How do you measure success across your GTM teams?

If asked that question a few years ago, most SaaS leaders would agree that new logo acquisition was one of the most important factors in creating enterprise value. Today, the market looks a little different.

As sales cycles get longer and tech spend continues to be scrutinized, SaaS companies need to double down on improving customer retention and driving expansion within their existing customer base. We sat down with Nick Mehta, CEO of Gainsight, along with an expert panel of SaaS finance leaders to discuss:

- Retention and expansion best practices

- The importance of cross-functional alignment

- How to identify expansion opportunities and achieve profitable growth

Here’s what we learned.

The state of SaaS retention: what does success look like?

You can’t have a conversation about expansion or monetization without referencing GRR and NRR. NRR, specifically, is a huge indicator of efficient growth and reflects your ability to retain and monetize your existing customers.

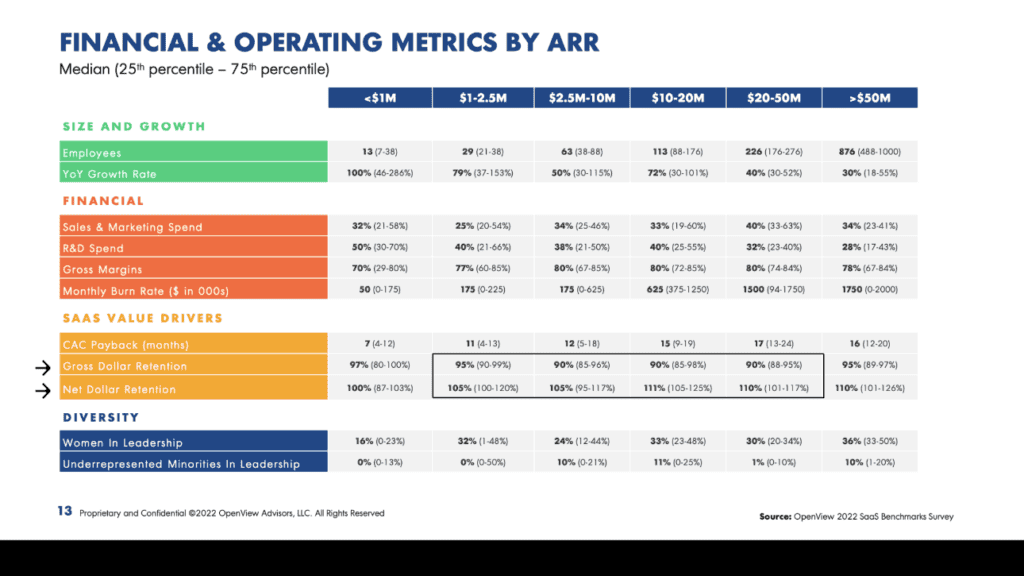

We referenced OpenView’s 2022 SaaS Benchmarks Survey to answer the question: what does best-in-class GRR and NRR look like across private SaaS companies?

Between $1M-$50M ARR, the median Gross Revenue Retention of the surveyed companies is solidly at 90%, while Net Revenue Retention rates sit around 105% and 110%, respectively. After reviewing these findings, Nick pointed out that it’s more useful to talk about GRR and NRR separately when discussing retention and expansion.

“Obviously people talk about [GRR and NRR] together, and I think it’s actually really useful to talk about them separately. The challenge is that public companies only report NDR as sort of a vanity metric. Each public company manipulates the calculation to make it look really, really good. But the truth is, one of my beliefs is, long-term, if you have bad GRR—even if you have good NRR—the shell game ends over time because you run out of customers to be able to upsell,” says Nick.

Nick goes on to explain that many consumption and usage-based SaaS businesses will typically see more variable NRR rates depending on the state of the market. However, a decline in Gross Revenue Retention should be more concerning as it represents a more fundamental issue within a business.

CMOs are making customer health a top priority

As a result of recent economic uncertainty, B2B growth strategies will tilt heavily toward retention, cross-sell, and upsell revenues. This is confirmed by Forrester’s 2023 predictions, suggesting that 3 times as many CMOs will make customer health a top priority this year.

