SaaS Payments Solution

Manage the entire payment lifecycle with confidence

Integrates with:

Eliminate risk in SaaS billing and payment processing

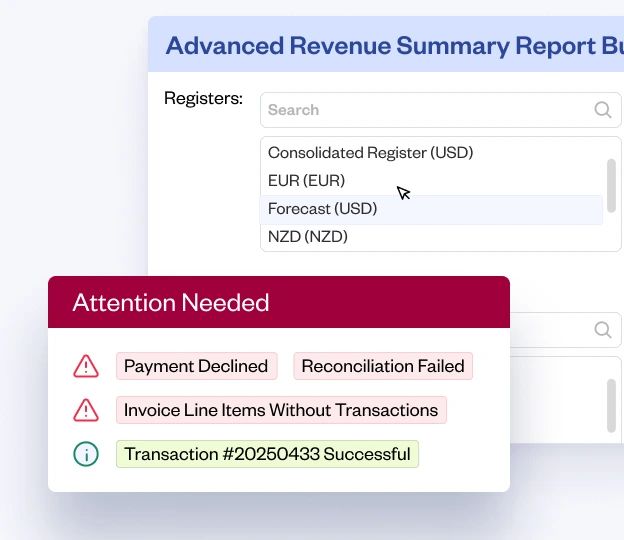

Reduce failed payments

Real-time visibility into failed transactions enables your team to retry, resolve, or follow up—reducing payment interruptions and involuntary churn.

