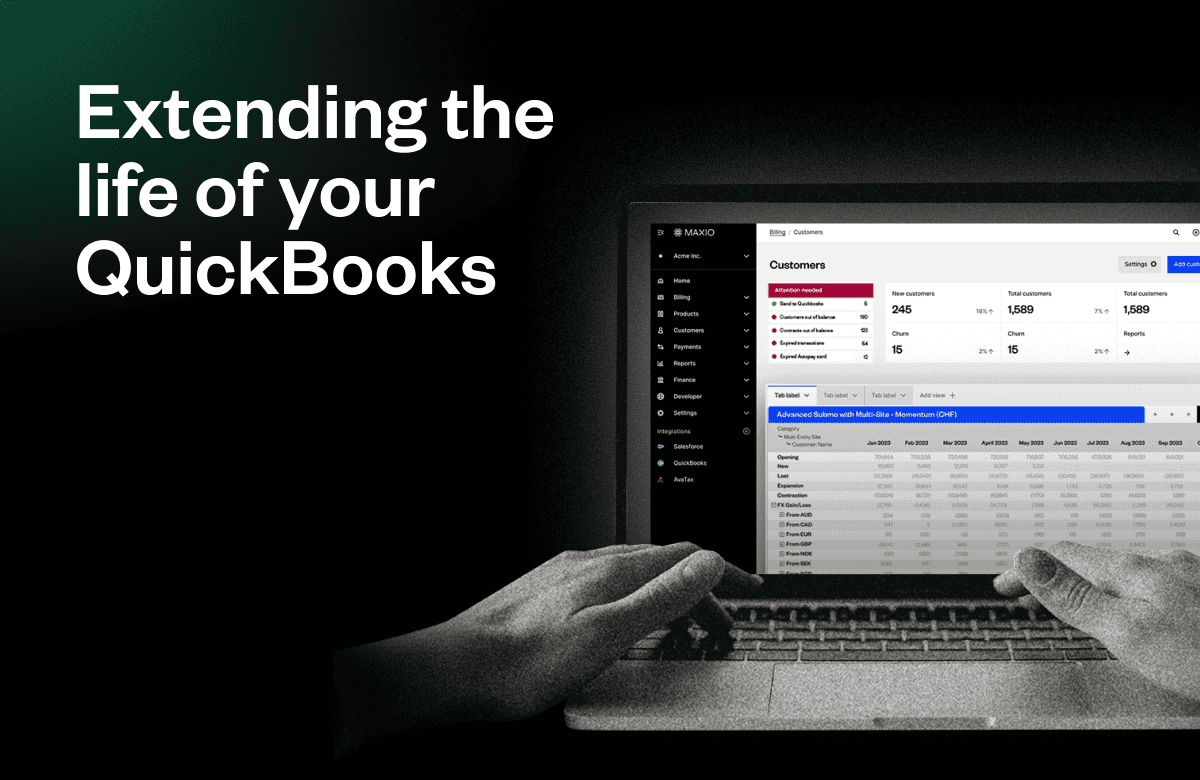

The QuickBooks SaaS Story: Can You Relate?

