Why Usage-Based Pricing Gives SaaS Companies an Edge

In today’s saturated SaaS market, differentiation is critical. Pricing strategies can determine whether a company thrives or struggles to retain customers. Usage-based pricing (UBP) has emerged as a powerful way for SaaS businesses to gain a competitive advantage. By offering a flexible, scalable pricing model, companies can attract a wider customer base, drive greater adoption, and optimize revenue growth.

UBP is more than just an alternative pricing model—it’s a strategic differentiator. Companies that implement it successfully not only stand out but also increase customer retention and long-term profitability. Let’s explore how UBP enhances pricing agility and positions SaaS businesses ahead of their competition.

How UBP Creates a Competitive Advantage

Differentiation in Pricing Strategy

Traditional subscription-based pricing models can create barriers to entry, particularly for small businesses hesitant to commit to high upfront costs. UBP removes these barriers by allowing customers to pay for what they use, making services more accessible across a broad customer spectrum.

SaaS companies leveraging UBP can position themselves as customer-centric providers, offering tailored solutions that meet the needs of startups, SMBs, and enterprise clients alike. This level of accessibility provides a distinct advantage over competitors who rely solely on rigid pricing structures.

Better Market Fit and Expanded Customer Base

A one-size-fits-all pricing model often alienates potential customers. Different businesses have different needs—some require minimal access, while others demand enterprise-scale functionality. UBP ensures that pricing aligns with usage, making it appealing to a diverse range of customers.

By adopting a flexible pricing structure, SaaS companies can:

- Attract startups and small businesses with low-cost entry points.

- Provide enterprise clients with scalable solutions that grow alongside their needs.

- Support high-growth businesses seeking adaptable pricing models that evolve with their usage patterns.

Stronger Customer Relationships and Retention

UBP fosters trust and long-term engagement by ensuring customers pay only for the value they receive. When customers feel they are being billed fairly, they are more likely to remain loyal and continue expanding their usage.

Additionally, UBP reduces the risk of churn by allowing customers to scale their engagement based on evolving needs. Instead of seeking alternative solutions, they can simply adjust their usage, making them more likely to stay with the provider long term.

Increased Revenue Potential and Profitability

One of the most compelling aspects of UBP is its ability to drive organic revenue growth. Unlike rigid pricing tiers that may cap customer spending, UBP enables natural expansion—customers who find value in a product increase their usage, leading to incremental revenue gains.

This model also eliminates the friction associated with forced plan upgrades. Instead of pushing customers toward higher-cost tiers, businesses can let usage scale naturally, ensuring that increased spending feels seamless and justified.

The Role of Pricing Agility in Competitive Markets

In fast-changing SaaS markets, pricing agility is essential. UBP provides the flexibility companies need to adapt to evolving customer demands and economic conditions.

Responding to Market Trends

SaaS companies can use UBP to test different pricing structures and adjust based on customer feedback and usage trends. This ability to pivot quickly ensures businesses remain competitive and aligned with market expectations.

Customizing Enterprise Agreements

Larger clients often require tailored pricing structures. UBP allows SaaS companies to offer custom agreements based on actual usage, making it easier to close high-value enterprise deals.

Adapting to Economic Fluctuations

During economic downturns, businesses often cut costs, leading to higher churn in rigid subscription models. UBP enables customers to scale back temporarily rather than cancel altogether, preserving customer relationships and maintaining revenue continuity.

Addressing Common UBP Challenges

Managing Revenue Predictability

UBP introduces variability in revenue streams, but hybrid models—combining base subscriptions with usage-based components—help balance stability with scalability.

Educating Customers on UBP Pricing

Transparent billing is essential to ensuring customer trust. Businesses should provide:

- Clear, easy-to-read invoices detailing usage-based charges.

- Self-service dashboards to help customers track their spending.

- Proactive notifications to prevent unexpected charges.

Continuous Pricing Optimization

To remain competitive, SaaS companies must refine their pricing based on real-time usage data. Regular adjustments ensure they capture optimal revenue while continuing to meet customer expectations.

