As someone who’s guided SaaS companies through periods of exponential growth, I’ve experienced firsthand the breakneck pace of change that makes forecasting subscription revenue an immense challenge.

Between unknowns around customer retention, usage fluctuations, and market shifts, obstacles loom around every turn–no two days feel the same.

In years past, I’ve known early-stage SaaS leaders who may have relied on intuition or “gut calls” to drive growth decisions amidst the chaos of scaling. After all, when you have less than 100 customers, it feels like you can keep most of the high-level company financials in your head. But now, basing growth decisions on feeling rather than data just isn’t an option.

This is why it’s critical that you start forecasting future revenue in your SaaS business. No matter what unpredictability your company faces, the ability to construct effective forecasting frameworks allows you to plan future months, quarters, and years proactively–instead of falling victim to whatever economic headwinds stall your growth.

Throughout this article, I’ll be sharing some of the highlights from my recent webinar with Maxio, “Forecast-Ready SaaS Metrics,” so that you can start building accurate revenue forecasts in your business.

Core Data Sources You Can’t Afford to Miss

For starters, you can’t build accurate revenue projections unless you have access to quality data sources. I’ve known many founders who have leaned on the optimistic side and inflate their projections, while seasoned execs often erred on the side of caution and built their projections conservatively.

Neither of these is a great way to scale a business. At the end of the day, you need facts and figures not hunches–to guide your decisions.

First and foremost, you need a reliable financial reporting system if you want to build a revenue forecasting model. The right tools act as the bedrock for accurate financial models, whether you’re using an accounting platform or a dedicated financial operations platform like Maxio.

Secondly, having access to HR data on your sales team headcount is crucial for calculating key metrics like revenue per FTE. Comparing FTEs historically helps determine if you have enough organizational firepower–or are overextending resources–to deliver expected revenues. No forecast aligned with reality should be made in a vacuum without factoring in your frontline hiring plans and current employee productivity.

Third, reconciling bookings captured in your CRM with recognized revenue numbers can help you maintain data integrity. As Maxio COO Chris Weber suggested on our webinar, tying your revenue down to the penny ensures consistency between your sales projections and financial outcomes.