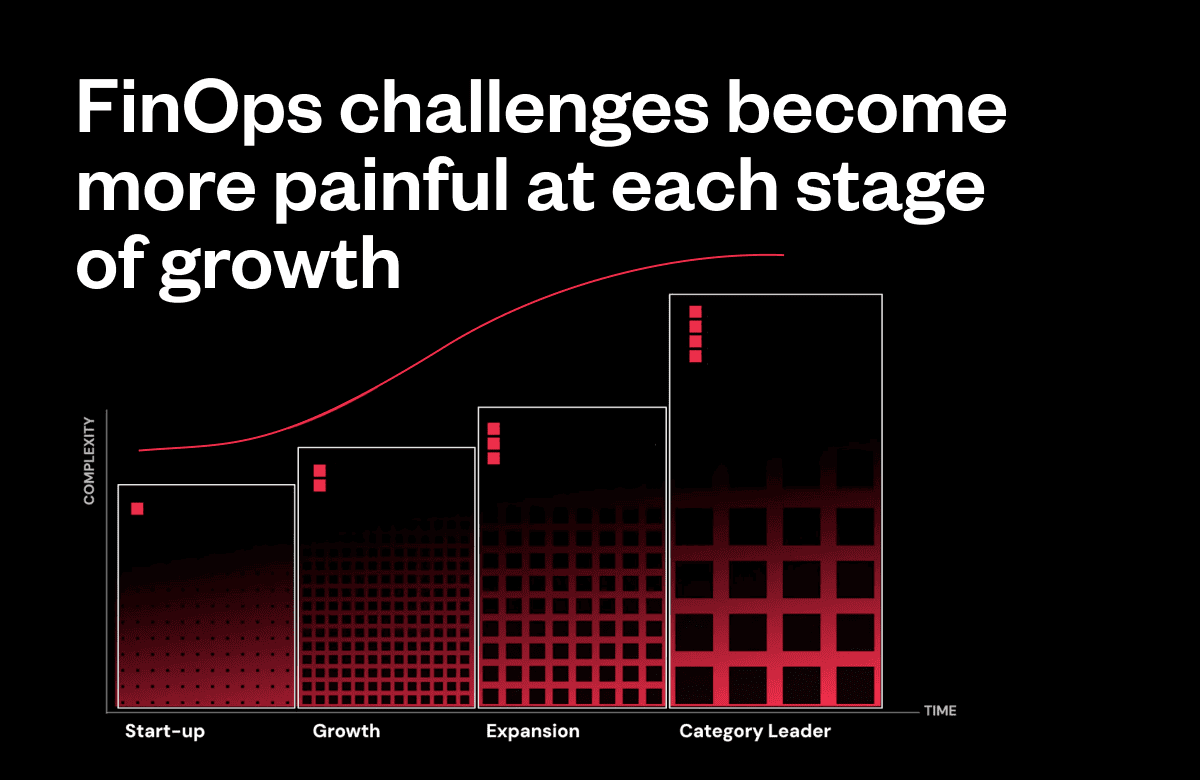

You’ve been there, right? Your QuickBooks instance was doing just fine in your company’s infancy. But now you’ve got hundreds of customers, and the FinOps debt is piling up.

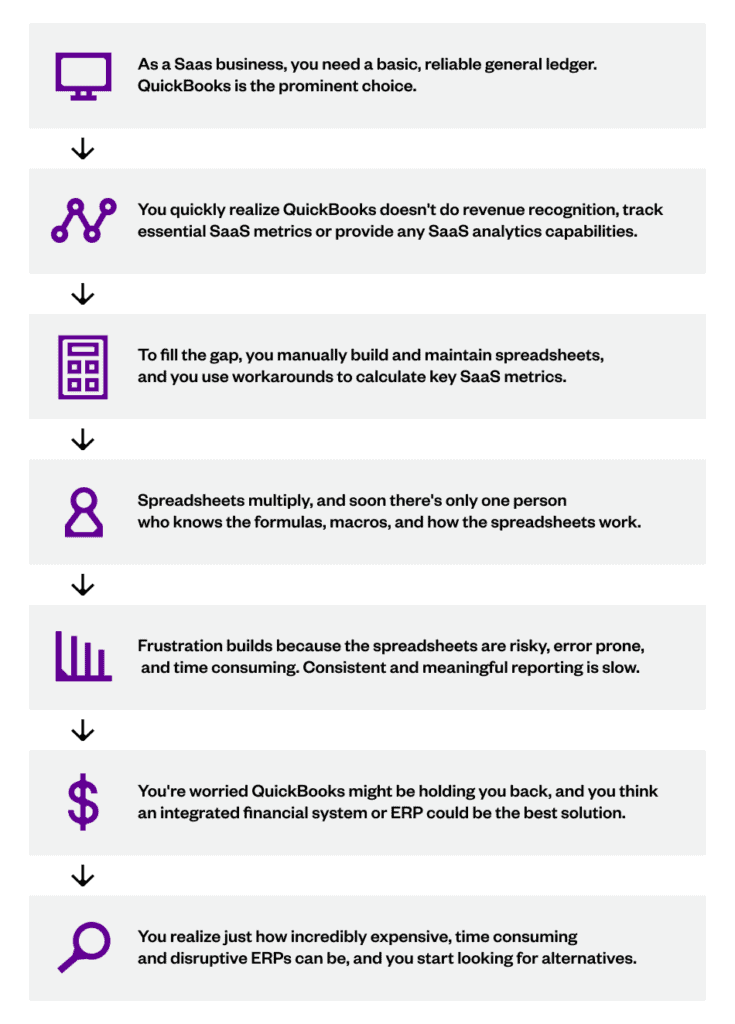

While QuickBooks was initially a great option for your business, you now need to support more complex financial operations and reporting functions. QuickBooks wasn’t built for B2B SaaS or subscription-based businesses, so finance teams create complicated workarounds to make it viable. At some point, your team has to admit it’s just not a good option and begin looking at an ERP, which is a necessary move. That process often looks something like this:

We know exactly how disruptive moving to an ERP can be for a SaaS business. While it may be the best next step at some point, that doesn’t make it the best next step today.