Gain a Competitive Edge with UBP

Usage-based pricing isn’t just a pricing model—it’s a strategic advantage that enables SaaS companies to attract more customers, increase retention, and drive scalable revenue growth.

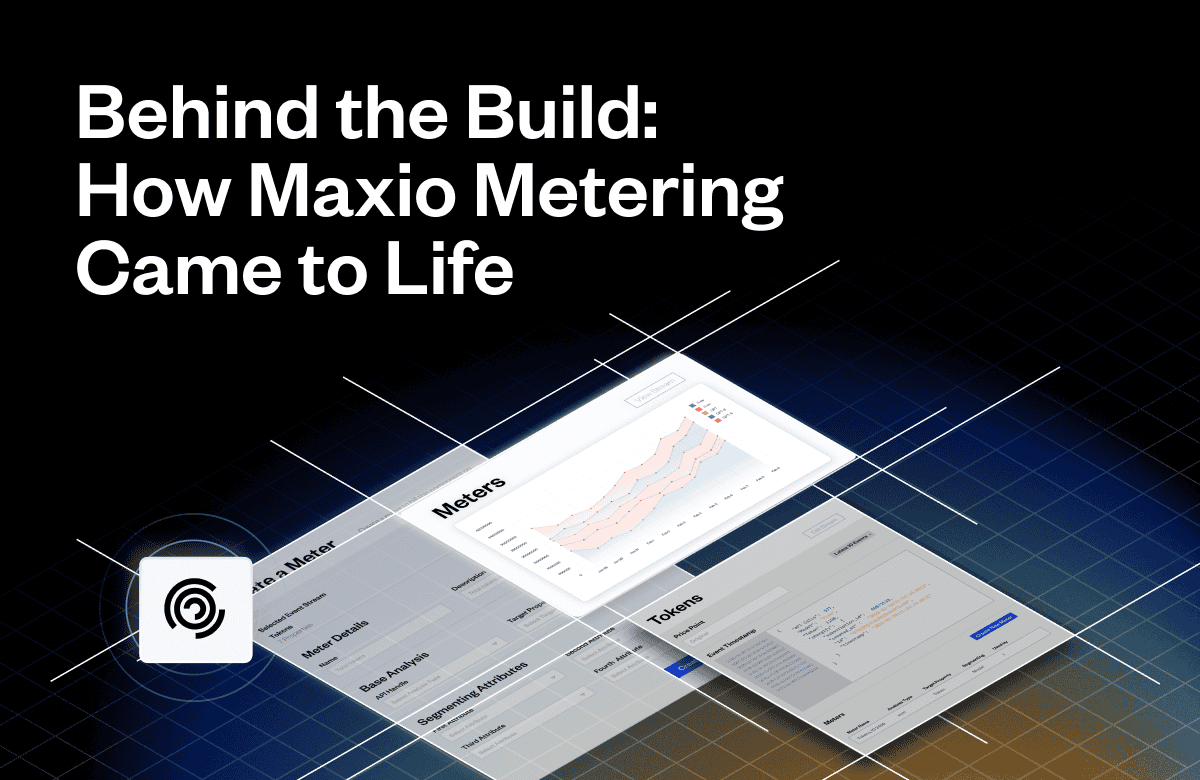

How Maxio Supports Competitive UBP Strategies

Maxio provides the tools SaaS companies need to implement UBP effectively, including:

- Real-time usage tracking: Gain insights into customer behavior and spending patterns.

- Flexible billing automation: Ensure seamless and accurate invoicing.

- Customizable pricing models: Support tiered, volume-based, and hybrid structures.

- Predictive analytics: Leverage data-driven insights to optimize pricing and revenue strategies.

Want to refine your UBP strategy? Download Maxio’s, Adopting Usage-Based Pricing in SaaS: A Practical Guide for expert insights and best practices.

Looking for a seamless way to implement usage-based pricing? Request a demo of Maxio today to see how our platform can optimize your revenue and pricing model.