Calculating monthly recurring revenue (MRR) is simple enough for most B2C subscription businesses that have flooded the market in recent years.

These consumer-focused subscription services — the ones delivering things like smoothie kits, socks and razors to their customers’ doorsteps each month — tend to have much simpler pricing structures, such as 2-3 tiers of plans. Calculating the MRR for those companies just requires taking that typical monthly payment and multiplying it by the active number of active subscribers.

Many B2B SaaS companies used to take a similar approach to calculating MRR. But, as we wrote in our post Think Relationships, Not Subscriptions, SaaS pricing has become much more complex in recent years. These days, SaaS customers pay a host of one-time fees and metered fees, not to mention the discounts and other price variations that complicate calculations.

This complexity has caused some confusion about how SaaS businesses should calculate MRR. It’s imperative to get this crucial measurement right in order to accurately assess the health of your business. In this article, we’ll discuss:

- The purpose of MRR as a metric

- Factors that skew MRR

- How to get more out of your MRR metrics

Understanding the Purpose of MRR as a Metric

Recurring revenue is the lifeblood of a SaaS business.

When customers opt-in to a monthly payment, it allows companies to predict their future revenue with a level of accuracy that retail-focused businesses can only dream of.

For SaaS businesses in particular, MRR is one of the best predictors of growth and company health. (For that reason, it often factors heavily into investors’ estimation of a company’s value.)

MRR might sound like a technical accounting term, but it’s not. Financial reports aim to calculate revenue with precision and accuracy and, in general, are calculated at the end of the month. By contrast, the MRR is future-focused and there can be more flexibility in the way it’s calculated.

In general, we like to think of the MRR as the amount of revenue that businesses can reasonably expect to collect from subscribers each month. Put another way, it’s a measure of expected monthly recurring revenue based on snapshots of your subscriber base.

Factors That Skew MRR

Here are the main stumbling blocks that prevent SaaS businesses from getting an accurate read on their MRR.

Anticipated revenue from trial customers

We all wish that 100 percent of the customers who sign up for the trial versions of our software would convert to paid users. Of course, the real conversion rate for the average company is far different.

That’s why including anticipated revenue from trial users in MRR estimation makes the metric less accurate.

Paused accounts

When users pause their accounts, should their revenue be taken out of the MRR calculations right away? Your business needs to distinguish the difference between the following:

- customers who have simply paused their accounts for a short predetermined amount of time

- customers who are technically canceling their accounts for the present but might start up again sometime in the future

“Paused” accounts are still technically active subscribers, so their monthly revenue is still included in MRR. Canceled clients’ revenue gets removed, but if they join again a short time after that cancellation, (at Maxio, this increment is 90 days) their revenue is also flagged as “reactivation MRR.”

One-time payments

Here’s a reminder that the middle “R” in MRR stands for “recurring.” By definition, any one-time fees such as setup fees or training fees should not be included in the MRR metric, even if you charge them consistently to each new customer.

The MRR should help you understand how much money comes in from your subscriber base each month. One-time fees muddle that clarity.

Missed payments

When a customer misses a payment or their credit card payment fails, it might seem like you should remove that payment from the MRR. However, this skews the metric in ways you might not anticipate.

First of all, these late or failed payments often do come in at some point within the month, which prompts you to add the payments back in.

But also, because the MRR is intended to be more of a “snapshot” of the monthly payments your customers are responsible for rather than a hard-and-fast financial report, you should get credit in the MRR for that expected revenue.

Discounts and credits

Your MRR calculation will differ drastically from the actual revenue you collect in a given month if you don’t take discounts into account.

So, when you give your customers discounts, you should deduct those from your MRR calculation accordingly. (For example, if you charge a customer just $50 after applying their discounts, you should calculate $50 toward your MRR. That number changes when the discount ends to reflect the full amount.)

An exception to this is when you give your customers a one-time credit, such as $20 back on their bill to make up for a mistake you made. In Maxio, “comps” don’t affect MRR unless they’re greater than the total monthly payment for that customer.

Early and annual payments

What happens to your MRR if your customer pays upfront for the year or the quarter?

Thanks to regulations like ASC 606 and IFRS 15, many companies are legally obligated to use accepted GAAP revenue recognition principles. That means that revenue should not necessarily be recognized by companies right when the cash comes in. Instead, they should be recognized when the money is earned. (In the accounting world, this is called “accrual accounting.”)

As we mentioned in our eBook on Revenue Management for SaaS companies, “revenue recognition” is complicated for SaaS businesses, which technically “earn” their money 24/7. How you decide to recognize cash in your financial statements is up to you. But breaking these larger payments down into monthly installments is a no-brainer for the sake of an accurate MRR figure.

Metered fees and quantity-based fees

As we mentioned in our full blog post about metered fees in revenue reporting, opinions are split on whether or not to include metered fees or “usage-based fees” in MRR.

Whether you choose to do so depends on how your business levees these metered fees.

Refunds

Should you retroactively remove payments from MRR if they’ve been refunded to a customer?

We don’t think so. The MRR should represent a “present monthly value” and represent what a customer and your overall customer base is worth moving into the future – refunds should not affect that value.

Again, those refunds do affect cash flow, so we’re not saying you should ignore them completely. However, you should view refunds as a separate issue relevant to other financial calculations that can be analyzed in other financial reports.

