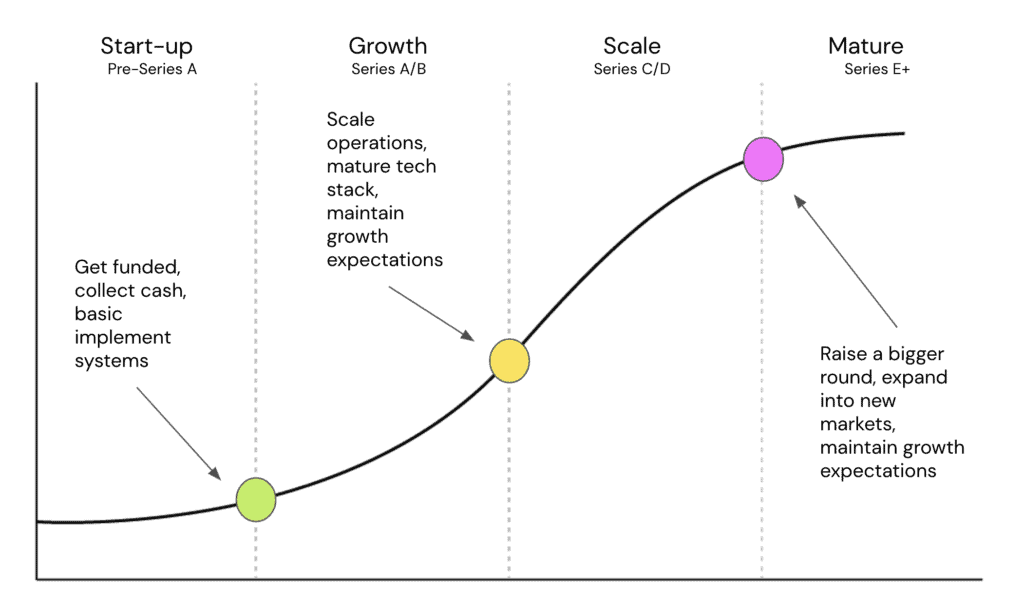

As your SaaS company navigates through new inflection points and growth stages, managing finances becomes increasingly complex.

From tracking revenue streams to monitoring expenses and filing taxes, SaaS businesses need a reliable accounting solution to stay on top of their financial management. Fortunately, with the growth of online tools and cloud-based technologies, bookkeeping and accounting have become more accessible and efficient than ever before.

In this guide, we’ll introduce you to seven trusted accounting software tools that can help SaaS companies scale and streamline their financial operations. Our updated list features software that provides real-time tracking, creates invoices, collects payments, and retains relevant documents for tax purposes.

Let’s dive in and explore how the right accounting software can revolutionize your SaaS business.

Benefits of SaaS accounting software

There are countless benefits to using SaaS accounting software for your business needs. Here are some of the top reasons why more and more SaaS companies are turning to cloud-based accounting solutions:

- CRM integration: By integrating with your customer relationship management (CRM) system, you can streamline your cash flow management and order-to-cash process. For example, Maxio syncs bi-directionally between your general ledger and CRM so you can push and pull customer and billing data wherever you need.

- Cloud-based: With cloud-based software, you can access your accounting data from anywhere, anytime. Unlike with on-premise software, this makes it easy to stay up-to-date on financial reporting, expense tracking, accounts payable management, and more.

- Revenue recognition: Accounting software helps you recognize revenue efficiently and accurately. This is important for SaaS companies that use accrual accounting methods, offer multiple billing and pricing models, and need to stay ASC-606 and IFRS-15 compliant.

- Expense management: SaaS accounting software enables you to track and manage expenses easily. You can create budgets and analyze expenses in real time, which makes it easier to review your cash inflows and outflows and keep your balance sheet healthy.

- Subscription management: If you’re a SaaS business, subscription management is critical. Accounting software helps you manage recurring payments, identify churn, and analyze customer acquisition costs. For example, Maxio lets you consolidate your product catalog, manage subscription activity, and automate your entire order-to-revenue process, from renewals to revenue recognition.

