CFOs often approach us with the same problem…

“We’re growing faster, but my team can’t keep up with the pace.”

Month-end close takes longer, invoices are missed, revenue recognition mistakes compound, and reporting becomes an ordeal. What’s already a difficult job becomes a grind. With Maxio, B2B SaaS finance teams eliminate friction from their billing and financial operations allowing teams to focus on strategic projects rather than putting out operational fires.

The problem?

Operating out of disconnected systems leading to inefficient processes.

Before Maxio

- Reconciling data from disconnected systems

- Long month-end closes from inefficient processes

- Difficult or failed audits

With Maxio

- One-click investor-grade metrics & financial reporting

- More efficient month-end closes

- Audit-ready revenue reporting and audit trails

Maxio eliminates the friction that is slowing down your team

Make manual workflows like board reporting, rev rec, and collections the easiest part of your month.

Ready to reach zero-friction-finance?

Save dozens of hours on month-end close

From sales order to sent invoice – 79% faster

- Process sales orders efficiently with automation and two way integrations.

- Automate collections with custom dunning schedules.

- Organize and track every invoice in one place.

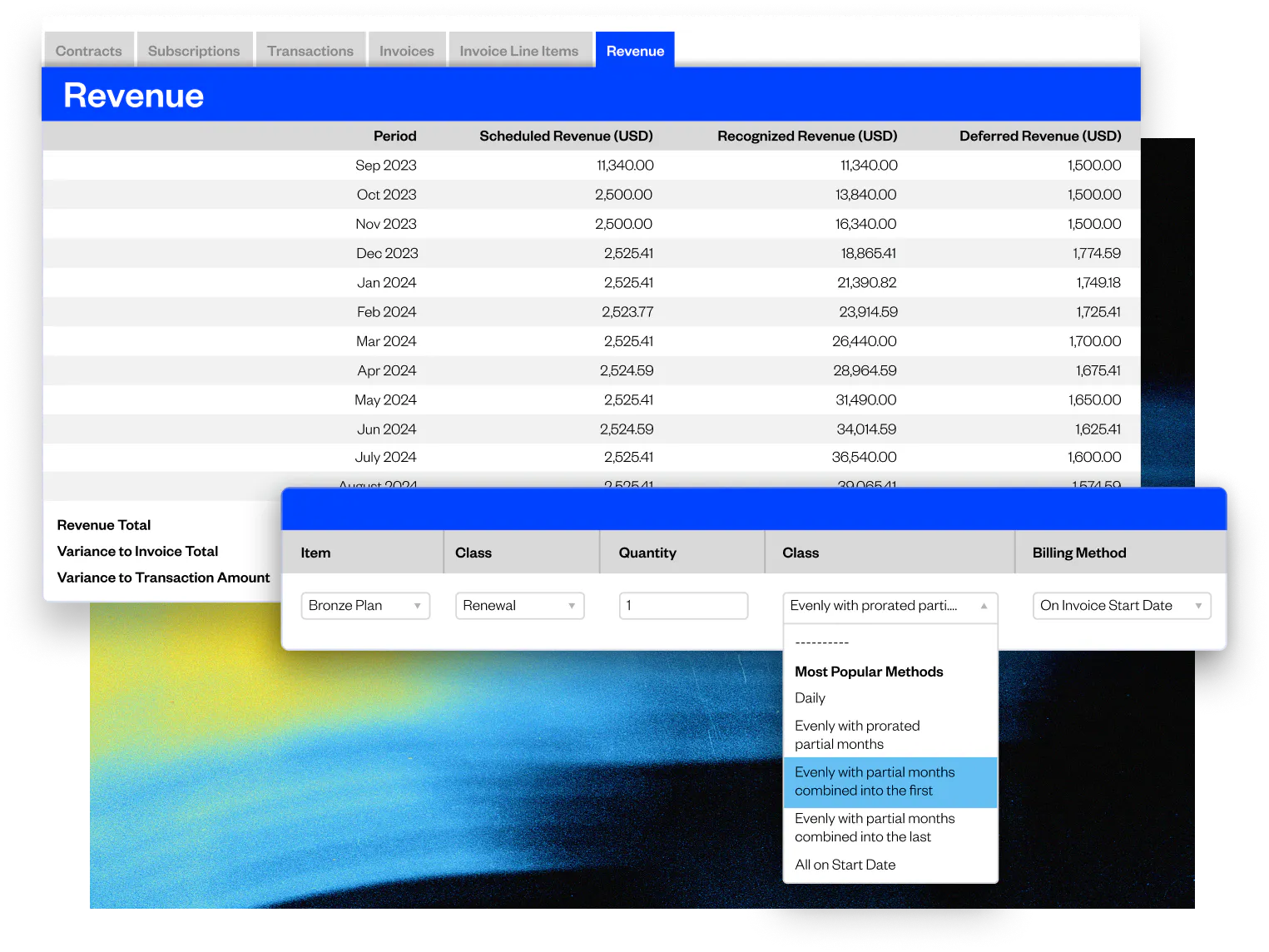

Make revenue recognition frictionless

- Automatically apply your revenue policy with accuracy and consistency across your entire customer base.

- Create revenue and deferred revenue schedules instantly.

- Sync paid invoices with your general ledger—no manual transfer required.

