U.S. businesses have been subject to financial reporting regulations for more than 80 years. ASC 606 is one of the latest and will have a particular impact on SaaS businesses.

Revenue recognition has never been easy for SaaS companies without the right accounting and subscription management in place, but the new rules could add another layer of complexity to an already troublesome area. The standards will affect private companies starting this December (public companies are already subject).

That means the time is now to ensure your revenue recognition is in accordance with current and new guidelines.

ASC 606 Changes That Will Affect SaaS Businesses

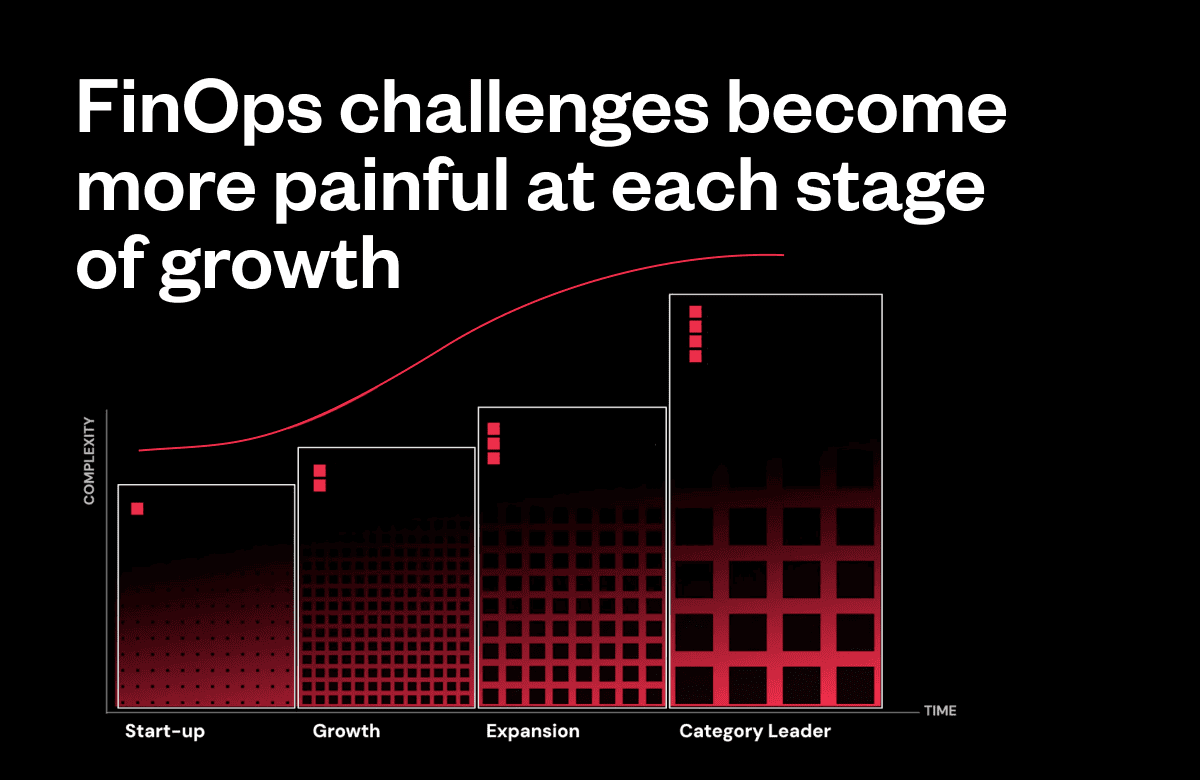

For SaaS businesses, ASC 606 means adjusting accounting practices for upfront and contingent fees, distinct performance obligations and the cost of fulfilling a contract. The very nature of the SaaS business model can make this tricky. For example, subscriptions change frequently as you’re adjusting and fine-tuning your offering or simply trying to meet customer needs. Often times, subscription elements are complex and rolled out over time.

SaaS firms must decide whether to recognize this revenue right away or defer it. Usage-based pricing adds more intricacy to the accounting process.

ASC 606 and Revenue Recognition

According to the ASC 606 standard, each element of a subscription must be identified. It must have a transaction price and you must recognize revenue as each element is fulfilled. This means a lot of manual data entry, tracking, spreadsheets and copying and pasting if you’re currently working from QuickBooks or a similar solution. It also makes a lot of room for error—never a good thing when you’re trying to meet a federal accounting standard.

Whether you have a combination of annual, monthly or quarterly agreements, each with their own unique performance obligations, or you charge upfront support fees that are accounted for in a deferred revenue column on the balance sheet, you really need an automated subscription management solution that has some flexibility. Revenue recognition under the current guidelines is tough enough. You don’t want to add to the already burdened finance team come December.

ASC 606 Gives You Flexibility with Structuring Contracts

Let’s say the first two months of a customer contract are consumed with implementation. See if your subscription management solution can automatically schedule revenues to reflect the performance obligations related to implementation in a way that can be customized and replicated. Or what if a sales rep sells a multi-year agreement by negotiating quarterly instead of monthly invoicing? The right solution will prompt you when it’s time to trigger an invoice for a particular obligation and tell you when it’s time to recognize the revenue or defer it.

Ideally, you should be able to go into any customer contract or group of contracts and adjust the revenue recognition approach, including terms and billing frequency. Even though we’re talking about a rigorous regulatory standard, a proper subscription management solution would actually give you ultimate flexibility.

As long as you’re accounting for revenue properly in accordance with ASC 606, you can still decide how to structure your contracts and terms of service. And you could even have more customer-driven, automated revenue recognition options depending on the capabilities of your subscription management solution.

What’s The Story Behind ASC 606?

The ASC 606 standard was probably enacted to rein in on aggressive revenue recognition actions taken to inflate actual corporate performance of public companies. Revenue recognition can become extremely complex when you bundle services or support with your subscription, commit to delivery of any non-standard functions/capabilities, or when you agree to some customer acceptance criteria (“out clauses”). But the bottom line is that valuation of your company is impacted by, if not solely determined by, your historic revenue performance.

Make Sure You Understand Revenue Recognition in Light of ASC 606

The more you know about revenue recognition, the better your record keeping, the more you adhere to contracts and terms that simplify revenue recognition, and the more consistency you achieve in your customer licensees, the lower the risk of a disconnect between your revenue recognition methods and results and those of a strategic investor or acquirer.

Plus, you’ll remain on the right side of the ASC 606 auditors.

Additional resources about revenue recognition:

- Revenue Recognition(rev rec) – is an accounting principle and a process for reporting revenues by recognizing the monetary value of a transaction or contract over a period of time as the revenue is “earned.” Read more here.

- (Video – Part 1) Revenue Recognition for Entrepreneurs and Those without a Finance Background. Watch part 1 here.

- (Video – Part 2) Revenue Recognition for Entrepreneurs and Those without a Finance Background. Watch part 2 here.