As year-end approaches, budgeting becomes a pivotal exercise for SaaS finance teams, requiring careful attention to both strategy and detail. However, the process offers more than just balancing numbers—it’s an opportunity to set the financial tone for the coming year and position your company for long-term success. By implementing proven tactics, you can transform your budgeting process into a strategic advantage that drives smarter decision-making and resource allocation. In this post, we explore five practical strategies, shared by finance experts CJ Gustafson and Ben Murray, that will help you build a more effective and resilient budget for 2025.

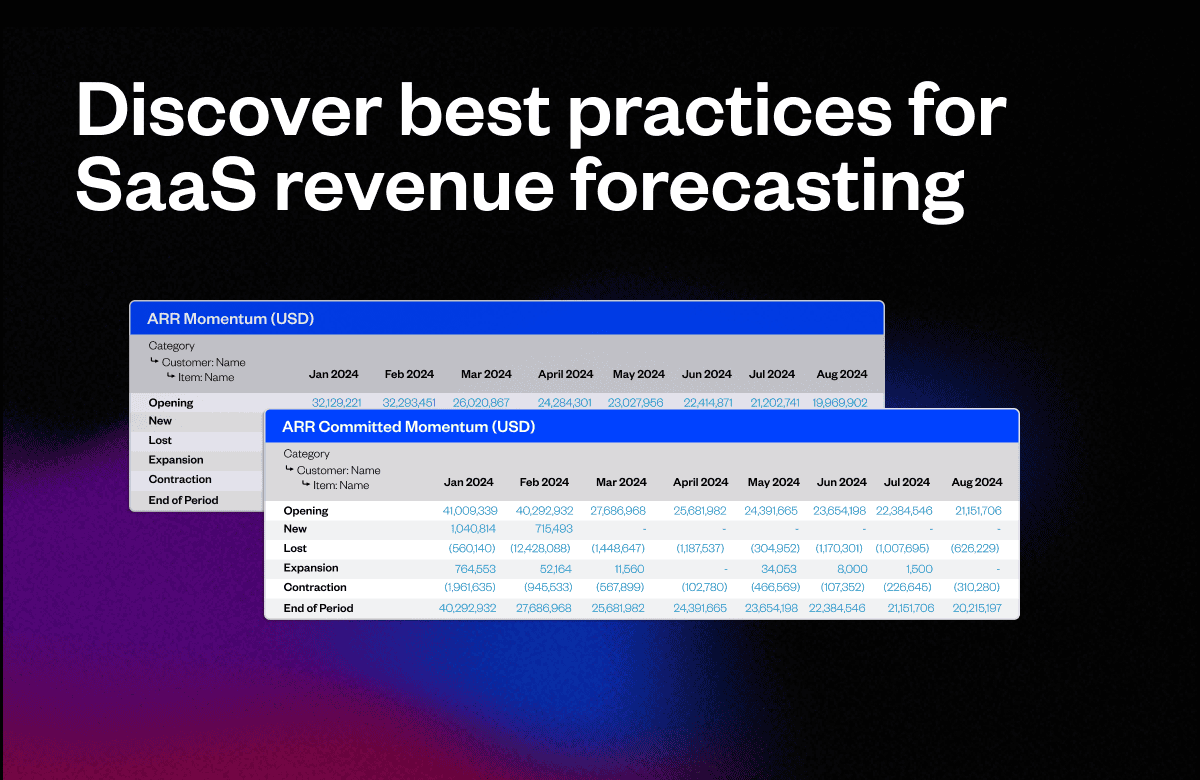

9A+3F: The Forecasting Formula for Accurate Year-End Projections

Instead of simply forecasting based on gut feel or historical data alone, 9A+3F (nine months actuals + three months forecast) offers a way to anchor your projections in reality while allowing room for predictive insights. This formula ensures you’re working with solid data while adjusting for future possibilities.

Tactic:

Use the 9A+3F model to continuously monitor and adjust your revenue forecasts throughout the year. By the time you hit the budgeting season, you’re operating with both accuracy and insight. In practice, this means not waiting until Q4 to adjust, but consistently updating your model as new data emerges.

Key Insight:

Tracking key metrics like gross revenue retention (GRR) and net revenue retention (NRR) alongside your 9A+3F calculations can provide better visibility into customer churn and expansion opportunities, helping you refine your forecast accuracy.

Mastering Headcount Planning: A Data-Driven Approach

Headcount is one of the most significant budgetary line items for any SaaS business. Both CJ and Ben emphasize the importance of accurately forecasting headcount and getting precise about whether you’re hiring for approved, active, or anticipated roles.

Tactic:

Implement a “headcount envelope” strategy where you set a maximum allowable number of employees in each department for the year and phase hiring over quarters to manage costs. Aligning your hiring plan with your product roadmap or go-to-market strategy ensures that you only hire when absolutely necessary, and it prevents over-budgeting based on unrealistic recruitment timelines.

Key Insight:

Incorporating backfill roles and attrition forecasts offers flexibility in your hiring plan. Anticipating delays in hiring creates a natural buffer that helps ensure the budget stays on track.

Top-Down Meets Bottom-Up: Optimizing Budget Allocation

Rather than treating top-down and bottom-up budgeting as opposing forces, CJ advocates for harmonizing the two approaches. The idea is to set strategic, high-level targets from the leadership team while allowing department heads the autonomy to allocate resources based on their granular understanding of day-to-day needs.

Tactic:

Work closely with department heads to establish a budget envelope—a maximum resource allocation per department—that ties directly into the organization’s overarching priorities. For example, if the company is targeting a 15% revenue increase, the sales and marketing budgets should reflect investments needed to support that goal.

Key Insight:

Creating a prioritization framework helps departments focus on essential initiatives and align their budgets with core objectives, preventing overextension of resources.

Managing Budget Variances: Prepare for the Unexpected

As CJ points out, every budget will be wrong to some degree, but the key is preparing for how wrong it might be. Rather than creating budgets that are “pinned to the penny,” building in buffers and managing expectations around variances is essential.

Tactic:

Establish a variance management process where departments are required to present a contingency plan alongside their budget proposals. This could include reducing discretionary spending like travel and training in case of underperformance or delaying certain initiatives until later in the fiscal year when actuals are clearer.

Key Insight:

Tracking under-utilization of allocated budgets early on allows for strategic reallocation of funds to more critical initiatives.

The Role of Post-Mortem Analysis in Budgeting

A budget is only as good as the lessons you learn from past performance. Conducting post-mortem reviews isn’t just about evaluating where things went wrong but identifying what worked—and why.

Tactic:

Hold quarterly post-mortems with department leaders to understand where the budget fell short or over-performed. Incorporate this feedback into your next budgeting cycle, especially when reviewing assumptions around headcount, revenue targets, or non-people-related expenses like software and travel.

Key Insight:

Transforming post-mortems into cross-departmental discussions can enhance alignment and foster insights that drive more effective budgeting across the organization.

Make 2025 Your Most Effective Budgeting Year

By adopting these actionable budgeting tactics, you can elevate you annual budgeting process into a powerful strategic tool. Whether you’re refining your forecasting models or aligning top-down targets with bottom-up insights, these proven approaches will help you better allocate resources, manage variances, and set your organization up for financial success in 2025.

For an in-depth discussion on these budgeting tactics and more insights from CJ Gustafson and Ben Murray, watch the full webinar on-demand.