So, you’ve decided on European venture capital to scale your SaaS.

At this point, you’ve already poured your time and energy into product design, conducted hours-long whiteboarding sessions, and maybe you’ve built a loyal user base. Even after all that hard work, without capital to scale your idea, your progress could screech to a halt.

For some European SaaS founders, self-financing and bootstrapping give them the capital they need to scale their operations. Take Hotjar, for example, a website analytics platform that received no outside funding and hit $25M (€23.5M) in revenue before Contentsquare acquired them in 2021.

However, for most early and seed-stage SaaS founders in the EU, VC-backed funding streamlines their path to an IPO or successful exit—but it’s not always easy to acquire. Although it is home to the world’s largest single market, Europe is still a fragmented trading environment of multiple jurisdictions, languages, cultures, and business practices. In short, it takes tremendous effort to raise capital and scale pan-European tech companies.

European VCs play a vital role in supporting founders on this journey by sharing local market insights and identifying opportunities for growth throughout the EU. If you have your sights set on taking the VC route, here’s what you need to know.

VC history in Europe

Compared to the United States, venture capital in the EU is still very new.

In the late 1990s, the number of European venture capital firms investing in software could be counted on two hands. Since then, the European VC ecosystem has been growing and maturing rapidly. Between 2010 and 2020, venture capital fundraising grew sixfold to nearly $24B (€22.5B).

Some of this growth can be attributed to new financial regulations such as the Regulation on European Venture Capital Funds (EUVeCa). To move towards a pan-European venture capital market, the EU adopted the EUVeCa in 2013. What does this mean for venture capital in the EU? EUVeCa allows European fund managers with less than €500 million under management to raise capital from experienced investors freely throughout the EU without having to meet all of the demands of the AIFMD.

Financial regulations like EUVeCa help level the playing field for smaller member states in the EU with fewer domestic investors and barriers to cross-border fundraising that keep them from working with venture capital funds located in larger European countries.

Today, the European venture capital scene looks much different. European startups attracted more than $110 billion (€103B) throughout 2021, and the continent continues to make waves in the global venture scene.

State of VC funding in the EU

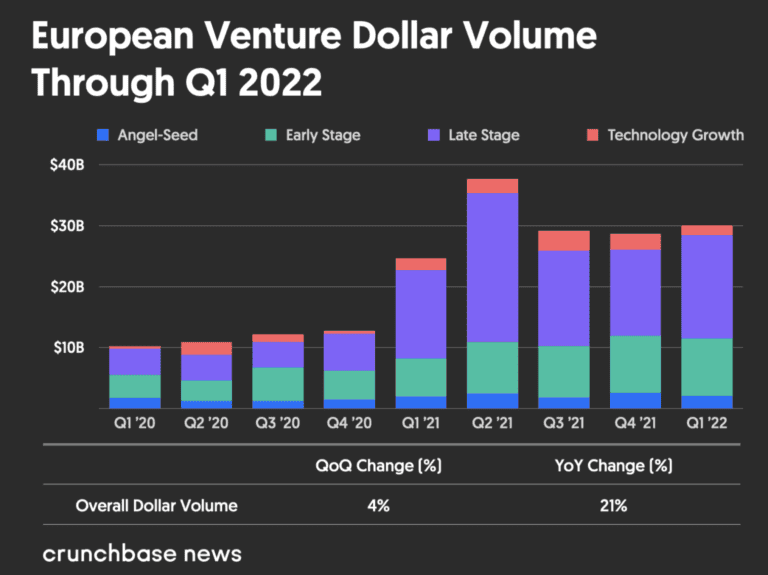

While global VC funding has taken a dip, European startups have had a solid start to the year. According to CB Insights’ State of Venture report, European startups attracted $26.8 billion (€25B) in funding during the first quarter of 2022

CB Insights also state that early-stage activity accounted for the largest deal shares—67%. However, Crunchbase’s breakdown is more granular, differentiating seed and angel deals from early-stage ones. Specifically, early-stage funding in Q1 2022 was $9.4 billion (€8.8B), up 50% YOY from the first quarter of 2021.

With startup valuations skyrocketing, record numbers of unicorns, and ever-increasing volumes of capital flowing into the European tech ecosystem, Europe is finally making its presence felt worldwide.

However, despite its success at the beginning of 2022, investment in seed-stage and early-stage European companies has slowed sharply in the past couple of months. Due to the current economic conditions and investor uncertainty, European VCs will likely take a more conservative approach to their capital investments in the immediate future.

Venture capital in the U.S. vs. the EU—what’s the difference?

The European venture scene has several differentiators that set it apart from the U.S., including longer fundraising cycles, fewer emerging managers, and more CVCs.

A new comparative study by Different Funds, which looked at 600 investment firms across 74 regions in Europe and the U.S., found that European funds are more international, more diversified in funding, and more generalist.

For example, European VCs take longer to fundraise: US firms tend to raise a new fund every 3.2 years on average, compared to 4.4 years in Europe. They also invest faster, adding 5.6 companies to their portfolios on average each year, compared to 3.6 companies for European VCs. In short, European VCs are historically slow. If you need money fast, think again—you should give yourself a long enough cash runaway to maintain operations instead of relying on an instant capital injection to help you scale.