- Financial reporting functionality: You wouldn’t want to walk into a meeting with your investors or the board without accurate financials, right? Accounting software can provide financial reporting functionality that allows you to generate balance sheets, income statements, and cash flow statements quickly and easily.

- Sales tax: Sales tax is often a time-consuming and complicated process. Accounting software can help you automate sales tax calculations, ensuring that your business stays compliant.

Aside from the benefits mentioned above, it’s worth mentioning the biggest reason to invest in a SaaS accounting solution: to eliminate spreadsheets. An experienced finance professional can make a spreadsheet fit almost any use case, but as your SaaS company starts to scale, your color-coded master spreadsheet can quickly turn into a liability.

By investing in a dedicated accounting software, you’ll spend less time on transactional accounting activities and more time plotting your company’s financial future.

7 best accounting software solutions for SaaS companies

Each of the SaaS accounting software solutions listed below are fully capable of meeting your business’s needs, however, each one will differ slightly when it comes to your industry, primary use case, revenue range, budget, and more.

It’s also worth mentioning that Maxio already has integrations built for Xero, Netsuite, and Quickbooks. Whether you’re a startup, mid-sized company, or rapidly scaling to the enterprise level, these are the accounting solutions you should consider to support your finance department.

Maxio (Previously Chargify & SaaSOptics)

Ideal User:

The Maxio platform was built specifically for finance professionals at early-stage, mid-sized, and rapidly growing B2B SaaS companies.

Software Overview:

In short, Maxio automates your billing, subscription management, collections, and SaaS metrics reporting, so you can stop chasing dollars and focus on what’s next. That being said, because Maxio is built exclusively for B2B SaaS, it is not a great choice for other industries or verticals like e-Commerce, media companies, hardware manufacturing, or IOT companies.

Need to streamline your financial operations? With Maxio, you can:

- Bill customers and get paid any way you want

- Never miss an invoice or payment ever again

- Complete your month-end close in minutes (not days)

- Pass financial audits with flying color

- Report to your BoD/investors with confidence

- Access a single source of truth for financial & operating metrics

Regardless of your revenue range or growth stage, Maxio is equipped to help you navigate financial obstacles so you can achieve efficient, predictable revenue growth and lead your business with confidence.

Pricing:

Maxio pricing starts at $599/month. You can view our pricing page for more info.

Xero

Ideal User:

Xero is the world-leading online accounting software built for small businesses.

Software Overview:

Xero is a cloud-based accounting software company that provides a range of accounting and financial management solutions to small and medium-sized businesses.

One of Xero’s greatest strengths is that it makes it easy to track project profitability. This is because Xero allows its users to see how much each project is costing them in real-time and compare that to their estimated profits.

The platform also offers a wide range of features, including invoicing, inventory management, bank reconciliation, payroll, and expense management, among others. Another advantage of Xero is its strong integrations with other business tools, including third-party applications like PayPal, Stripe, and Maxio.

Xero + Maxio integration:

Together, Maxio and Xero provide:

- GAAP/IFRS-compliant revenue recognition without spreadsheets

- Efficient invoice scheduling and highly customizable e-invoicing

- Milestone-based revenue and invoice management not available in Xero

- Out-of-the-box subscription metrics and analytics not available in Xero

- Ability to apply one payment to multiple invoices which is not available in Xero

- Flexible and efficient accounts receivables and collections management

- Allows you to reconcile your Stripe payments to your GL

You can learn more about the Xero + Maxio integration here.

Pricing:

Xero’s subscription-based pricing plans range from $13 a month to $70 a month.

NetSuite

Ideal User:

NetSuite is the leading integrated cloud business software suite, including business accounting, ERP, CRM, and e-commerce software.

Software Overview:

NetSuite is a cloud-based business management software company that offers a wide range of solutions, including ERP, CRM, financial management, and e-commerce. The software is designed to help businesses manage their operations more efficiently and is known for its scalability and flexibility.

