Early in the life of a startup, product is all that matters. But once that is in place, companies turn to sales and marketing to drive growth. There must be dozens of books on how to scale sales and marketing in a SaaS business. But there’s very little written about the finance function. Does finance even matter early on?

Early in my VC career, I was burned a couple of times by “over-qualified” CFOs who liked to talk strategy and M&A but, in several cases, could not generate accurate financials or metrics. So for many years, I advised my early-stage portfolio companies to spend as little as possible on finance—just enough to keep their books in order.

My views have changed, however. For any SaaS businesses booking a dozen or more customers a year, a well-functioning finance department is strategic right out of the gate. Why? Because finance is where data resides, and data is the lifeblood of a SaaS company.

Built-in Data Integrity

Why should the data live with finance and not marketing or sales? The finance function has an inherent level of checks and balances that marketing and sales don’t have. Financial statements are designed to balance and are tied back to the reality of the bank account. They can be manipulated, but not for long.

I have worked with many SaaS businesses that kept track of things like ARR and bookings in their CRM or some separate spreadsheet, and they were inevitably incorrect. CRMs can feed and receive data from the finance function, but their data still needs to be cleansed by finance. ARR and bookings need to be reconciled with billings and cash, and that only happens in finance.

I don’t mean to imply that other departments are sloppy or untrustworthy; it’s just that their systems are not designed to be balanced. They can’t tie their numbers to anything real, like a bank account. So, many systems want to be the one source of truth, but no other function has the inherent structure to constantly validate its numbers.

To maintain accuracy, however, startup finance departments must reconcile cash at least monthly. According to Ben Murray, The SaaS CFO, “If you don’t [reconcile monthly] and you have systematic errors in your accounting process, the errors will continue.” Karie Minton of PlusPoint Consulting elaborates, “Even for companies doing regular ‘reconciliations,’ the biggest issue is understanding what constitutes a reconciliation. Printing out the account activity or simply rolling forward the balance is not a reconciliation. Reconciling proves the balance is correct.”

Use Finance to Make Better Decisions

Armed with accurate data, what are the most useful deliverables the finance function can supply to the startup management team? Early on, it’s as simple as generating helpful financial statements and a few key metrics. That sounds easy, but in practice, most startups do not produce good financial statements and metrics to help guide their decisions.

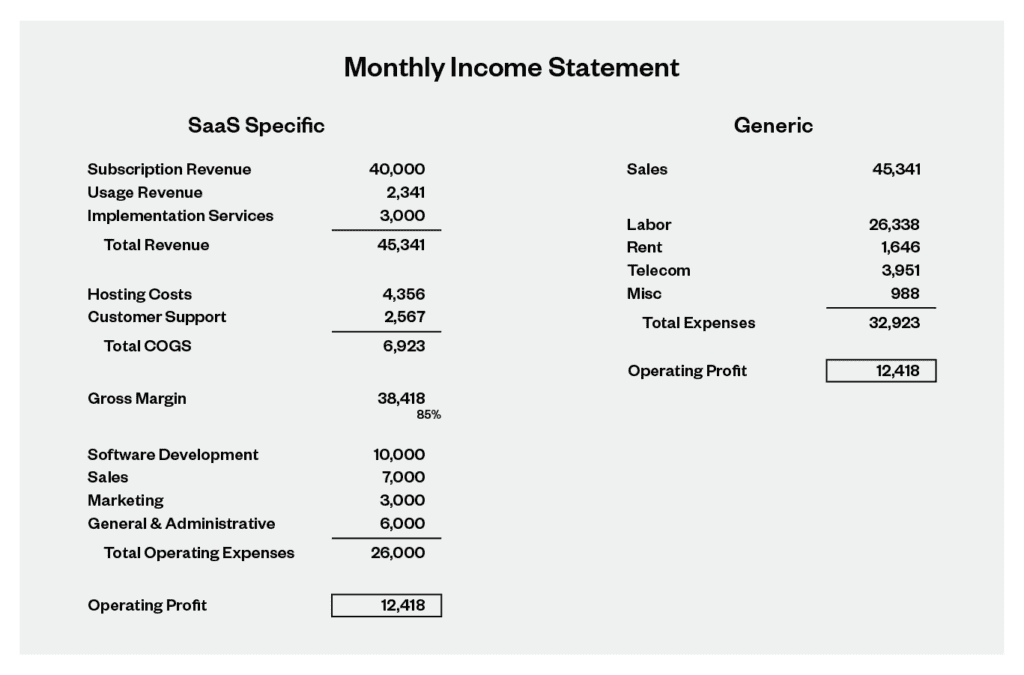

Let’s start with something as simple as the chart of accounts. The chart of accounts is a list of labels you use to categorize the money flowing through your company. But if you use the labels pre-populated into QuickBooks for your SaaS company, you will be using the same labels as an ice cream shop and a tattoo parlor. Do you really need a “Finished Goods Inventory” account? Do yourself a favor and start with a chart of accounts designed for a SaaS company.

How will this be an advantage? Let’s look at a company’s income statement with a SaaS-specific chart of accounts vs. one without. This is basic, but it’s obvious how the presentation on the left can provide insight that the income statement on the right cannot.

In addition to providing visibility on spending and gross margins, the SaaS-specific income statement allows critical SaaS metrics like CAC Payback and others to be calculated and tracked.

These benefits are not just internal; they apply directly to fundraising and M&A. SaaS investors and buyers understand and expect a SaaS-specific financial presentation. It provides the basis for their analysis. At SaaS Capital, we often had to help companies create a more detailed income statement if they did not already have one. This slowed the process and, in some cases, stopped us from providing capital entirely.

Some SaaS businesses at the very early stage won’t gain much insight from SaaS metrics such as Net Retention Rate or CAC Payback simply because the data is not rich enough to provide meaning. However, all SaaS companies will benefit from well-constructed financial statements.