Along with these differences, there are several questions that potential investors want to know—questions like: Is Europe really a cheaper place to invest? Crunchbase data shows that while a sizable gap remains in the size of the average and median early-stage funding round in Europe compared to the U.S., it narrowed in 2021. And from Series C onward in 2021, the typical European startup raised more in terms of average and median round size than its U.S. counterparts.

Crowdfunding and financial programs

In the EU, crowdfunding is a viable option for early-stage SaaS companies and can be done before, during, or after a round of venture capital investment. Crowdfunding platforms like Seedrs, Seedcamp, and CrowdCube allow European SaaS founders to get customers invested in their company before it goes public.

The European Commission also gives SMEs and small mid-caps in the EU access to capital through various programs, including:

- The Single EU Equity Financial Instrument

- The Pan-European Venture Capital Fund-of-Funds program (VentureEU)

- The European Scale-up Action for Risk capital (ESCALAR)

How to acquire VC funding in Europe

With all of the above information in mind, here are the steps SaaS founders should take to acquire VC funding in the EU.

Make a VC shortlist

An early-stage, European-founded startup will likely be seeking a European-based VC to lead their early funding rounds because they better understand the challenges of building fast-growth startups in Europe, can devote more time to startups in the same time zone, and offer more opportunities for networking across the EU tech landscape.

As you evaluate your funding options, take the following variables into account:

1. Funding stage: What stage of funding is the firm focused on? If you’re an early-stage company or startup, you’ll want to partner with a VC firm that’s equipped to guide you through your beginning market stages and help you grow.

2. Industry focus: While many serious VC funds make efforts to diversify their portfolio, you should ensure your prospective VC partner understands the nuances of your specific industry and how your SaaS fits into the marketplace.

3. Past deals: A proven track record of successful exits, IPOs, and overall growth is a must when searching for a VC partner. Are they transparent about the types of investments they make? How have they helped companies similar to yours? If you want more personal insights, consider reaching out to founders from their listed portfolio companies and ask how their experience has been working with their current VC partner.

4. Connections: The VC-founder relationship doesn’t begin and end with a round of funding—having a built-in network of industry professionals is equally important. A well-connected VC firm can bridge the gap between securing future funding, hiring talent, and raising awareness about your SaaS in the marketplace.

5. Location: “Out of sight and out of mind” isn’t just a clever turn of phrase. Most VC firms like to invest locally, so European startups should search for VC partners that are located within a similar time zone. Being able to reach your investors quickly, conduct quarterly meetings face-to-face, and work on the same schedule will ensure that your company stays top-of-mind.

6. Shared vision: Alignment between your VC partners and your executive team should be non-negotiable. Before signing a terms agreement and cashing the check, ask yourself the following questions:

- How hands-on do you want your VC partner to be in operations?

- Do you have a similar vision for your company’s product roadmap, or are there forks in the road?

- Do you want to take a conservative or an aggressive approach to growth?

- How vested do you think your potential VC will be in your company’s success?

Get your financial records and SaaS metrics in order

Inaccurate financial and SaaS metrics reports are major red flags for VC firms. Without a verifiable history of their company’s performance, SaaS founders have no way to validate their story and prove the ROI of their company to potential investors.

To keep your financial records up-to-date, try treating your monthly finances like a software release. At the end of every month, you should:

- Go into your CRM and run a report for what you should have booked.

- Reference your financial spreadsheet and ensure that the bookings listed in your CRM match what your finance department has accounted for in their general ledger.

- Go into your GL and ensure all those bookings are set. Even if you’re off by € 50, find it and fix it.

Performing this process on a monthly basis gives SaaS companies accurate insights into their current financial and business health. The only glaring issue is that this process is not easily scalable. As your company begins to grow, you’ll need to make additional finance hires, perform regular spreadsheet maintenance, and ensure that bookings, revenue changes, and company expenses are being updated 24/7.

Eventually, you’ll need to swap your spreadsheets for a FinOps tool that removes all the manual steps listed above. Investing in a dedicated financial operations platform that sits between your CRM and GL ensures that all your financial records remain up-to-date. Instead of warehousing data in a spreadsheet, a finops tool automatically syncs data across all your systems, so you can quickly pull updated SaaS metrics, easily navigate funding rounds, and gain the trust of potential VCs.

Identify VC firms interested in long-term partnerships

In your attempts to raise capital, don’t fall prey to VC firms that are looking for a quick cash grab. Unfortunately, many venture capital funds keep early-stage companies on bait n’ hook by issuing a meaningless terms sheet to feign exclusivity. Until you’ve gone through the legal process and had their money wired to you, you are not beholden to any VC partner.

Keep in mind that venture capital isn’t just about raising funds—it’s a partnership. Along with the money, you should ensure that the firm you choose will help you with legal, talent, sales, marketing, and product counsel if necessary.

Making the VC pitch

At some point in your VC journey, it’ll come time to make your pitch. And while a thoughtfully designed sales deck and founder story are helpful, VC partners want to know that an investment in your company will ultimately turn a profit.

To help you validate your company’s performance, we at Maxio have created this Financial Operations Checklist specifically for SaaS founders. This checklist includes actionable templates to help you implement consistency in your financial operations, so you can breeze through audits, make smarter business decisions, and develop trust with potential investors.