The SaaS landscape is changing, and the office of the CFO must evolve to support it. Gone are the days when finance leaders were expected to simply deliver quarterly numbers and follow GAAP/IFRS. Today, the modern CFO needs to act as a strategic partner to the rest of their executive leadership team.

Are you able to collaborate within your organization? How can you turn financial uncertainties into meaningful dialogue with other business leaders? These are the questions that are shaping the role of the modern CFO.

According to Crist Kolder Associates’s 2022 volatility report, the number of CFOs being promoted to CEOs is steadily trending upward—a strong indicator that finance leaders are continuing to play a larger role when it comes to strategic business decisions.

We sat down with Chris Ortega, CEO of Fresh FP&A to understand how the role of the CFO is evolving in B2B SaaS. We also touch on:

- Chris’s six key pillars of financial transformation for CFOs

- Strategies for reducing your OPEX and cash burn (without jumping straight to a reorg)

- A new way to think about collections and dunning to improve customer relationships

- How to evaluate tech vendors for the greatest ROI

- The seven main operating metrics you should be measuring for business performance

Want to hear these insights directly from Chris? Check out the full video interview here.

Understanding the 6 pillars of financial transformation

These six pillars were designed with one goal in mind: to provide finance leaders with a framework to support both their department and the needs of their organization.

Foundational Pillars

These foundational pillars are what drive the most value in a finance department. In other words, they’re non-negotiable.

- People: Hiring and retaining the right talent. The foundation of any good finance department is made up of the right people, whether they’re an entry-level accountant, controller, or VP of finance.

- Process: Developing SOPs across your department. You need to have a clear, step-by-step process for your month-end close, running budget vs. actuals, forecasting, and other key financial processes.

- Partnership: Building trusted relationships within your organization. Ensure that you’re communicating your company’s financial position to leaders in other functional areas, such as sales, marketing, customer success, and (of course) your board and investors.

Chris advises that all finance leaders focus on their foundational pillars before anything else. According to Chris, the biggest mistake he sees startups and B2B SaaS companies make is “thinking that technology is going to solve all [their] problems.” Once you’ve built a strong foundation, then you can think about implementing that fancy new piece of financial tech.

Scaling Pillars

These pillars represent opportunities for CFOs to optimize business performance and improve their company’s financial position.

- Platform: Investing in the right tools to optimize your financial performance. The right tech stack can optimize your financial processes across the board, but only if you have the foundational pillars to support it.

- Performance: Identifying areas to improve business performance. Studying the health of your business across customer segments, business lines, and geographies gives other business leaders the insights needed to set goals in their functional areas.

- Profit optimization strategies tactics: Executing on opportunities to increase ARR/MRR, cash flow, and profitability. Advising sales leaders to double down on a particular customer segment and reducing dollars spent on unnecessary tech are both great examples of this pillar.

How to achieve financial transformation with the six pillars method

You want to hire the right people, optimize your financial processes, and develop trusted partnerships inside and outside your organization first. Once you’ve built a solid foundation, you can worry about your tech stack, business performance, and identifying areas to drive revenue and increase profitability.

Chris emphasizes that “financial transformation is a process, not a destination.” If you want to achieve true financial transformation, you need to create a vision, strategies, tactics, metrics, and milestones to measure your progress within each of these pillars.

Reducing tech spend to tackle OPEX and cash burn

The modern B2B tech stack is falling under heavy scrutiny as CFOs continue looking for areas to reduce costs. In Chris’s opinion, too many traditional CFOs go straight to layoffs and redundancies to reduce their cash burn and OPEX.

However, most teams don’t have the right tools or processes built around procurement: Do you know when certain software licenses expire? Are you paying for tools with overlapping features and capabilities?

By investing in tools to manage and track software spend, you can eliminate redundancies in your business before attempting a reorg or round of layoffs. For example, at Maxio, we make this possible through our expense management capabilities that help finance leaders capitalize, recognize, and report on expenses throughout their organization.

Evaluating tech vendors: nice-to-haves vs. need-to-haves

As CFOs crack down on tech spend, other software needs will inevitably arise. Here are three steps to determine if a vendor is a nice-to-have or need-to-have product.

1. Can the tech produce quick ROI?

Quick time-to-value is an absolute must for CFOs evaluating software tools in today’s market. Before you approve a purchase request for software, ask yourself:

- Does this tool contribute to revenue growth, reduced churn, or retention?

- How long does it take to see ROI?

- What other upfront costs are associated with this purchase? (Implementation, consultants, etc.)

- Are payment terms negotiable, or are we locked into an annual contract?

2. Does the vendor function as a partner?

Will the potential vendor work with you to achieve your goals, or are they just giving you a license and then throwing you to the wolves?

ERPs and other large, enterprise tools typically have disassociated customer support. This means you’re on your own most of the time after implementation—and if you do hire a consultant or specialist to help you manage a piece of tech, you’ll most likely have to pay a handsome fee.

So what’s the alternative?

By getting hands-on with your tech stack evaluation, you can maintain a one-to-one relationship with your software vendors and facilitate conversations around how much you’re paying, the value you can expect, and the support they offer upfront.

Automating collections and dunning to get cash in the door

Unfortunately, it’s not uncommon for well-sized SaaS companies to have substantial amounts of revenue lost in outstanding invoices. As the current market continues to breed uncertainty, SaaS CFOs need to invest in time-saving tools that automate their collections and dunning processes, so they can spend more time on strategy vs. transactional accounting.