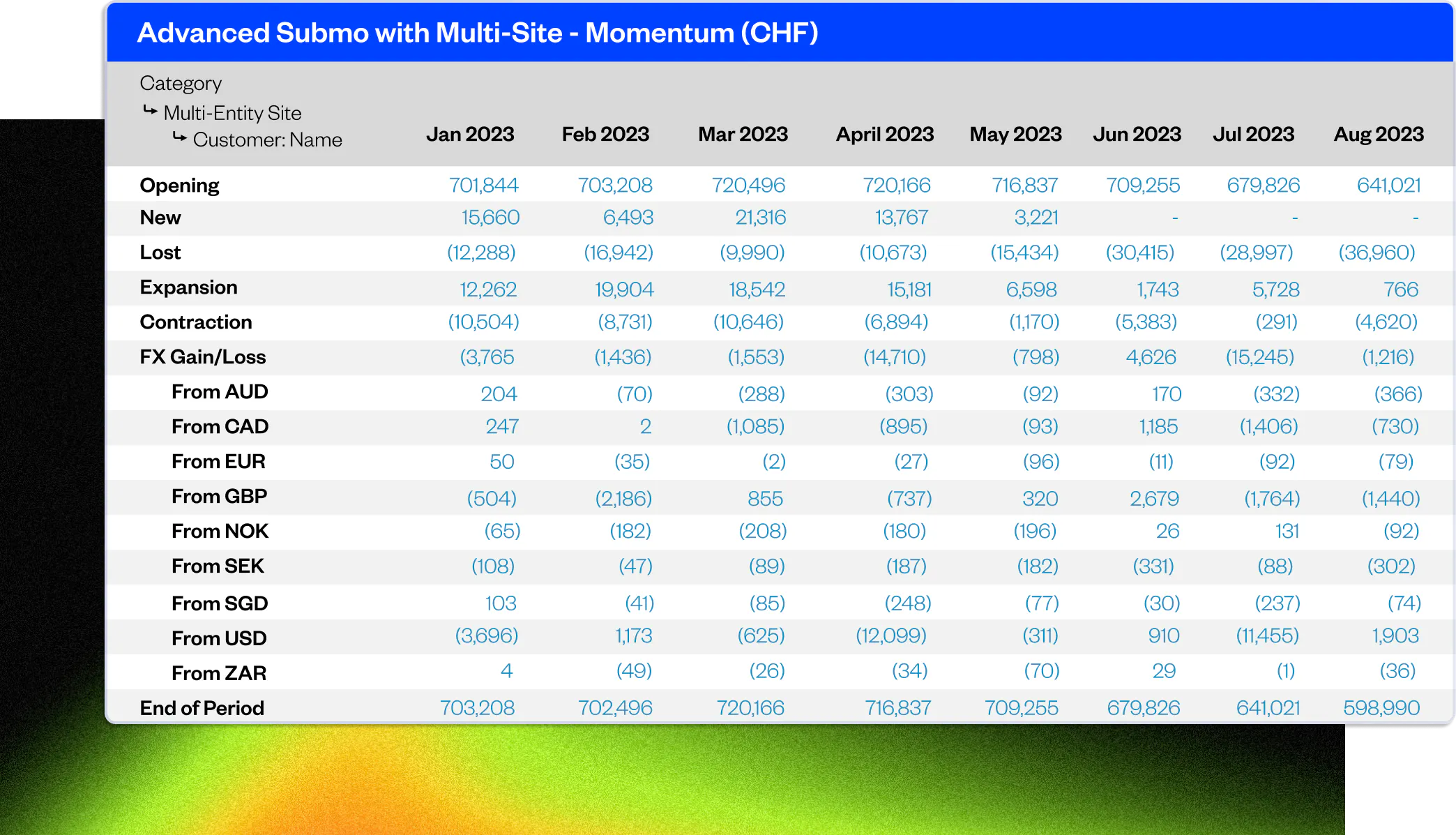

One-click investor-grade SaaS metrics

- Generate key SaaS metrics like ARR, MRR, churn, LTV, and more.

- Understand what is driving your business with drillable reporting.

- Segment reports with customer data.

Audit-ready financial reporting

- Connect all of your customer, contract, invoice, revenue, and payment details together into a single source