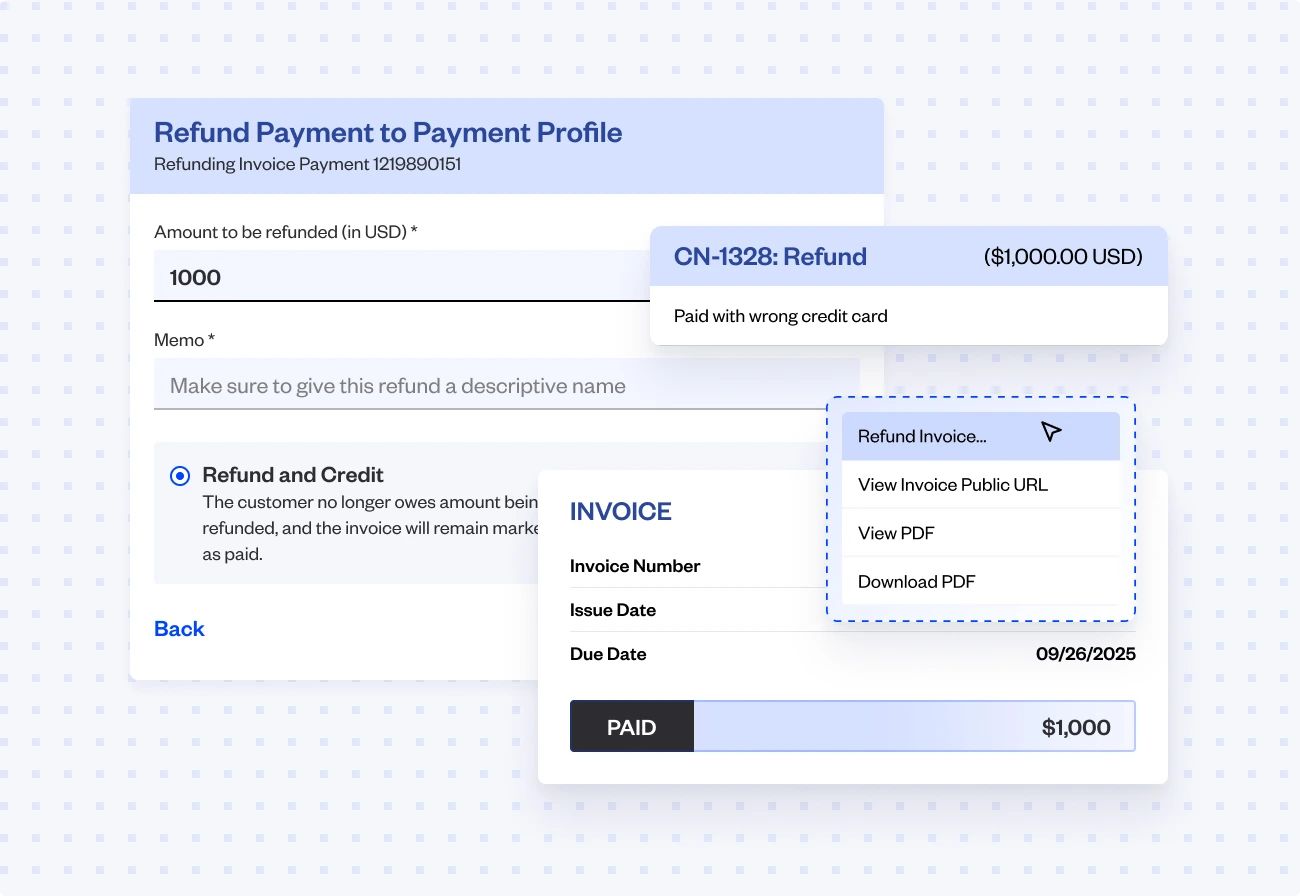

Prevent lost revenue

Protect every dollar across your payment operations: Avoid revenue leakage with automated reconciliation, chargeback handling, and built-in fraud detection.

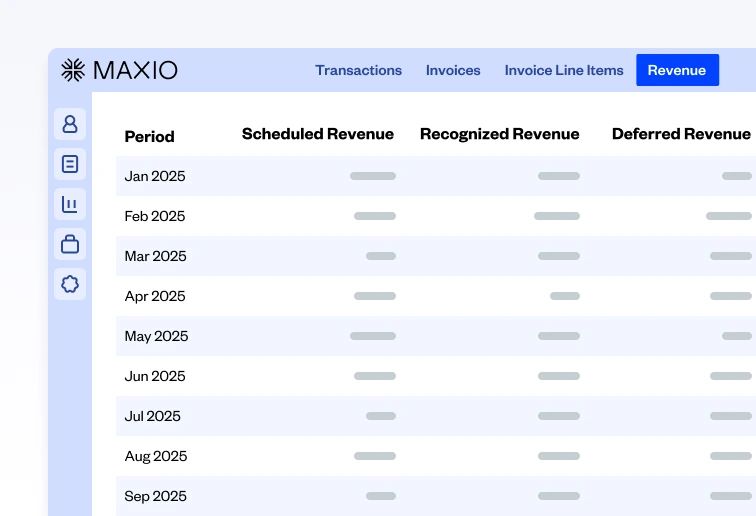

Maintain security and compliance

Guard your payment operations and customer data with enterprise-grade security, fully compliant with SOC 1 & 2, ISO 27001, PCI DSS level 1, and GDPR.