“Isn’t that what a collections agency is for? Can’t I just outsource collections to them?”

“This seems like a job for the accounting department. Can’t they handle it?”

Sentiments like these belong to the old way of thinking about the office of the CFO. When you handle collections in-house through time-saving tech, you improve the customer experience by:

- Identifying missing, late, or failed payments

- Assigning a CSM to follow up with a customer or target account

- Diagnosing the real issue behind the collections problem and providing a solution (new payment terms, scaling back usage, alternative pricing models)

Modern CFOs can actively participate in customer retention and support their company’s customer-facing teams by assuming collections responsibilities and owning them in house.

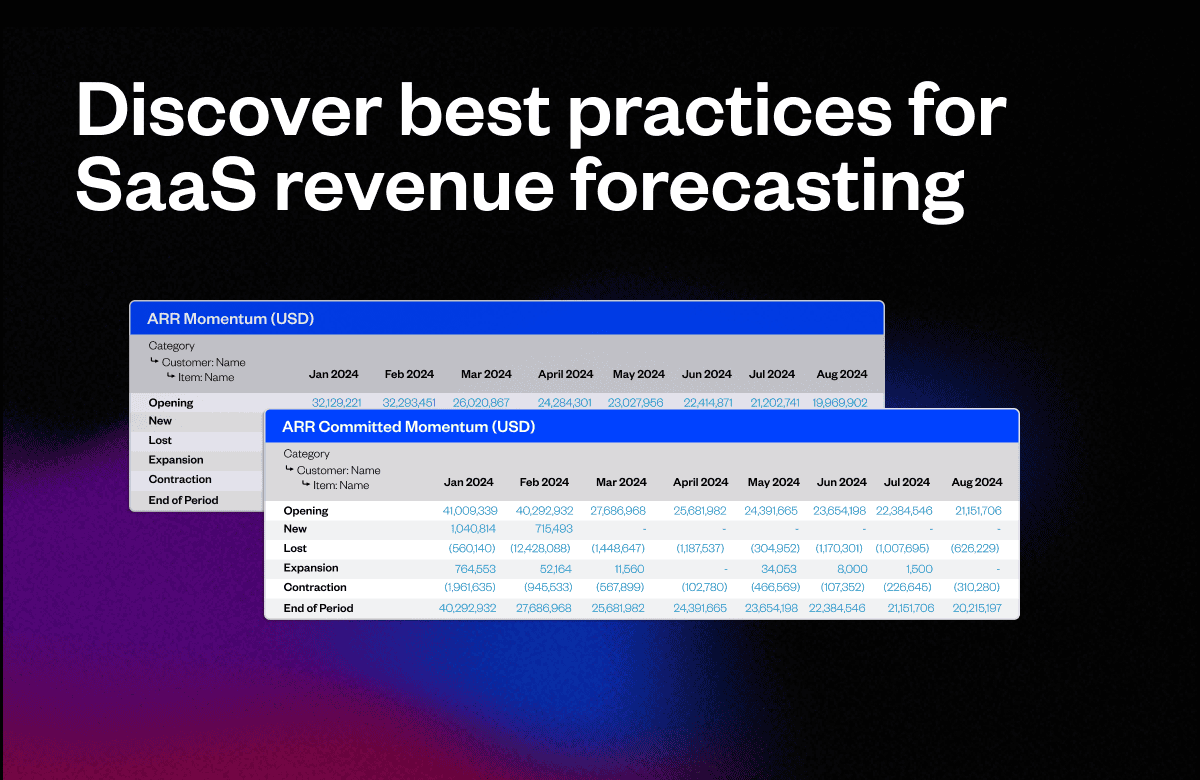

The seven operating metrics all SaaS CFOs should be measuring

How many SaaS metrics are you tracking to measure business performance?

Instead of over measuring 20, 30, or 40 different metrics, Chris believes finance leaders need to boil it down to a select few key metrics that truly measure their business. These include:

- Leads

- Opportunities

- Opportunities to closed/won

- Closed/won to new projects

- New projects to projects completed

- Projects completed to NDR

- NDR to cash

By boiling down their financial KPIs to these seven, CFOs are able to serve the business by engaging with other functional areas, such as marketing, sales, customer success, and finance. Chris advises leadership teams to review these on a quarterly basis, see how you’re measuring your budget vs. actuals, identify any forecasting errors, and adjust accordingly.

In Chris’s opinion, this method helps CFOs avoid analysis paralysis and provides a clearer picture of business performance across an organization.

2023 is the year of the CFO. Do you have the right tools to make the most of it?

As we look forward to 2023, it’s clear to see that the CFO is the connective tissue between departments and a key player in the success of the modern B2B SaaS business.

The modern CFO should be asking questions like “where are we from a growth perspective?” and “Which customer segments, product capabilities, and geographies are performing well?”

But all of that is near impossible without the right tools in place. Using a financial operations platform like Maxio to automate transactional accounting activities and access real-time SaaS metrics, CFOs can focus on activities that add value to their business.

Listen to our full conversation with Chris here or schedule a demo with our team to see how Maxio is helping SaaS finance teams navigate the new tech landscape in 2023.