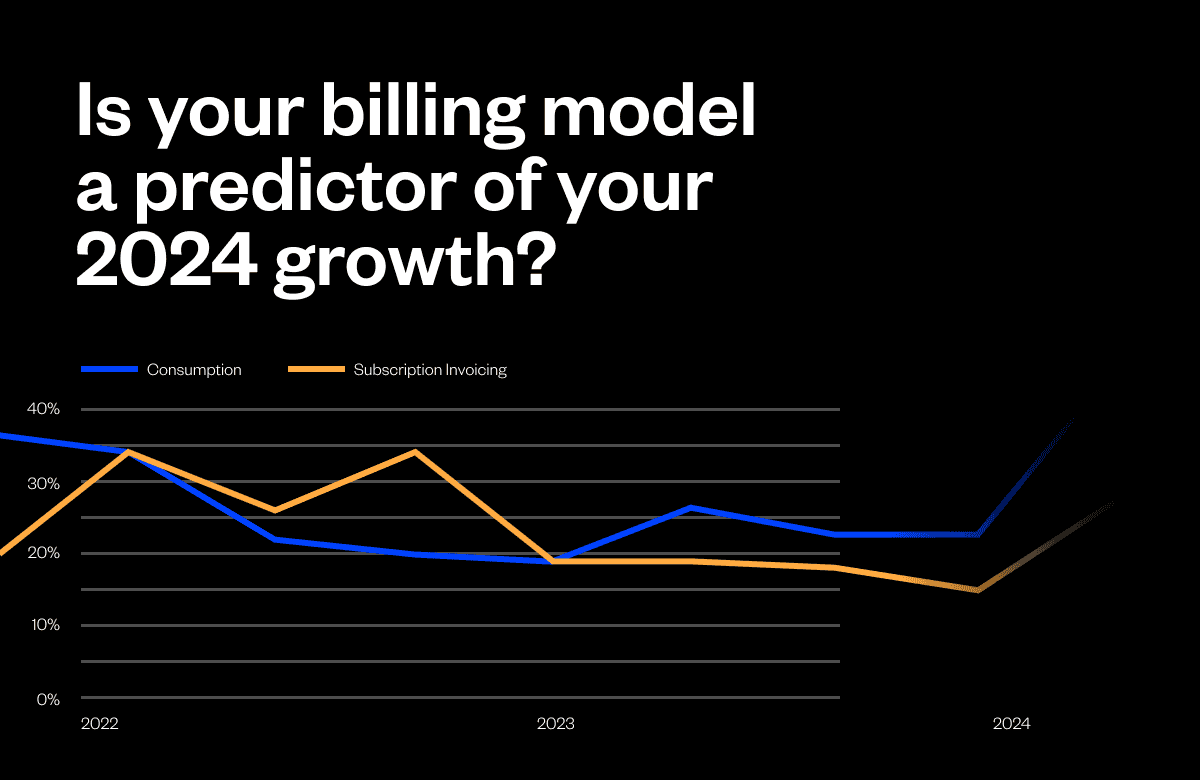

Things are looking rough for SaaS companies. The tech sector is facing its biggest downswing in two decades, venture capital is drying up, and as I recently wrote on LinkedIn, SaaS leaders are trying to figure out how to batten down the hatches and lead their businesses through uncertain times.

For many tech veterans, though, the current turbulence is nothing new. I was there for both the dot-com bust and the Great Recession, and I was one of the lucky survivors. From my vantage point, the primary lesson was clear: cash is king for companies seeking a viable path through challenging market conditions.

That might sound obvious, but the reality is most companies struggle to grasp these simple truths. A recent Harvard Business Review report showed that 80% of companies fail to regain their pre-recession growth rates within three years of a slowdown, and less than 10% manage to boost their sales or revenue growth as they emerge from a recession.

What separates the thrivers from the survivors?

Too many companies tackle the challenge by focusing purely on reducing their burn rate. That’s important, of course, but to truly succeed, you also need to pay attention to your monetization strategy.

Why monetization matters

Right now, investors are looking to back software companies that have brought their burn rate under control. If you’re spending more than you’re making, you’ll need to turn things around and find a quick path to profitability. (Sequoia, arguably the most successful VC based on historical portfolio performance, provided a set of recommendations to their portfolio companies, which are captured here.)

We’re starting to see the early signs of “battening down the hatches” at many VC-backed startups—especially those with less than 24 months of cash. These CEOs are being told to cut burn to last 2.5 years and maybe even raise now at a lower valuation, as the IPO market has contracted significantly and valuations are down across the board.

How can companies cut back on spending while also continuing to drive the growth that investors demand? That’s where developing a thoughtful monetization strategy comes in.

At its core, monetization is about how you get paid. It’s the sum of your pricing models (recurring pricing, usage-based pricing, one-time fees, etc.) and your revenue collection strategies (monthly, annual, prepaid, subscriptions, contractual agreements, etc.).

This matters because if you want to thrive in this downturn, you’ll need to find ways to do more with less and be strategic about how you run your business. This is what we describe as a company’s monetization strategy.

Take control of monetization

Monetization is one area where things have changed a great deal since the last downturn. Today’s leaders have powerful new tools that help them implement innovative monetization practices, take control of their financial operations, and keep growing their business even as they bring their burn rate and other vital financial metrics under control.

At Maxio, for instance, we’re creating the first true one-stop SaaS FinOps platform—a financial toolkit that founders and SaaS executives can deploy quickly and at low cost to gain visibility into and control over every aspect of their company’s monetization strategy. As one of my favorite management gurus, Peter Drucker, said: ”You can’t manage what you can’t measure.” By putting critical financial KPIs at executives’ fingertips, we’re giving founders the tools they need to grow and succeed, even in challenging times.

During an economic crunch, founders must stay laser focused on managing their business efficiently, keeping cash flow front of mind while growing a vibrant business. This means doing more with less, improving the effectiveness and efficiency of your existing team by leveraging the right tech to provide the critical insights they need.

Armed with rich FinOps intelligence, business leaders can show “growth discipline” and make smarter decisions about the level of debt they take on to fuel their growth. They can move faster to identify and respond to changing market needs, realigning their company in agile ways to avoid threats and seize opportunities. They can find operational efficiencies to lower their burn rate without slowing growth. And, they can make more intelligent, more effective investments in critical technologies that deliver real ROI in both the short and long term.

In today’s climate, disciplined growth requires data-driven leadership and a clear monetization strategy. That’s where Maxio comes in.

Maxio helps founders take control of mission-critical financial issues such as billing, subscription management, and financial analytics. We give leaders the tools they need to achieve both, ensuring their business doesn’t just survive but thrives—even during these turbulent times.

Weathering the storm

Tech industry veterans know there’s always sunshine on the other side of the storm. Investors and the broader marketplace will reward companies that use this moment to pave the way for future growth. But not everyone will make it that far.

To ensure your company thrives, you need a solid financial footing. This means ensuring you have access to critical business insights, from GAAP/IFRS financial metrics to SaaS monetization data, to overcome today’s challenges and unlock tomorrow’s opportunities.

The truth is we’ve come a long way since the last economic downturn. There are more ways to monetize your products and services than ever before; and for SaaS founders, a smart monetization strategy might be what separates winners from losers.

Making SaaS monetization easy and intuitive is Maxio’s core focus. Let’s talk about how we can help you steer your SaaS business through the coming storm.