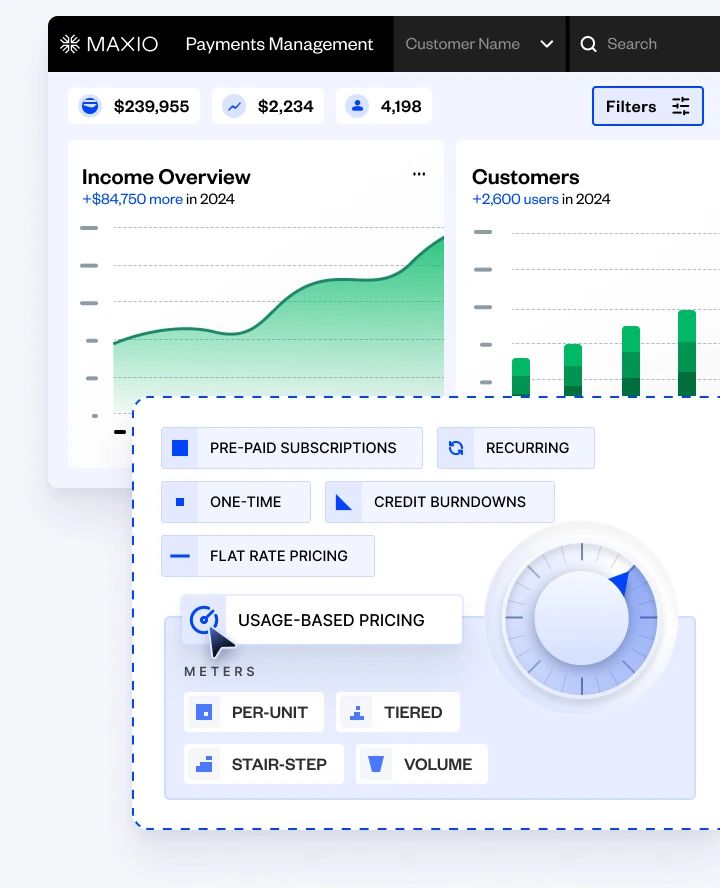

Drive growth with a SaaS payment solution built for control

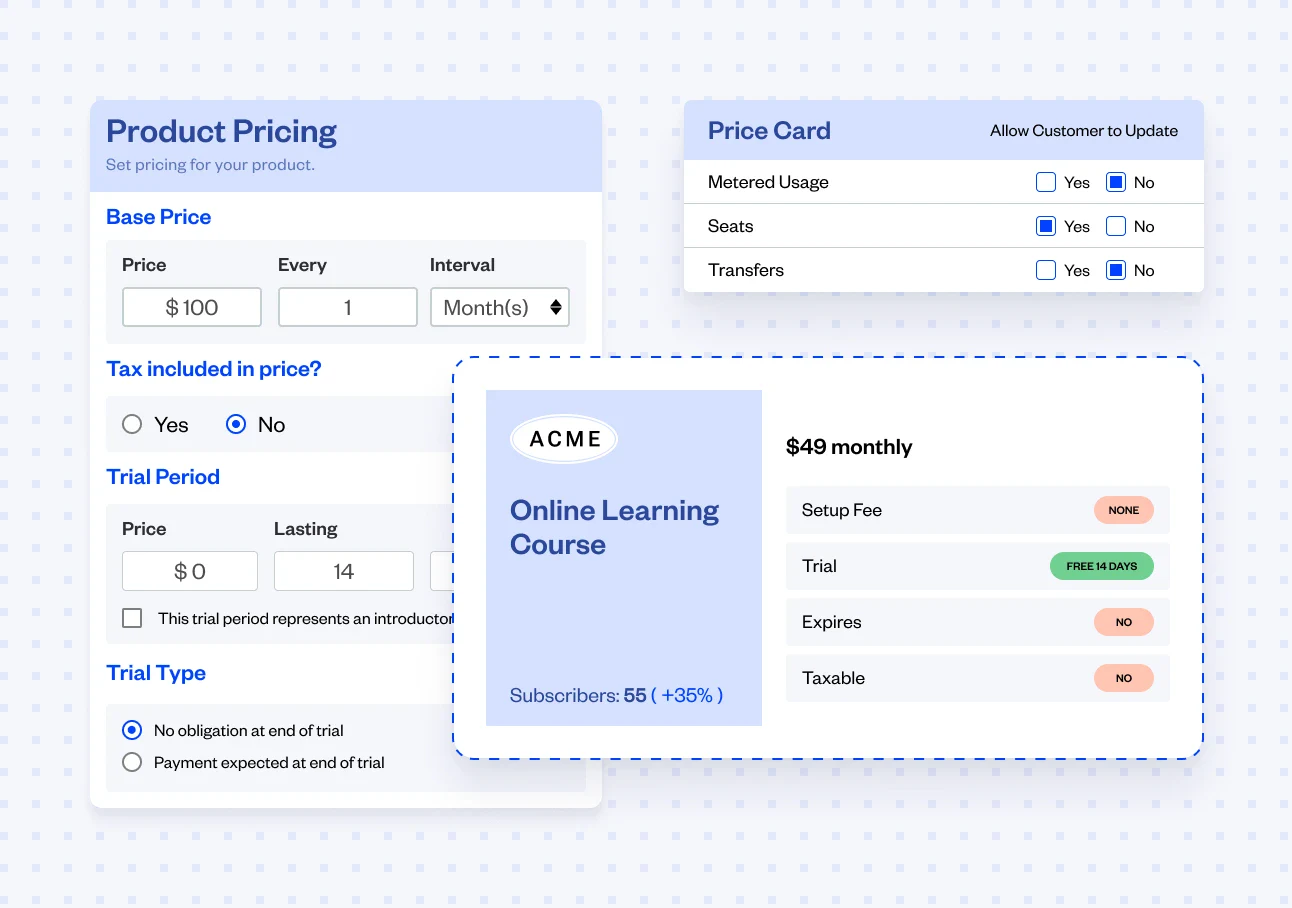

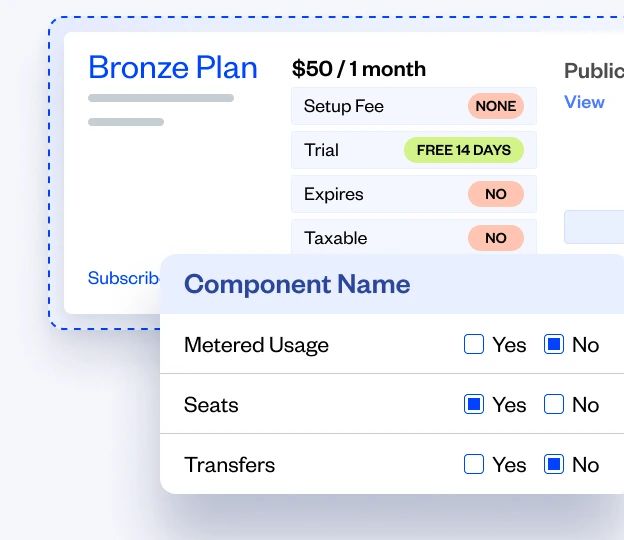

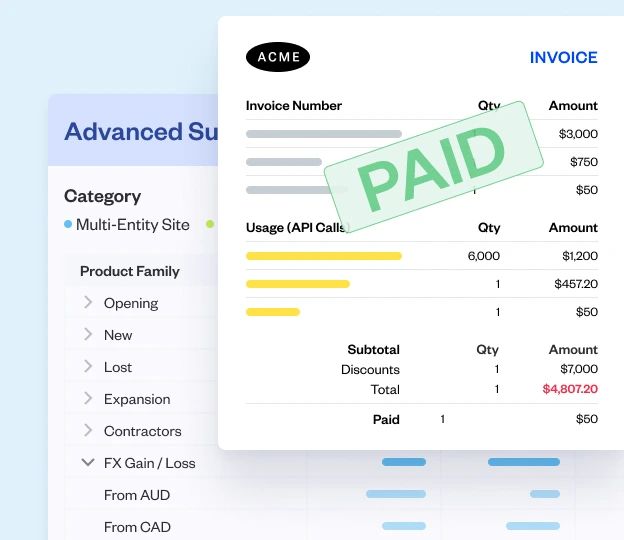

Automate invoicing and collections with recurring billing

Boost cash flow and cut manual work with recurring billing plans that automate invoicing, collections, renewals, tax calculations, and more.