In this post, we’ll help you understand if now is really the best time for you to transition to an ERP, and if it’s not, how Maxio can help you extend the life of your QuickBooks account instead.

5 Signs You’re Outgrowing QuickBooks

Unfortunately, there’s no silver bullet for knowing exactly when to call it quits with QuickBooks. Some might say it’s after you reach a certain ARR or employee count threshold. But in reality, the life of QuickBooks has less to do with how much ARR you’re managing and more to do with how sophisticated your business operations are.

For example, QuickBooks wasn’t built to manage subscription revenue and recurring billing, especially if you have sales-negotiated contracts. It also doesn’t provide all the essential SaaS metrics and analytics necessary to manage, grow, and retain customers or connect with customer relationship management (CRM) systems. All of these challenges add up to make life pretty difficult in the back office.

While there’s not a single moment you can point to, here are a few signs that you may be reaching the end of your QuickBooks lifecycle.

Your board is pressuring you to switch to a subscription model.

Challenge

Once your company acquires enough customers to prove product-market fit, your board starts to pressure you to adopt a subscription model. Subscriptions mean recurring revenue streams for the business. This is good for you and good for the board, but it’s going to be a nightmare for invoicing in QuickBooks.

QuickBooks wasn’t built for subscription businesses. “Recurring transactions” is the closest thing it has to a recurring billing function, but that’s like using a band-aid when you need stitches.

To fill in the gaps, you rely on a spreadsheet for invoice scheduling and visibility into cash flow. However, invoicing is often missed, late, or incorrect. Additionally, late invoices tend to negatively impact cash flow.

Solution

Maxio simplifies your recurring billing so invoices are fully managed and scheduled when a contract is won. This ensures invoices go out on time and provides you with the visibility you need into your business’s health.

With Maxio, you can:

- Process orders

- Manage renewals and invoices

- Manage upgrades, add-ons, and extensions

- Create custom invoice themes

- Include subscription dates in line-item descriptions

- Calculate sales tax

With our complete dunning and collections function, you can also reduce Days Sales Outstanding (DSO) to maximize cash flow.

Investors are asking for metrics you can’t produce.

Challenge

You won’t find subscription metrics in QuickBooks. Without the ability to dig into MRR, ARR, churn and retention (logo and dollar), and customer lifetime value (CLV) within your billing/invoicing engine, SaaS businesses must use spreadsheets to compensate again.

While QuickBooks does provide basic general ledger functionality, that alone isn’t enough for a SaaS business. Some businesses will try to force a CRM like Salesforce to provide SaaS metrics like MRR or ARR, but these quickly get out of sync with numbers tracked by the finance team.

It’s one thing to go back and forth internally over how you arrived at a certain number. It’s another thing entirely to have the same discussion in front of potential investors or, worse, have a potential investor call out an inconsistency. Shaky SaaS metrics erode investor trust and call into question the integrity of your financial operations. If you have this problem, it’s not a matter of if but when you need to level up from operating in just QuickBooks alone.

Solution

The Maxio analytics engine is the most optimized subscription analytics engine in the market, delivering accurate and real-time insight into all of your key SaaS metrics, including MRR, ARR, dollar churn and retention, logo churn and retention, subscription momentum, cohorts, CLV, and more.

Because these metrics are built from the same financial transactions that generate your GAAP revenue and invoicing, they’re the most accurate subscription analytics you can get.

You’ve started color-coding your spreadsheets.

Challenge

You need contracts, invoices, and revenue recognition schedules to produce GAAP-compliant revenue reports and correct deferred revenue. But QuickBooks wasn’t built to handle recurring invoicing (at least not well).

As a workaround, you’re likely augmenting the work in Excel. However, as you acquire more customers and introduce more complicated sales-negotiated contracts, the spreadsheet starts to take on a life of its own. You’re left with a color-coded mess filled with complex formulas and error messages.

