This article is part of a three-part on series on raising debt for SaaS companies as an alternative to traditional VC funding. You can check out part one here and part two here.

Why take on debt?

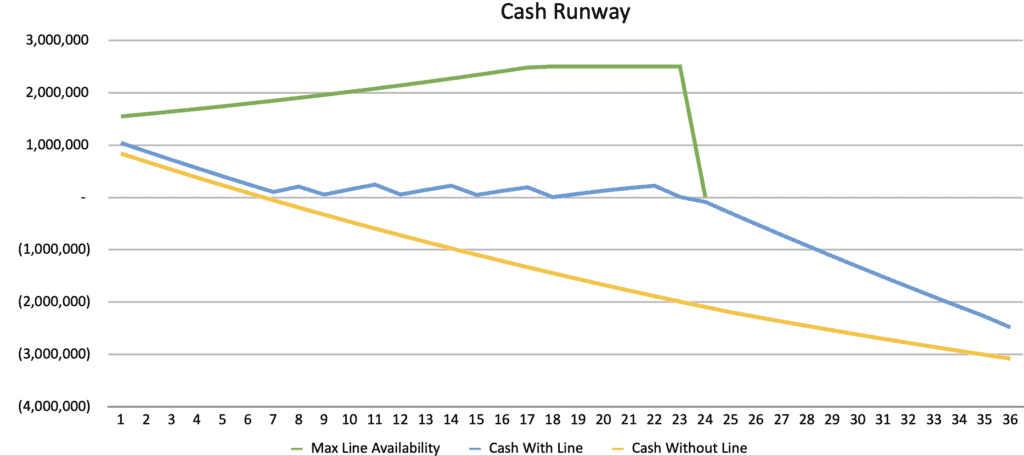

The primary reason SaaS companies borrow money is to extend their cash runway. And while some companies may also borrow to fund an acquisition or smooth out seasonal cash flow, I will focus on runway extension here.

Loan amount, structure, and covenants impact runway extension, and it takes a little work to model how a specific debt offering will help your business. That said, comparing the total cost of a loan to the months of runway extension it provides is the best way to evaluate SaaS debt. Ultimately, the cost per month of runway extension is what you care about.

For example, a large bank term loan taken in conjunction with equity financing may have a low-interest rate and no fees; however, based on your company’s burn rate and the loan structure, it may only extend your cash runway a month or two beyond what the equity alone would have provided. That makes it a costly debt when you add up all the interest and divide it by just a few months of actual utility.

You will still want to look at interest rates and calculate internal rates or return, but in the final analysis, cost per month of runway extension is what you should focus on. (Note: When calculating IRRs, use the XIRR function in Excel. It is the most accurate and much better than APR or IRR*12.)

The accompanying SaaS Loan Calculator calculates IRRs and the cost per month of runway. It also generates a graphical representation of runway extension for various loan structures. Included here is an example of an MRR-based credit facility. As you can see, the debt offering extended the borrower’s runway from seven months to twenty-five months.

Finding the best debt financing option for your SaaS company

Once you’ve determined whether or not raising debt makes sense for your company, it can still be difficult to wrap your head around the different kinds of debt structures that are available.

What kind of debt should we take on? Which debt structure will ultimately improve our financial position? How can we model out what cash burn will look like in the months following?

Using this loan analysis calculator, you can determine exactly how much debt you should raise, the debt structure that makes the most sense for your business (line of credit, term loan, revenue-based financing, equity financing, contract funding), and more.

You can access the complete loan analysis calculator here.