One of the biggest pros of NetSuite is its comprehensive suite of features, which can be customized to meet the needs of businesses of all sizes. The platform offers robust financial management capabilities, including accounts payable and receivable, budgeting, and forecasting. Additionally, NetSuite’s CRM and e-commerce solutions are highly regarded and can help businesses streamline their sales and marketing efforts.

Another advantage of NetSuite is its scalability. It can grow with your business and can support multiple subsidiaries, currencies, and tax jurisdictions. This makes it a great choice for businesses that are expanding globally.

However, NetSuite’s strengths are also its greatest weaknesses. For example, NetSuite’s breadth and depth of features can be complex and difficult to set up, which may require businesses to invest heavily in training, implementation, and support. Additionally, NetSuite’s pricing can be on the high side, which may be a downside for smaller businesses with limited budgets.

NetSuite + Maxio integration:

The thing about NetSuite is in most cases, it drastically complicates your financial operations. Migrating your existing financial data is difficult, and can result in data errors during implementation. However, if you’re required to switch to NetSuite, you don’t have to move everything.

By integrating NetSuite and Maxio, you can easily toggle between Netsuite and Maxio to see the records you need to see, without having to manage your financial processes within NetSuite.

Within Maxio Advanced Billing, you can sync financial records between Maxio and NetSuite, including:

- Product catalog

- Customer details

- Invoices

- Payments

How does it work?

Maxio and NetSuite sync bidirectionally, updating records automatically between platforms. What does that mean, exactly?

Whether you’re working in Maxio or NetSuite, you don’t have to worry about manually migrating data or toggling back and forth between platforms to find the data you need. With bidirectional data syncs between Maxio and NetSuite, you can access up-to-date information wherever you are.

Pricing:

NetSuite’s pricing varies depending on which product configuration your company selects, the add-on modules required, the total user count, contract duration, and specific industry requirements. The other costs typically include implementation as well as a third-party consultant to handle implementation.

Quickbooks Online

Ideal User:

Quickbooks Online is a cloud-based accounting software that is designed for small and medium-sized businesses, freelancers, and self-employed individuals. The ideal users of Quickbooks Online are those who want to manage their finances more efficiently, save time on bookkeeping tasks, and have better control over their finances.

Software Overview:

QuickBooks Online is a cloud-based accounting software developed by Intuit, designed to help small businesses that might not have an accounting background to manage their finances efficiently. The software provides a range of features, including invoicing, bank reconciliation, expense tracking, and financial reporting.

QuickBooks is available both online and via desktop and is ideal for businesses that outsource their accounting tasks to a bookkeeper or accountant. This is because QuickBooks only allows up to 40 users for its highest-tiered plan, and even then, some plans require every user to pay for their own account.

Another advantage of QuickBooks Online is its strong integration capabilities. The software can be easily integrated with third-party applications, such as PayPal, Shopify, and Maxio to streamline business operations and improve efficiency.

Quickbooks + Maxio integration:

You can learn more about the Quickbooks and Maxio integration here.

Pricing:

Quickbook’s subscription-based pricing plans range from $17 a month to $36 a month.

Freshbooks

Ideal User:

Freshbooks is a cloud-based accounting software designed for small business owners, freelancers, and self-employed professionals.

Software Overview:

FreshBooks is a cloud-based accounting software company that provides invoicing, time tracking, and financial management solutions for self-employed professionals and freelancers. The software is designed to be easy to use and to help business owners save time by automating administrative tasks.

One of the biggest pros of FreshBooks is its user-friendly interface, which makes it easy for business owners to navigate the software and manage their finances with little accounting knowledge. The platform also offers a wide range of features, including invoicing, expense tracking, time tracking, and project management, among others.

However, FreshBook’s niche use case doesn’t make it a logical choice for B2B SaaS businesses. For example, the software can be limited in terms of its accounting capabilities and doesn’t handle more complex revenue recognition and financial reporting scenarios well.

Pricing:

Freshbook’s subscription-based pricing plans range from $17 a month to $55 a month, including custom pricing for larger businesses that need dedicated account management and additional add-on features.