In comparison, most B2B CMOs in the boom times of SaaS were focused on top of funnel, lead gen, and “how do we get more pipeline?” Now, more marketing, sales, and CS teams are all collaborating on NRR to drive predictable, top-line revenue growth.

Customer Success: revenue generator or cost-center?

Customer success teams are the tip of the spear when it comes to driving retention across the org. However, that doesn’t mean that all SaaS companies see eye-to-eye on the value of the CS function.

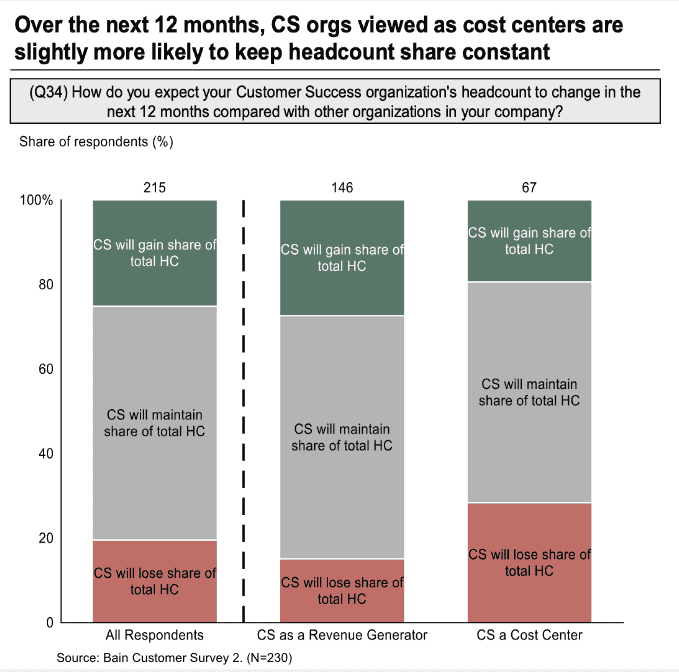

According to Nick, based on an upcoming research report with Bain, Customer Success is less likely to be cut across most SaaS organizations. However, there is a clear distinction between SaaS companies who view CS as a revenue-generating function vs. a cost center.

“What we’re finding is that the companies that seem to be doing [retention] really well are working closely with sales to drive expansion leads and are tightly aligned to the sales process. I think the top-level message is that people are doubling down on retention and expansion. And it seems like the ones that are doing it the best are looking at [Customer Success] as not just a way to serve customers, but a way to drive revenue,” says Nick.

The state of business technology and churn

According to the Systematic State of Business Technology 2022 report, business technology teams have more budget than last year, but less room for experimentation and innovation.

- 80% of business technology teams saw an increase in their budget this year, with nearly a third reporting that it “significantly increased”

- The portion of respondents’ budgets going towards innovative software and process improvements is down 10% from last year

- 82% of teams are currently expected to get more done—and nearly half of those teams are being measured against higher expectations with fewer resources than they had previously

What does this mean for private SaaS companies?

As finance leaders continue to scrutinize software spend across their organization, SaaS companies need to position themselves as a need-to-have solution.

For example, at Maxio, we’ve consolidated our products into a single platform, so B2B SaaS companies can handle all their billing, collecting, metrics, and financial reporting in one place. Similarly, Nick Mehta claimed that Gainsight is working to deliver their three main products as a combined solution. By consolidating your tech stack, you’re helping your customers avoid the unnecessary SaaS sprawl and achieve greater cost savings over time.