- Produce accurate, reportable revenue with just one click

- Run calculations with always up-to-date billing and invoicing records

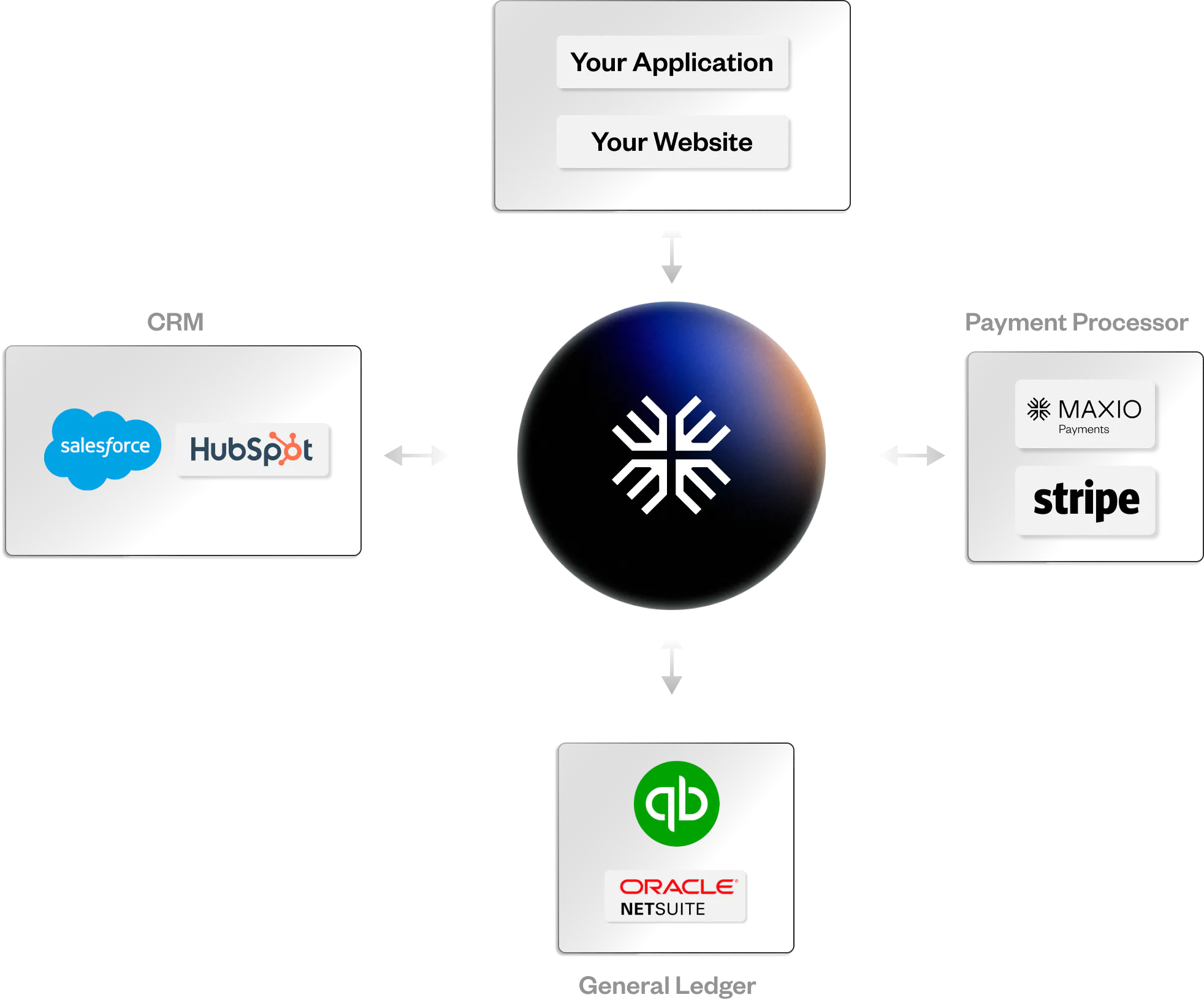

Integrate your financial tech stack

Reduce accounting errors and save time with Maxio’s bi-directional integrations. Automate tedious tasks like manual entries, reconciliation, and more.

Resources from Maxio’s blog

January 27, 2025

Financial Reporting

Top Red Flags in SaaS Financial Reporting

“I have reviewed the financial statements of over a thousand SaaS companies, and certain red flags consistently stand out.”

October 08, 2024

Financial Operations, Investment

Rethinking Budgeting: Insights from Top Finance Executives

“I asked the most competent people I know from the highest-performing organizations how they approached budgeting. ”

September 16, 2024

Cash management, Financial Operations, Financial Reporting

5 Budgeting Tactics Every SaaS Finance Leader Should Implement for 2025

“Explore expert strategies that streamline budgeting, improve resource allocation, and set the stage for long-term SaaS financial success.”

Finance and accounting software FAQs

Finance and accounting software is software purpose built for finance teams. This type of software automates historically manual accounting processes freeing teams to dedicate time on more strategic projects. Processes like revenue recogntion, producing SaaS metrics, reconciliation, collections, and more are handled by this type of software.

Finance software helps ensure compliance with Generally Accepted Accounting Principles (GAAP) by streamlining the revenue reporting process specific to your own business model. Revenue recognition automation features ensure consistent and compliant revenue accounting within the specific requirements of IFRS 15 and ASC606 and other GAAP principles, so your finances are always in order and annual financial audits go smoothly.