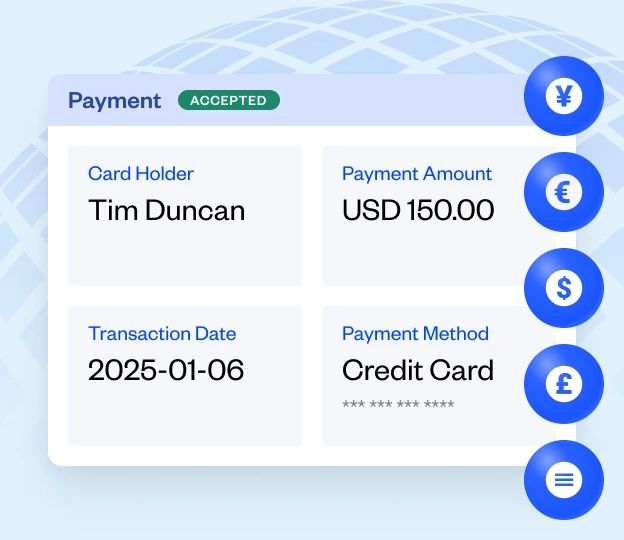

Accept payments with Maxio’s built-in payment gateway

Accept ACH, credit cards, debit cards, and digital wallets like Apple Pay in our

all-in-one, PCI-compliant platform.

Support global payment methods with multi-currency capabilities

Accept international payments, settle in multiple currencies, and stay compliant while expanding into global markets with multi-currency accounting software.