Tackling the customer churn problem

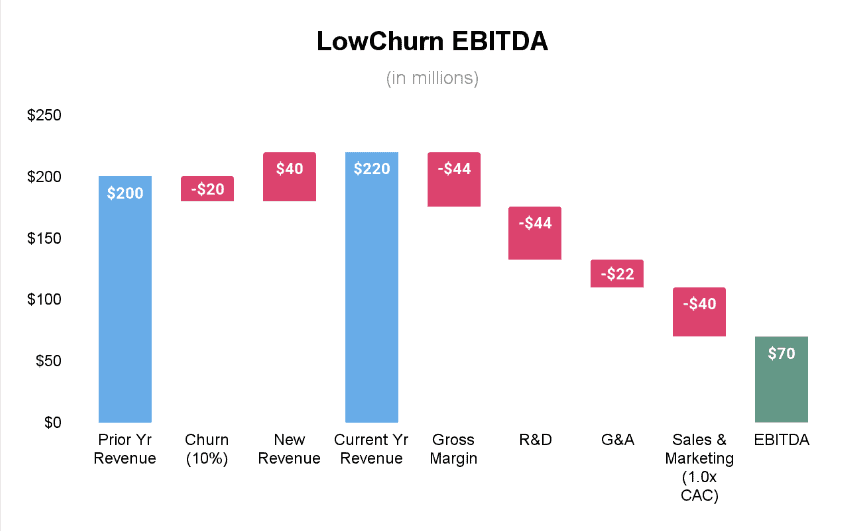

It’s almost impossible to build a highly profitable company if you don’t figure out churn. Nick Mehta offers the following hypothetical to prove his point:

Imagine there’s a SaaS company called LowChurn that matures at $200M in revenue. (Pretty good!) If we assume 80% gross margins (world-class), this means LowChurn has $160M of gross profit. At scale, R&D might be 20% or even 15%. 20% of $200M is $40M of R&D. And let’s assume G&A is 10%, or another $20M. So LowChurn’s Gross Profit minus G&A minus R&D is $100M. Sweet!

- 80% gross margins leave LowChurn with $160M of gross profit

- Let’s say churn is 10%, so LowChurn has to “refill” $20M of revenue to get back to the prior year’s revenue

- Targeting 10% terminal growth, they need another $20M

- LowChurn now has $70M of EBITDA. Add that to the 10% growth rate and you get a 42 on a Rule of 40. Pretty good (though not amazing)

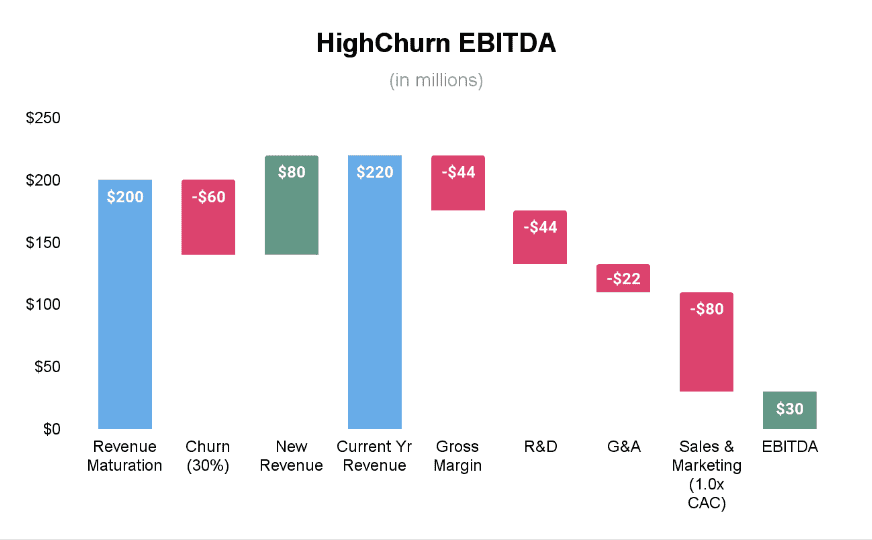

Now, let’s imagine a similar company with a great name like HighChurn—with 30% churn. (Ouch!) They have to “refill” $60M just to get to 0% revenue growth and another $20M to grow 10%. At a 1:1 CAC ratio, that means $80M of sales and marketing. So now HighChurn is only making $30M EBITDA or 14%. Add that to the 10% growth and this company has a mediocre “Rule of 40” score of 24.

- HighChurn has 30% churn (ouch!)