Most revenue recognition tools are able to integrate with other systems. These may include customer relationship management (CRM) platforms like Salesforce; enterprise resource planning (ERP) systems like Oracle NetSuite; and a range of project management and general ledgers/accounting software your organization may use.

Integrating with these platforms streamlines workflows, allowing for real-time data synchronization, ensuring that all revenue-related activities, such as sales, renewals, and cancellations, are accounted for.

Maxio’s advanced accounts receivable management software streamlines accounts receivable management by automating customer payments and collections management. It allows users to customize invoicing, implement automated dunning processes to recover past due payments, and manage customer accounts efficiently. These features help businesses reduce the time and effort spent on manual collections and improve cash flow.

SaaS reporting tools enable decision-makers to access accurate, real-time data, displayed in easy-to-read graphs and reports, and clearly understand the status of each of their key performance indicators in relation to their KPI goals.

By representing data in an understandable way, SaaS reporting tools enable business leaders to make informed decisions quickly, optimize strategies, and drive growth. This data-driven approach ensures that decisions are based on actual performance metrics, rather than assumed conclusions or gut feelings.

See what Maxio can do

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

SaaS reporting tools

Never lose sight of your business performance with accurate, reportable SaaS metrics.

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond.

Subscription billing

Manage complex billing scenarios without cluttering your product catalog.