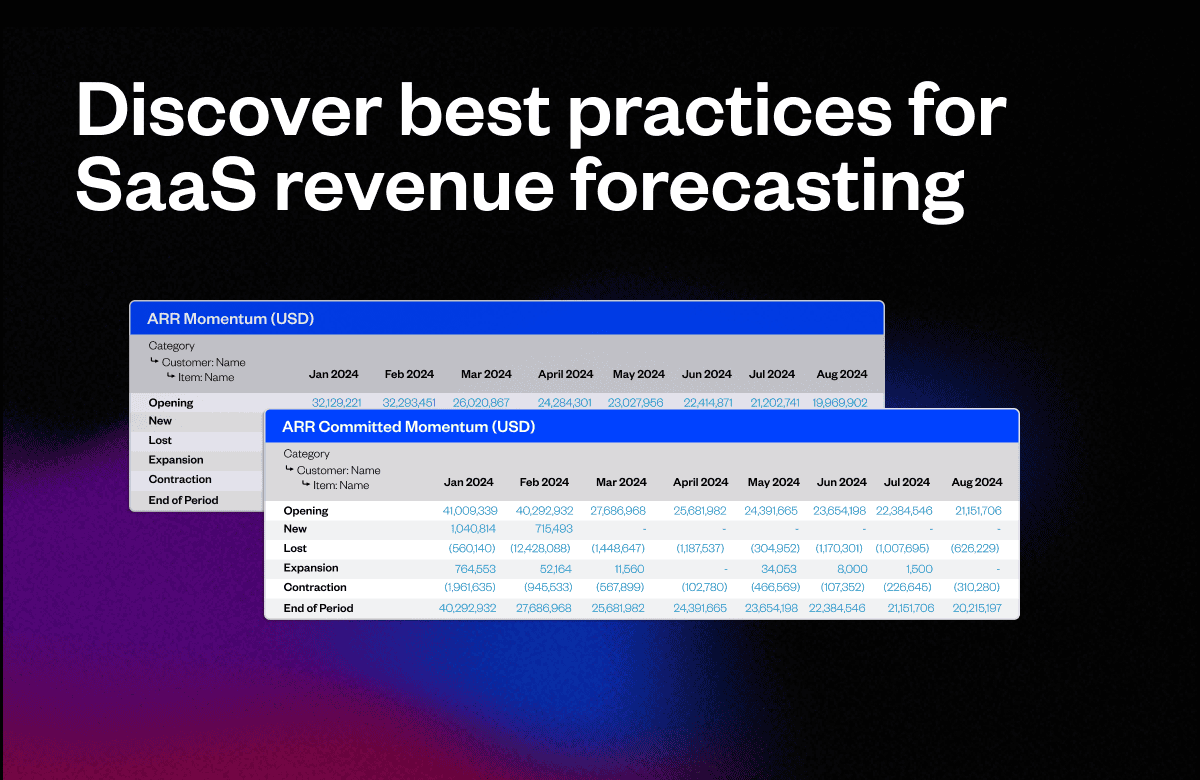

Lastly, you shouldn’t forget that you can use customer revenue data to gain granular insights into subscription momentum across your customer segments. By breaking your revenue data into customer types, geos, pricing plans, or other critical groupings, you can tailor your assumptions and forecasts to whatever story you’re telling–whether it’s to your board, investors, or your executive team.

How to Build A Forecasting Model With Key Inputs

If you want to build a revenue forecasting model you can trust, you need reliable data.

As a CFO, it’s my job to make sure that companies aren’t making sweeping guesses about their financial performance. And neither should you. Instead, you should take the time to make custom assumptions for each of your major customer groups based on how they actually behave.

This is where having access to a reliable financial operations platform comes in handy yet again. For example, with Maxio, you can break out the metrics for long-time subscribers separately from newer customers, those on premium plans vs. basic ones, and SMBs apart from enterprises.

Since each segment acts differently as far as renewals, add-ons, or cancellations are concerned, you’ll get insight by factoring in those unique details across your subscriber base. Additionally, you should ground your model in segment insights rather than overall averages to make your forecasting volumes, revenue, and churn far more accurate.

Another helpful tip I’ve learned when building out a revenue forecasting model is to map your assumptions like expected renewal rates, expansion vectors, and churn risks across your customer types, firmographics, pricing plans, or other categories within your own subscriber base. This way, you can retain enough granularity in your model to steer each lever impacting subscription revenues while right-sizing complexity.

Real-world Use Cases for Building an Accurate Forecasting Model

Following so far? I’ve covered a lot of theoretical modeling advice in this article, so let’s walk through a few real-life examples to tie this all together.

Let’s say you’re providing an enterprise SaaS solution. The company has grown to the point where customers’ needs are getting more specific and it’s becoming necessary to set up sales-negotiated contracts.

In this case, you’ll want to include an extended runway from initial contact to a closed deal. Map out the step-by-step flow of your sales process, incorporating key variables like seasonality or average sales cycle length. Once you’ve accounted for these variables, you can start building revenue projections based on models that reflect the real-world operational tempo and rhythm of your business. Ultimately, this lends authenticity to your forecasting data and can help you uncover trends that would have gotten lost otherwise.

In short: Matching your assumptions to reality = Proactive planning = Greater chance of success in scaling your SaaS business.

Manage Re-Forecasting Efficiently

So, you’ve learned how to build an accurate revenue model. Now what?

Rather than treating revenue forecasts as a one-and-done exercise, you should regularly refresh your models by inputting your team’s most up-to-date performance data and observations. Markets move fast–what was true last quarter likely won’t hold for the current one as competitive dynamics and customer needs evolve.

By continually checking your assumptions against the latest actuals and recalibrating as needed, you can empower your business to nimbly adjust strategies ahead of the curve. These ongoing revisions ensure your planning stays grounded in current realities rather than outdated projections–this is what will give your team the confidence to pursue growth in spite of any market fluctuations.

I also strongly suggest that you should check where your projections were incorrect during the revision process. This is key for ensuring you’re able to accurately forecast your future business performance.

After each forecast refresh, compare your newest projections against earlier ones to detect any mismatches. Review your variances by asking: were we off-base estimating churn rates or growth? If so, you should drill into what specifically caused the differences. Identifying why these deviations happened will allow you to continue refining the accuracy of your inputs over time.

As you’re making your revisions, you should also watch closely for changing trends in your data.

For example, if you notice a subset of customers sharply dropping off, it may indicate it’s time to lower expected renewal rates for that segment in the next forecast. The key is responding to real trends rather than temporary exceptions or outliers that self-correct. Training your team to spot true signals separates helpful recalibration from any potential overcorrection to market noise.

Leverage Your Data for Certainty in Uncertain Times

So there you have it. That’s my two cents on building forecasting models.

As a SaaS CFO who’s advised numerous leading companies, I’ve seen even the most buttoned-up organizations struggle with an extremely volatile and complex market landscape. But leaders who invest early in accurate metrics dashboards and customizable forecasting models give themselves the ability to slice through the confusion and make the right decision, no matter where they’re at in the growth curve.

If you want to start building your own models, I suggest you start with this revenue forecasting model I’ve pre-built for you. Better yet, if you’re already a Maxio customer, you can pull metrics from the subscription momentum report to use as the initial inputs for this model and start making better decisions about your company’s future.