- HighChurn has to “refill” $60M just to get to 0% revenue growth and another $20M to grow 10%

- 1:1 CAC ratio—that means $80M of Sales and Marketing

- They are only making $30M EBITDA or 14%—mediocre “Rule of 40” score of 24

Looking at these two examples side by side, this should be a huge wake-up call for SaaS companies to get churn under control if they want to build a profitable business. Moreover, unless you tackle your customer churn problem, your business may not be worth anything over time as the market will question its underlying economics: What’s the cause of churn? Will this company ever be profitable? What happens if they can’t keep up with targets for new logo acquisition?

Identifying expansion strategies

Mitigating churn is only one part of the equation when it comes to improving your GRR and NRR. To achieve efficient growth, you need to drive expansion across the following areas:

- Segments: SMB vs. mid vs. enterprise

- Capabilities: Horizontal vs. vertical product enhancements

- Geographies: Where you’re focusing global sales efforts

After bringing together Chargify and SaaSOptics to form Maxio, we got laser focused on capability expansion to ensure that our platform met the needs of our customers across the different stages of growth.

Capability Expansion

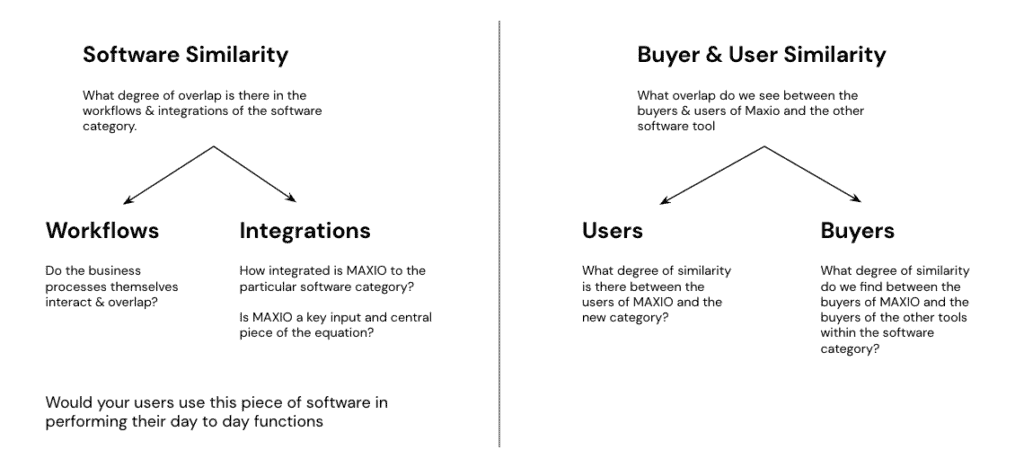

At Maxio, we look through the lens of software and user similarities to achieve more efficient cross-sells within our customer base.

Using company and customer data to identify expansion opportunities

The best way to identify expansion opportunities within your company is to examine both your company and customer data.

- Company data: Which customer cohorts and product lines make up the most of our revenue? Where are we seeing revenue grow or decline or overtime? What types of customers are most at-risk for churn or non-renewal?

- Customer data: Who are our ideal customers? How much does it cost to acquire them? Where are we seeing usage increase or decrease? How do they behave over time (GR & NR)? How is our pricing strategy impacting our win and churn rates? What is our retention rate by product line?

At Maxio, our SaaS metrics and analytics capabilities allow you to drill down into this data to benchmark the health of your business and identify expansion opportunities across your customer base.

Achieving efficient revenue growth in the new market

There will never be a one-size-fits-all approach to solving the retention problem in SaaS. However, we can continue to invest in customer success, identify expansion opportunities, and improve our unit economics to achieve the ultimate end goal of any successful company: profitability.

At Maxio, we’re equipping B2B SaaS companies with the financial and SaaS metrics reporting capabilities to analyze the health of their business across customer cohorts, product lines, and business segments.

Want more help navigating the new SaaS market? Check out our recent guide, Scaling During a Recession: Winning Strategies for SaaS Leaders. In this playbook, you’ll learn how pricing consultants, fractional CFO’s, and SaaS veterans recommend you adapt to keep winning—even in a volatile market.

![[520] Blog image: Customer Success and CFO](https://www.maxio.com/wp-content/uploads/2024/05/CS_and_CFO.png)