Download a Chart of Accounts

This sample Chart of Accounts allows your finance team to view, organize, and manage your assets, liability, equity, revenue, and expense accounts in one place.

Accrual is Better Than Cash Accounting for Understanding the Business

In the example above, I assume both presentations were done on the same accounting basis, either cash or accrual. In reality, many startups working with simple income statements do all their accounting on a cash basis. That can be workable if the company is billing its customers monthly because there is little difference between cash and accrual in those businesses.

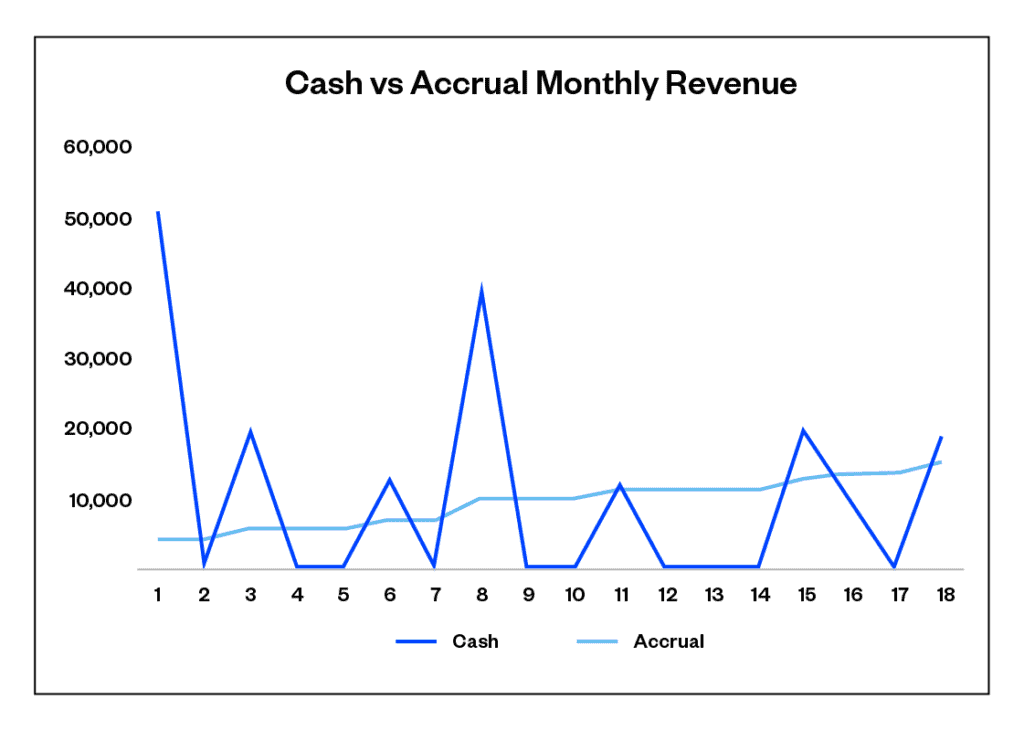

If, however, the SaaS business bills some of its customers quarterly or annually, cash-based financial statements interject a lot of variability when analyzing the business. Cash certainly is king, but surprisingly, it’s not the best way to understand the financial performance of a SaaS business. Cash accounting makes revenue irregular and obscures underlying trends in the business.

The chart below shows the same company’s monthly revenue on a cash vs. accrual basis. This company has annual contracts it bills in advance. Using cash, it’s hard to calculate even simple things like growth rates. Cash accounting can also make CAC ratios and retention rates hard, if not impossible, to calculate.

In addition to the decision-making data a well-designed finance department can deliver, it has two other critical roles in a start-up: billing and collections, and cash forecasting.

Billing and Collections

An amazing billing function will not distinguish your company in the market, but having a bad one will cost you customers and cash. A billing and collection system that allows customers to pay using their preferred method reduces sales friction and improves renewal rates. Unclear or inaccurate invoices cost you goodwill with your customers and often result in underbilling and lost revenue. Both subscription and usage-based billing create nuances not easily handled by generic small business finance packages.

Cash Forecast

Knowing if or when your company might run out of cash is essential. For some companies this is a simple calculation (cash balance/monthly burn rate), but for companies with lumpy renewals or seasonality, forecasting requires dedicated time and experience. All the successful early-stage CEOs and CFOs I have worked with kept a keen eye on their cash forecast, especially if they were bootstrapped.

Takeaway

A startup may not need to hire a CFO or implement a fancy accounting system right out of the gate. But founders do need to think about finance from the outset. They need to set up their books properly, leverage people with the right experience, and implement systems designed for SaaS. This can be a relatively inexpensive proposition, but it needs to be intentional.

At a minimum, a startup finance function should generate accurate books by reconciling to the bank account monthly, and it should produce SaaS-specific financial statements that provide insight into the business and the basis for accurate SaaS metric calculations.

One approach I have repeatedly seen successfully executed is the fractional CFO. A fractional CFO will have experience from dozens of SaaS companies and can leverage that knowledge to get things in shape without needing to be full time. There are dozens of great SaaS-specific fractional CFOs in the market.

It’s also important to use SaaS-specific financial systems from the beginning. They will help you generate useful financial statements and automate much of the metric calculation process. Fractional CFOs focused on SaaS will already be using these tools.

About the Author

Todd Gardner is the Managing Director of SaaS Advisors and the founder and former CEO of SaaS Capital. Todd was also a partner in the venture capital firm Blue Chip Venture Company and was a management consultant with Deloitte. Todd has worked with hundreds of SaaS companies across various engagements, including pricing, capital formation, M&A, metrics, valuations, and content marketing. Todd is a graduate of DePauw University and Indiana University.