Sometimes, it’s good to take a step back and gain a new perspective.

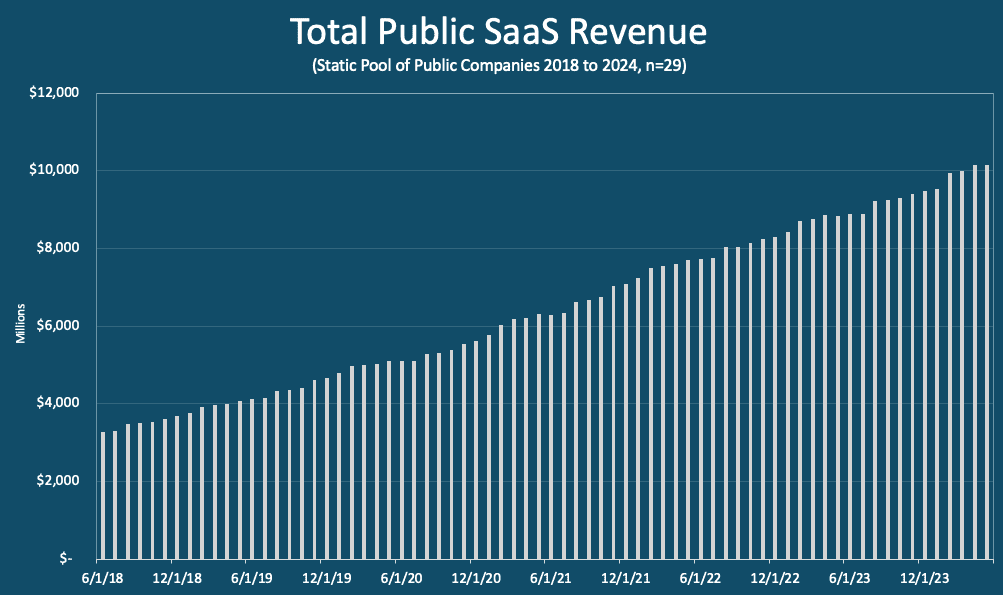

The accompanying chart sums up the revenue of all public SaaS companies that have been public over the last five years. It’s a static pool of public SaaS.

Remembering those years as the most chaotic in the industry’s history, with valuations spiking and then plunging, unicorns being born and dying, capital flowing and then drying up, a recession and a pandemic, it’s almost incomprehensible how stable the revenue trendline has been.

Almost all other industries have had revenue declines and spikes over this period, but because of its highly recurring revenue, that has never happened in SaaS and likely never will.

The industry’s size, not shrinking demand, is the primary reason growth rates are decreasing. For example, Workday added 27% more revenue in 2023 than in 2021, yet its growth rate slowed from 19% to 17%. The same is true for the industry. Back in the go-go days of the Fall of 2021, this group of public SaaS companies grew year-over-year revenue by $1.3 billion, which is precisely the same amount they grew revenue in the past 12 months. In 2021, the $1.3 billion in growth delivered a 25% growth rate; today, the $1.3 billion only delivers a 15% growth rate because the companies are larger.

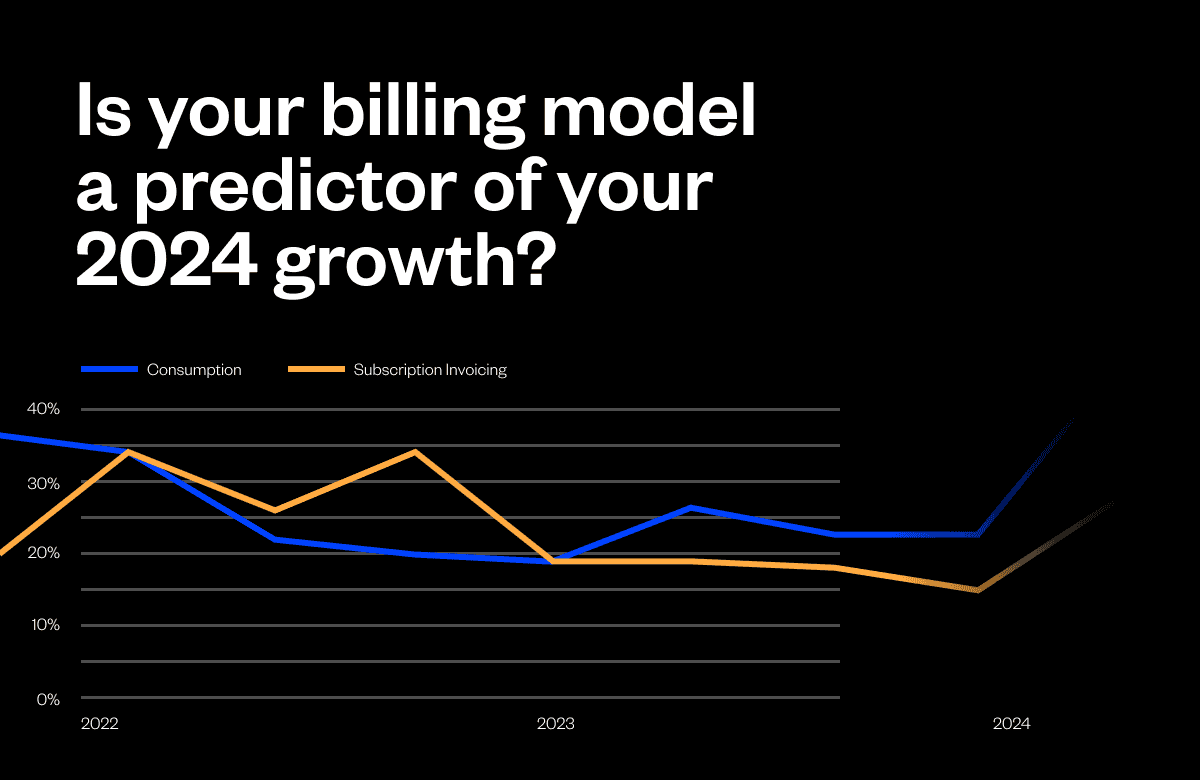

Is summing the revenue of a static pool of 29 public companies the best way to estimate revenue trends for the entire industry? It’s not perfect, but it’s clear that private markets are moving on a similar path. As outlined in the Maxio Institute Report, the slowing growth in private markets mirrors those of the public markets and is subject to the same math.

Implications:

- Customers are buying twice as much software from these companies as they did just four years ago, so let’s dial back the theories about why companies are spending so much less on software. Growth has absolutely slowed, but most of it has nothing to do with macro forces or execution. It’s just math. To have maintained the growth rates of 2020 and 2021 would have been insane. The slowdown was inevitable.

- SaaS is not a broken industry; it’s actually more predictable and stable than we think. The slowdown in growth is real, but as you can see, it is measured and predictable. The volatility we have seen in valuations and capital formation is mostly of our own making. For entrepreneurs and investors, the forward visibility of industry-wide growth trends could not be clearer.

- There are signs of renewed growth, but industry-wide growth rates will never be above 20% again. The dollar value of year-over-year revenue growth has increased in each of the last four months from $1.1 billion to $1.3 billion, yet the growth rate only increased from 13% to 15%. To hit 20% growth, new revenue must exceed $1.5 billion annually and go up.

No other industry can boast such consistent growth over the last five years while enduring repeated bouts of valuation whiplash. It’s uncertain if the volatility will persist, but the industry’s forward revenue trend is relatively easy to discern when you filter out the noise.