Increase MRR (Monthly Recurring Revenue). Lower CAC (Customer Acquisition Cost). Increase CLV (Customer Lifetime Value).

SaaS companies will jump to make any one of those things occur, but all three…yes!

Welcome to the happy consequences of Expansion MRR. Expansion MRR is an increase in Monthly Recurring Revenue created when existing paying customers upgrade or increase add-ons/extras. Neil Patel refers to it as the SaaS Holy Grail.

Look at the difference between new customer CAC and the cost of upselling existing customers (per $1 of New Annual Contract Value), according to the Pacific Crest 2016 SaaS Benchmarking Survey:

There are a number of ways to increase Expansion MRR, but today we’re focusing on pricing. Specifically, the ways you can structure your SaaS pricing plans that help “future proof” your company for optimal growth through Expansion MRR.

First, a quick note about the importance of Expansion MRR…

Why Expansion MRR Matters

“While there’s not a specific benchmark for Expansion MRR Rate, it’s good practice to aim for increasing it to exceed gross churn rate,” writes Geckoboard.

When your expansion is greater than your gross churn, you’ve achieved negative churn, which means the value of your existing customer base is growing without factoring in any new business. Negative churn can have incredible impact on your SaaS business’ exponential growth. Let’s look at an example from David Skok, from his blog Unlocking the Path to Negative Churn (we highly recommend you read it):

“The model starts with MRR at zero, and bookings from new customers at $10k in the first month, increasing by $2k every month after that (represented by the dotted blue line in the graph).The graph shows what happens to your bookings if in addition to your sales to new customers, you are seeing an expansion revenue from your current customer base of 2.5% every month (green line).”

He follows the model to explain that by the end of 5 years, the Expansion MRR would be contributing approximately $180,000 every month.

“Clearly getting to negative churn is one of the most powerful accelerators for growth,” writes Skok.

With that incentive, let’s look at the different ways you can structure your SaaS plans to increase Expansion MRR…

Fixed-Price Feature/Value-Based Pricing Tiers

At its heart, value based pricing encourages SaaS companies to view their pricing strategy as a product of the value they provide. Instead of fixating on cost-cutting to improve profit, companies focus on improving the service and value they provide, using extensive research to understand how customers actually value a product.

Ryan Law, CMO at Cobloom

Once a customer is fully engaged with your product and understands the value, they are more likely to upgrade for advanced features and functionality.

When you’re looking at structuring plans that help future proof your SaaS for increased Expansion MRR, utilizing feature and value based pricing means you understand the value of specific product features to your customers.

Structure your pricing tiers to include more advanced features on higher tiered plans. Don’t get us wrong, there will always be core features of a SaaS product available to all paying customers. From your research, you’ll also know which features have a higher value to customers and you can entice customers on an upgrade path with those features. Note: If you’re not already doing customer research, read Beyond NPS & Exit Surveys: What you should be asking prospects and customers.

“You want to upsell to a customer at a time when they have a need for your additional features – a time when upgrading makes sense to them. The best upselling opportunity is when your customer reaches a defined success milestone that has a logical opportunity for expansion related to it,” explains Emily Smith.

In SaaS upsells, it’s all about the value. If the customer can see the value of the upsell compared to his or her current subscription or purchase level, then they will understand why they need to buy.

Neil Patel, Co-Founder of Crazy Egg

Creating more highly featured versions of your product creates upsell opportunities. It also allows smaller customers a feasible entry point, with the option to scale to more advanced feature sets as they grow.

A great example is Shopify’s plan structure that starts with “Shopify Basic” and includes “all the basics for starting a new business.” It is a solid entry point to get a customer started and provides plenty of value to create stickiness.

With Shopify, once customers get up-and-running and start growing their business, the upgrade path adds better shipping rates, gift card support, professional reports, and cart abandonment recovery tools—all value added benefits that make the upgrade decision an easy one.

Fixed-Price Usage Restricted Pricing Tiers

It is very common for pricing tiers to include a combination of more advanced features (as discussed above) and usage-based limitations such as the number of users, mailboxes, insights, alerts, uploads, etc. available in each plan. With fixed-price usage restricted tiers, many companies include feature differentiators, but primarily focus their upgrade path on usage restrictions.

The balance of how much emphasis is placed on features vs. usage/consumption will vary from business to business, but it is important to think about how customers will use your product throughout the various stages of adoption and growth.

In the Dasheroo example below, the main plan differentiators are based on the number of dashboards, insights, mashups, and alerts.

Similarly, Filestack differentiates their plans based on the number of file uploads, transformations, viewing bandwidth, upload size, and storage.

In both of these example, there are some feature differentiators but the upgrade path is primarily based on usage limitations. As their customers’ consumption needs grow, so will their Expansion MRR as customers advance to higher tiers.

Base Plus Usage Pricing

In the aforementioned sections, the upgrade paths mostly include a mix of features and usage restrictions lumped together in different tiers. So a business may need to upgrade for more dashboards (usage-based) but get team sharing (feature-based) as a byproduct. Vice versa, a business may upgrade for a feature that also removes usage limitations. These groupings can lead to missed Expansion MRR opportunity down the road.