Solution

Maxio manages your revenue and invoicing schedules, contracts, and transactions. It also reports the revenue and deferred revenue you need to stay GAAP compliant. Tightly integrated with QuickBooks, Maxio records and reports on all key revenue numbers, so you don’t waste time and energy wrangling with spreadsheets or worrying about data inaccuracies. Built-in revenue integrity checks ensure you won’t overreport or underreport. You’ll know immediately if numbers are out of balance.

Finance, sales, and customer success data are scattered across systems.

Challenge

QuickBooks doesn’t integrate well with Salesforce and other CRMs if at all, which forces your team to manage customers and orders in a separate system that isn’t connected to your financial systems. That means sales teams who work exclusively in a CRM will see ARR, MRR, churn, retention, and other metrics that don’t align with the accurate picture produced by the finance team.

This causes you to spend too much time and energy trying to get your team on the same page with a shared understanding of performance against your key business metrics.

Solution

Maxio bridges the gaps between finance, sales, and customer success teams with a single source of truth. This is critical for upgrades and expansion opportunities, renewals, ongoing account management, and updating sales teams on payment and invoice status for commission insights. Our direct integrations with CRMs such as Salesforce, HubSpot, and Pipedrive close the gap between sales, finance, and customer success teams by providing a standard view of each customer’s orders, contracts, transactions, invoices, payments, and renewals.

With Maxio, you can close an opportunity in your CRM and book it in Maxio with complete revenue schedules, analytics data, and invoicing. In seconds, you can fully automate the process or insert a finance checkpoint to approve orders, from closed business to emailed invoices.

You’re overly protective of your spreadsheet.

Challenge

There are many things to take obsessive ownership of in a growing SaaS business: company culture, the go-to-market strategy, and even coffee. But only desperation and nightmares of broken formulas can drive you to slap the hand of anyone who dares touch your sacred spreadsheet. You know your energy is better spent elsewhere, but the headache of possibly breaking your spreadsheet has caused you to impose maximum-security permissions.

With all these disconnected, moving parts, it’s easy to see how and why QuickBooks and spreadsheets get out of sync. When this happens, it’s often a “silent failure.” Silent failures are the scourge of finance teams because they often go undetected. When finally detected, they cost hours to track down, diagnose the root cause, and fix. Over a year, this adds up to a tremendous amount of wasted time and money.

When uncovered during an audit or due diligence, your credibility can be damaged; worse, you may see adjustments to valuations and deal terms.

Solution

Maxio performs constant data checks to minimize risk and ensure:

Contract Value = Revenues Scheduled = Invoices Scheduled

These checks are in place to help you recognize all the revenue you’re entitled to recognize and invoice for all of the contract elements you are entitled to invoice. You receive an immediate alert if any of these values fall out of balance.

Moving from manual processes to automation with Maxio means you won’t miss renewals/invoices or incorrectly recognize revenue, which could jeopardize your enterprise value.

Practical Reasons to Extend the Life of QuickBooks

With all these headaches, why do we suggest implementing a financial operations tool rather than moving to an ERP like Intacct or NetSuite? It’s not just because we’re big fans of Maxio. (Although, there is that.) There are many practical reasons to avoid adopting an ERP too early in your growth cycle.

It’s expensive.

The license fees for ERP solutions are costly and typically require a multi-year commitment. It wouldn’t be outlandish to estimate that a large ERP, like Intacct or Netsuite, will cost you upwards of $100,000 annually. If you can delay the adoption of an ERP for just 3 years, that’s $300,000 in cost savings.

There’s a lengthy implementation time.

Depending on your stage of growth, implementing an ERP can be time consuming, typically taking 4 – 12 months. It is often necessary to work with one of their third-party professional services partners.

It’s disruptive.

Implementing an ERP successfully requires a dedicated full-time employee to oversee the process and another to maintain day-to-day operations. However, for growing B2B SaaS businesses, resources are often prioritized for engineering, sales, and marketing over finance and administration. It’s unlikely your finance team has the extra capacity to manage the business and make all the necessary business process and configuration decisions in a timely manner.

Why Not Extend the Life of QuickBooks by Supplementing with Spreadsheets?

There are several challenges with managing your subscription SaaS business with QuickBooks.

One challenge you’ll encounter is problems invoicing for subscriptions in QuickBooks. While QuickBooks has a recurring billing function, it can’t handle recurring invoices with variable amounts, a cornerstone of subscription SaaS businesses. Without managing this directly in QuickBooks, you’ll have to create a separate tab in your spreadsheet for invoicing schedules.

