelfware and ownership headaches.

On the FinOps side, it’s not so much a question of when to implement but how to optimize. You have a FinOps function in place; it’s how you’re able to operate as a business entity. But is it optimized? Are you really deploying your resources to the best of your abilities? Optimized FinOps teams do more than just close the books at month’s end. They drive important business changes through process and technology and continually provide operational insight.

For example, many SaaS companies will at some point transition from cash-based accounting to accrual accounting, which is a nightmare to manage in QuickBooks and disparate spreadsheets alone.

Many companies will put off the transition to accrual accounting for as long as possible because it’s difficult to map such extensive changes without adequate staffing to do so. That’s where the early implementation of FinOps comes in. With an efficient FinOps framework in place, you can enable your lean team to cover more ground through optimized processes and technology.

Sticking to the cash to accrual example, if you were hoping to switch to accrual accounting but only had limited resources to do so, you could leverage a subscription management platform, like Maxio, to automate much of the transition and, once complete, you will have a core, optimized platform in place that continues to support your growth.

Closing Thoughts & Key Takeaways

The reality is, there are truly a hundred ways to skin the cat when it comes to implementing processes and frameworks that enable scalability in early and growth-stage SaaS businesses. RevOps and FinOps frameworks represent a couple, but the possibilities are really endless. To sum up our findings in this exploration of RevOps vs. FinOps:

- RevOps refers to streamlining and optimization as it pertains to getting revenue in the door.

- FinOps refers to process optimization for converting business transactions into financial transactions–and all of the operational oversight that comes with that.

- While there are best practices for structuring orgs for each, both RevOps and FinOps are really more about frameworks and culture shifts than job titles.

- For both FinOps and RevOps, the earlier you adopt them, the better.

Looking for ways to effectively scale your one-man FinOps band? Talk to an expert at Maxio.