Sage Intacct

Ideal User:

Sage Intacct is a cloud-based accounting software designed for medium-sized businesses, nonprofit organizations, and financial service companies. The ideal users of Sage Intacct are those who need a sophisticated and scalable accounting system that can handle complex financial processes and provide advanced reporting capabilities.

Software Overview:

Sage Intacct is a cloud-based accounting software company that provides financial management solutions for businesses of all sizes. One of the biggest pros of Sage Intacct is its scalability. The software can be easily customized to meet the needs of businesses of all sizes, from small SaaS startups to large corporations. Additionally, Sage Intacct offers a wide range of features, including accounts payable and receivable, inventory management, and project accounting, among others.

Another advantage of Sage Intacct is its strong integration capabilities. The software can be easily integrated with a wide range of third-party applications, such as Salesforce, Stripe, and a native integration with Maxio.

However, Sage Intacct also has some cons that may be somewhat annoying or undesirable to some users. For example, the software can be complex and difficult to set up, which may require businesses to invest in implementation, training, and support. Additionally, its high price point doesn’t make it an ideal choice for many startups and early-stage companies.

Pricing:

Similar to NetSuite, Sage Intacct’s pricing varies depending on which product configuration your company selects, the add-on modules required, the total user count, contract duration, and specific industry requirements. Other costs typically include implementation as well as a third-party consultant to handle implementation.

Wave Financial

Ideal User:

Wave Financial is a cloud-based accounting software designed for solopreneurs, freelancers, and self-employed professionals.

Software Overview:

Wave Financial is a cloud-based accounting software company that provides financial management solutions for small businesses and freelancers. The software is designed to be easy to use and affordable, making it an attractive option for businesses with limited resources.

One of the biggest pros of Wave Financial is its affordability. The software is available for free, with optional paid add-ons for features such as payroll and payment processing. Additionally, Wave Financial offers a wide range of features, including invoicing, expense tracking, and accounting, among others.

However, Wave Financial may be too basic for businesses with more complex financial needs and may not be suitable for larger businesses with more extensive accounting requirements. Additionally, some users may find the ads within the software to be a distraction.

Pricing:

Wave Financial’s accounting software, invoicing software, and US-only banking software are 100% free. However, Wave’s optional paid features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors.

What to look for when choosing a SaaS accounting system

When selecting a SaaS accounting system, there are several considerations that you should take into account to ensure that you choose the best software for your needs. Here are some key features and elements to look for:

Security features

Security is a critical consideration for any SaaS accounting system. A few non-negotiable security features should include encryption, two-factor authentication, and regular security audits. This is particularly important for businesses that deal with sensitive information, such as financial statements, invoices, and customers’ financial records.

Ease of use

The software’s ease of use is also an essential consideration, particularly for early-stage businesses that may not have an experienced CFO, CPA, or equivalent financial professional to oversee their financial operations. Business owners should look for software that is intuitive and easy to navigate, with clear documentation and customer support to resolve any potential help requests.

Data & analytics reporting

Another key feature to look for is the software’s data and analytics reporting capabilities. Ideally, the software you choose should provide real-time insights into financial data, such as MRR and other key metrics, and allow you to generate reports quickly and easily. This is particularly important for sharing your company’s financial performance with your executive team, investors, and board of directors.

Forecasting capabilities

Lastly, you should look for SaaS accounting software that offers forecasting capabilities or revenue projections. This feature enables businesses to project future financial performance and decide where capital should be allocated across their organization. For example, forecasting tools are particularly useful when planning a merger or acquisition, managing cash flow, or preparing for an upcoming funding event.

Accounting software built for B2B SaaS

A reliable accounting solution is a fundamental component of the modern tech stack. By investing in an accounting system that’s built for the needs of B2B SaaS companies, you’ll be able to automate your transactional accounting tasks and focus on the future growth of your business.

That’s why we built Maxio—Maxio makes it easy for finance and accounting teams to recognize complex revenue, generate financial reports, and view SaaS metrics and analytics dashboards all in one place.

Schedule a demo to see how Maxio can help you go from spreadsheet jockey to strategic advisor.