If you have a complicated invoicing schedule, you’ll have to set calendar reminders so you don’t forget to send out invoices. If you miss one and forget to send an invoice, you’ll effectively “lose” ARR due to a simple, clerical error.

Your system will be highly susceptible to human error once you augment your work in QuickBooks with spreadsheets. Because you’re manually completing journal entries in QuickBooks from rev rec schedules in your spreadsheet, a simple contract change can wreak serious havoc downstream when it comes time to close your books.

Finally, you’ll still be accountable for producing SaaS metrics, even if those aren’t readily available in QuickBooks. Perhaps you can create yet another tab in your spreadsheet to calculate essential metrics like ARR, CAC, and CLV.

The problem is that formulas aren’t always applied consistently. Since there’s no governing body for SaaS metrics like there is for GAAP financials, many of these terms are up for interpretation.

As you can see, supplementing QuickBooks with spreadsheets alone is a largely error-prone process that ultimately opens you up to more risk than it is worth. It’s more of a stop-gap than anything; stop-gaps aren’t solutions.

Extend the Life of QuickBooks with a Subscription Management Platform

With a subscription management solution like Maxio, you can scale your financial operations significantly without the expense of an ERP or the headache of spreadsheets.

According to Jon Cochrane, VP of Strategy at Maxio, “If you want to extend the life of QuickBooks, you need an automated way to bill, collect, and report revenue.” That’s precisely what Maxio is. Maxio is a billing and financial operations platform designed to sit between your CRM and general ledger to streamline financial operations and reporting.”

Maxio’s bi-directional QuickBooks integration eliminates manually updating QuickBooks with Maxio transaction data and mitigates the risk of investors spotting errors in your spreadsheets. Maxio generates rev rec and invoicing schedules from transaction data pulled directly from your CRM.

You can also automate invoicing directly from Maxio and even set specific parameters for email cadences for A/R management. In terms of reporting, Maxio’ SaaS metric reports use your real transaction data to generate metrics, standardizing the application of formulas and removing speculation about where specific numbers came from.

Finally, you never have to worry about human-sync errors between your spreadsheets and QuickBooks. Maxio continually scans for discrepancies in your numbers and alerts you when out-of-balance accounts require your attention.

All in all, adding a billing and financial operations solution to QuickBooks is a fraction of the cost of transitioning to an ERP, and it takes mere weeks to implement rather than months. Moreover, because Maxio integrates with ERPs and smaller ledgers like QuickBooks, you can continue to reap the benefits of Maxio even after you have outgrown QuickBooks once and for all.

When is it Time to Switch to an ERP?

Even though it may not be as soon as you think, there will come a time when you do need to switch to an ERP. More often than not, this has less to do with the size of your company and more to do with the sophistication of your business model.

One of the most common reasons companies invest in an ERP is the decision to go international and operate that leg of the business as a subsidiary. Once you start introducing multiple entities, it can be challenging to keep everything straight without a more complex system.

The other primary reason to switch to an ERP is in the event of a merger or acquisition. With multiple companies’ financials being consolidated, the ability to manage more complex data sets becomes crucial.

These are not the only reasons to switch to an ERP, but they are by far the most common ones. Contrary to popular belief, the main takeaway is that ARR and headcount are not the primary catalysts for switching to an ERP.

The nice thing about a billing and financial operations solution like Maxio is that it scales with you as you transition to an ERP. Maxio’ integrations with Intacct and NetSuite marries the best of an ERP to the flexibility and SaaS focus of Maxio.

For practical insights and strategies on ERP implementation, check out our blog post on How We Implemented NetSuite in 8 Weeks. This comprehensive case study highlights Maxio’s successful transition and offers valuable tips for your own ERP journey.

Closing Thoughts and Key Takeaways

While switching to an ERP sooner rather than later may be tempting, there’s a substantial financial upside to putting off the transition. Delaying the switch for even a couple of years could mean the difference in hundreds of thousands in cost savings.

While managing this delay by augmenting key financial operations in spreadsheets has been the norm for most SaaS businesses, this is actually not sustainable due to its high susceptibility to human error.

A billing and financial operations platform like Maxio can effectively extend the life of QuickBooks for your team without the headache of spreadsheets. Interested in learning more about how Maxio can help you extend the life of QuickBooks at your company? Talk to an expert today, or sign up for a free demo to learn how Maxio can help your business grow.