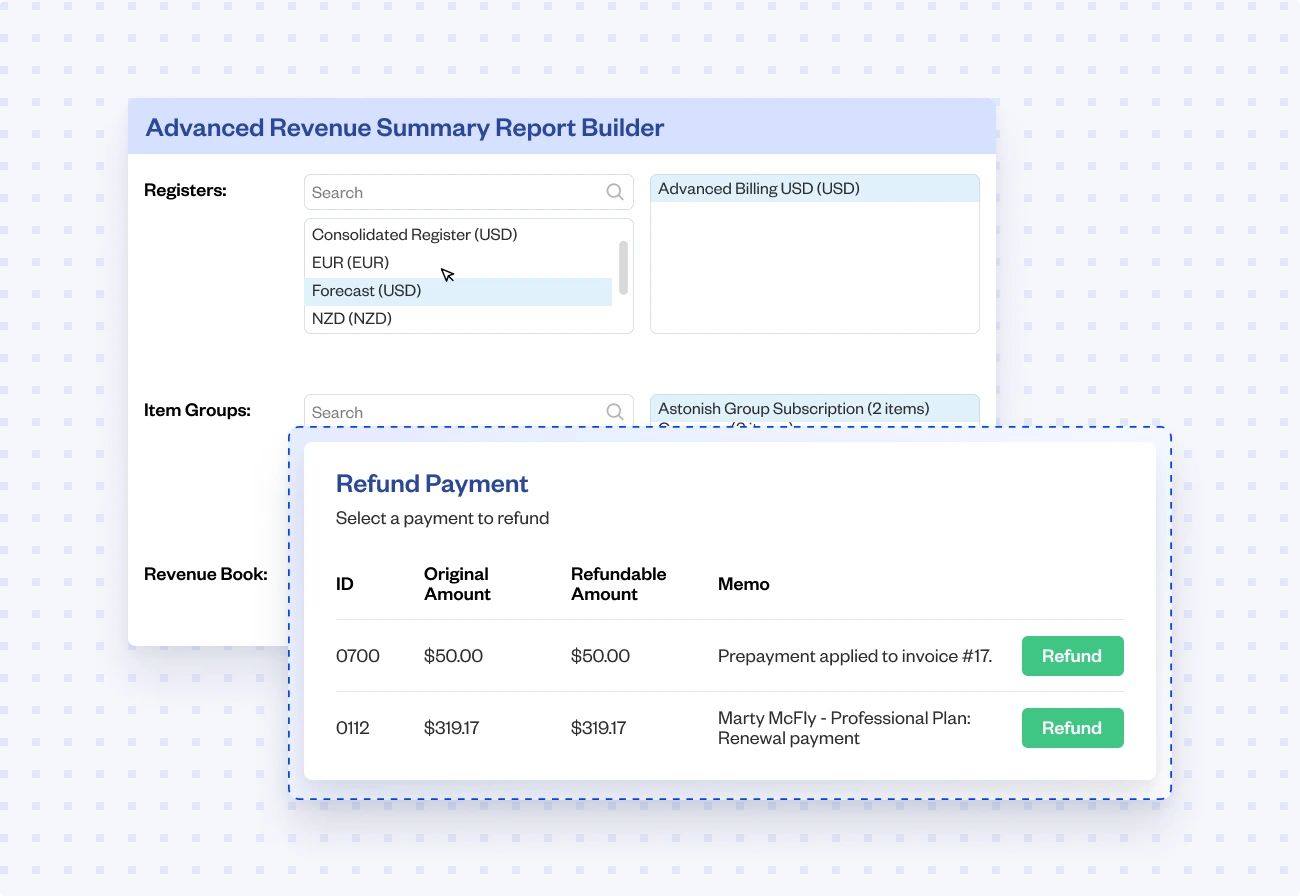

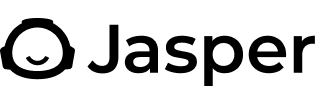

Monitor payments in real time with built-in reporting

Get instant insights into payment details and reconciliation status with SaaS reporting tools built to keep financial operations clear and up to date.

Integrate seamlessly with your CRM and GL

Customer reviews

Maxio Payments FAQs

The benefits of software as a service (SaaS) payment processing include automated recurring billing tasks, steady cash flow, and fewer manual errors. It’s designed for software companies with support for multiple pricing models, including recurring subscription plans and advanced usage-based billing software. This flexibility makes it easy to adapt your business model as you grow.

With built-in support for subscription-based recurring payments and chargebacks, Maxio’s SaaS payment processing offers the flexibility and visibility needed to scale efficiently. Fraud prevention tools and other features like dunning workflows, support for cancellations, and ways to update payment information help reduce involuntary churn and protect revenue.

Our integrated subscription billing software also supports recurring payments, subscription management, and flexible pricing to give SaaS companies a scalable way to monetize without stitching together multiple tools.

SaaS businesses choose Maxio Payments to simplify complex payment operations and reduce reliance on multiple payment systems and gateways by consolidating everything into a single payment platform. With built-in automation for reconciliation, invoicing, and subscription management, Maxio optimizes efficiency across global payment workflows and helps you collect payments reliably.

Maxio supports a wide range of payment options, including major credit and debit cards, ACH transfers, and international payment methods with multi-currency support, giving your customers flexibility at checkout and making it easier to match each customer’s payment preferences.

Deep integration with your billing systems and real-time visibility give teams better control and fewer manual tasks. Backed by in-house support and transparent pricing, Maxio transforms payments from a source of friction into a reliable growth engine.

Maxio’s subscription billing software offers unmatched visibility into the financial operations of your SaaS company.

More than 600 reviewers on G2 call Maxio a “very powerful product,” a “great tool for our finance department,” and an “integral part of our business.”

If you’re looking to streamline subscription management, schedule a demo to see how Maxio’s billing solution can support your business.

Maxio uses Interchange Plus Pricing for Maxio Payments. Interchange Plus Pricing is transparent. It separates card network fees from Maxio’s service fees, so you only pay for what you use.

This helps you save on high transaction fees, such as those charged for international cards or manually entered payments.

Yes, you can migrate from another payment processor to Maxio Payments. Maxio makes migrations seamless by using a secure, step-by-step process to transfer payment tokens from your existing gateway using PCI-compliant best practices. This ensures uninterrupted service for your customers while validating active cards for accuracy.

Support for SaaS platforms using Maxio Payments includes direct access to our in-house payments team. From onboarding and integration to ongoing operations, you’ll get expert help—not just a ticketing system.

Whether you’re configuring chargeback handling, refining dunning workflows, or ensuring your fraud protection tools are working effectively, our hands-on approach helps teams activate critical functionality faster and operate with greater confidence.

Maxio Payments supports ACH, major credit and debit cards, and digital wallets like Apple Pay. Google Pay support is currently in development.

Recognized for smooth implementations and great support