Autopilot is a great example of providing upgrade paths and Expansion MRR opportunities for both feature and usage-based needs. They offer two main feature-based pricing plans—Base and Business:

The pricing of both plans is driven by the number of contacts that you need to manage:

When you break down their pricing, it simply boils down to many tailored variations (i.e. Base w/ 1,000 contacts, Base w/ 3,000 contacts, Business w/ 1,000 contacts, and so on), but presented in a manner that is much easier to digest. By isolating feature vs. usage-based pricing, there are more Expansion MRR opportunities because a customer can:

- Upgrade from Base to Business with no change in the number of contacts (upgrade focus is solely feature-based)

- Upgrade to a higher contact tier with no change in the core plan (upgrade focus is solely usage-based)

- Upgrade from Base to Business and to a higher contact tier (a double whammy)

According to Autopilot, “the Base and Business plans are optimized for two segments: those starting out with customer journey marketing and those who desire more sophisticated features…It is important to note that the Base plan is a fully featured service that offers tremendous value for money – not a handicapped plan designed to force customers up to our most expensive offering.”

Autopilot’s sentiment in that last sentence is an important one. Expansion MRR can’t occur without retention, and “handicapped plans” often don’t provide the value needed to retain customers. Remember, happy, paying customers make ideal upsell candidates (we discussed this point in our post SaaS Customer Success: The secret to reducing churn and increasing MRR).

“Per User” Pricing

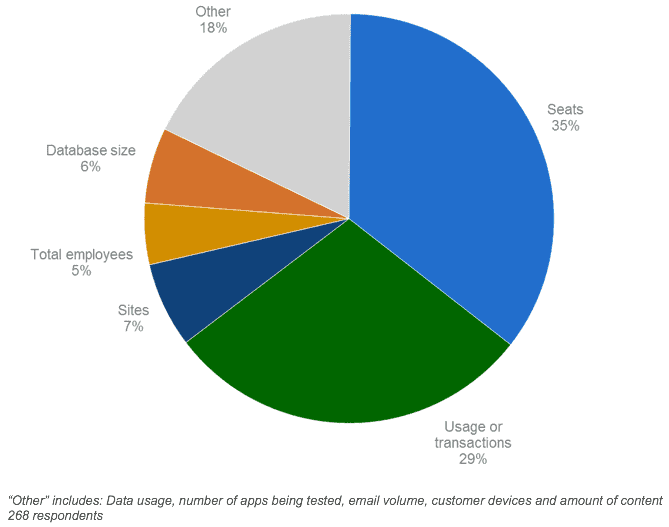

According to the Pacific Crest 2016 SaaS Benchmarking Survey, “Per Seat” Pricing (sometimes referred to as “Per User” Pricing) was the most common pricing structure of the SaaS companies surveyed:

Salesforce is the quintessential poster child for Per Seat Pricing:

Markodojo CEO and founder Joel York explains how Salesforce utilizes their usage based pricing structure to increase Expansion MRR:

“Salesforce has standard user-based subscription pricing, but then breaks its subscriptions into carefully designed modules of increasing functionality. If you’ve ever been a Salesforce customer, then you know that 90% of the upgrade process consists of you, as the customer, repeatedly bumping into the limits of your current subscription. When you need more users, or you need the capabilities of enterprise over professional, then you go online or pick up the phone and order them. The cost to Salesforce is minuscule compared to the original customer acquisition cost (which includes not only customers, but all the prospects that didn’t buy).”

In the earlier days of SaaS, Per Seat pricing was typically leveraged by larger, more enterprise-focused offerings. Over the past decade, it has quickly become a de facto standard for businesses of all shapes and sizes. Some modern day examples include:

Per User pricing is an obvious choice for businesses that are heavily driven by team member access (i.e. CRMs, help desks, team collaboration tools, project management tools, etc.). The success of future proofing your plans for Expansion MRR will rely on company/team growth and cross functional team adoption. For example:

- A CRM may start with the sales team but can expand into marketing, support, and customer success teams

- A help desk may start with the support team but can expand into product, sales, and customer success teams

- A project management tool may start with one product team but can expand into all functions of product/development plus other teams such as marketing

Once isolated teams are committed to using your product, it is mission critical for Expansion MRR that you promote ways to spread adoption throughout other cross functional teams within an organization. The more users added, the more Expansion MRR achieved!

Add-ons & Extras:

Finally, when structuring your pricing plans with customer expansion paths in mind, consider the value add of relevant add-ons and extras. Our focus in this post is increasing Expansion MRR, so the additions we’re talking about are recurring (not one-time add-ons).

For instance, HubSpot offers 3 main plans for their marketing software plus the following add-ons:

Premium support, continuing education/customer success, and integrations are also common SaaS add-ons. Add-ons often have a narrower appeal but high value, which is a nice expansion path for customers that want or need the extras.

Wrap-up

There are many considerations to take into account when determining the best pricing models for your SaaS business. Plans must provide enough value to generate happy, paying customers, while your upgrade paths must be structured in a way that aligns with customers’ growing needs.

Remember, when your Expansion MRR is greater than your gross churn you’ve achieved the SaaS dream: negative churn. The value of your existing customer base is growing without factoring in any new business.

It’s important to note that experimenting with your pricing models takes time and often includes more complicated product configurations. Maxio was built to remove the complexity around creating, launching, and testing product configurations, all of which allow subscription-based businesses to move faster and grow quicker.

Give our Sales or Support teams a call at 1.800.401.2414 to learn more, or sign up for a demo to test drive Maxio for free.