How to Get More Out of Your MRR Metrics

MRR is a powerful KPI in and of itself. However, you’ll get even more out of this metric by breaking it down in helpful ways.

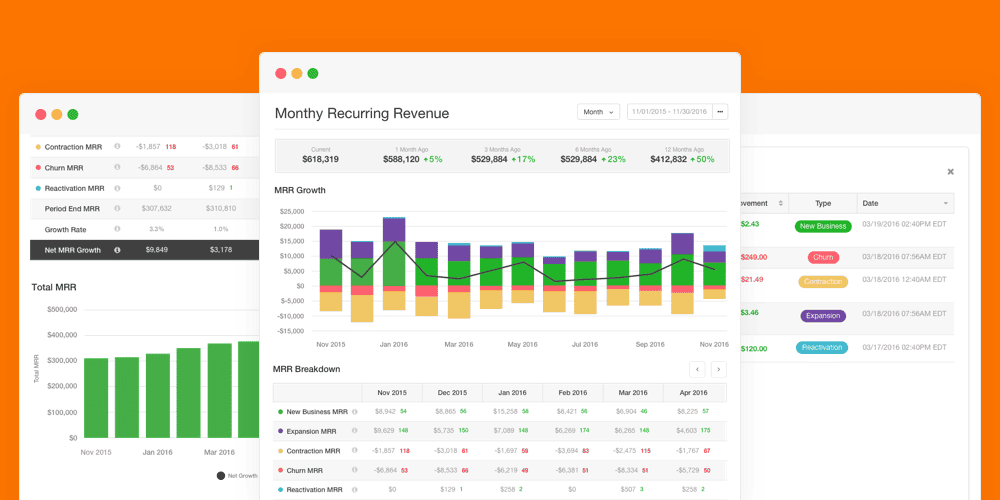

Your billing platform should be able to calculate the following types of MRR:

- New business MRR – Revenue dedicated to business obtained the same month

- Expansion MRR – Revenue from upgrades from the existing customer base

- Contraction MRR – Revenue lost from downgrades from the existing customer base

- Reactivation MRR – Revenue from clients who canceled but then signed back on

- Incremental usage MRR – Revenue from metered payments

The best billing platforms leverage the wealth of data they collect to enable customers to make smarter, data-driven decisions about the business. For example, Maxio displays MRR “movements” visually to make it easy for users to see how their MRR is being affected by various customer actions.

Maxio’s MRR Reporting

At Maxio, we understand how important MRR is to SaaS businesses. That’s why our customers get daily MRR emails that summarize the details regarding the health of their company. Users can also customize their MRR reports to make them more relevant to their business needs. For example, companies can decide whether to include revenue from metered services in their reports.

But how do you keep your MRR reports updated over time? Companies with other billing platforms (or no billing platform at all) must track and manually update this in a spreadsheet over time.

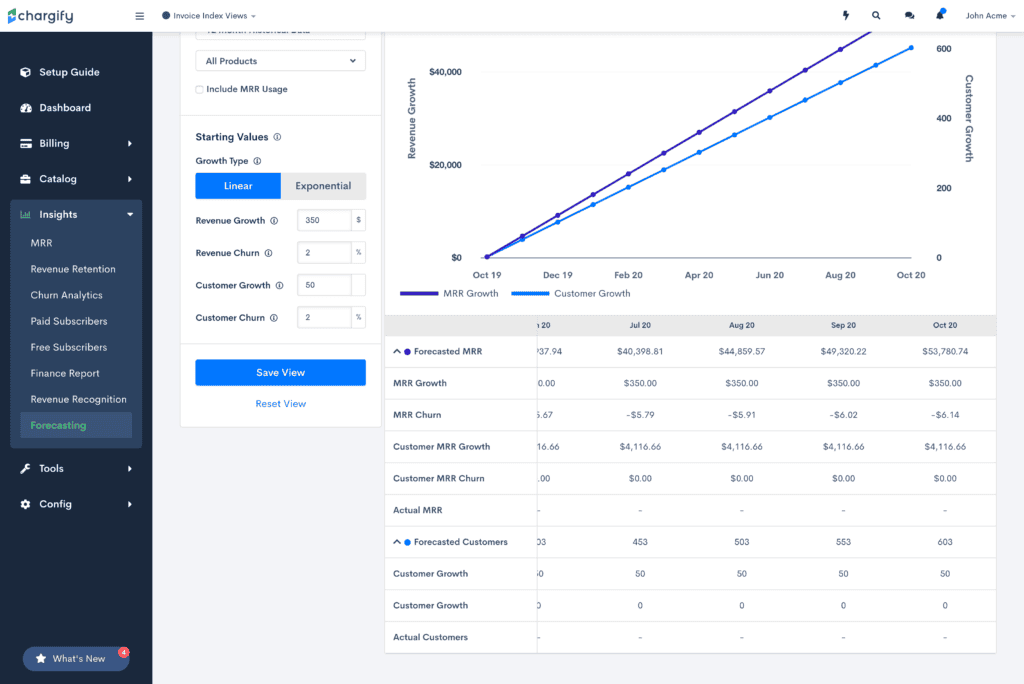

But not Maxio customers — we launched a powerful Revenue Forecasting Tool that allows companies to forecast their MRR using the tactics described above (as well as forecasted customer growth) and then track actual business performance against the forecast on-demand, automated and using actual company data.

According to the APQC, it takes companies up to 16 days each quarter, or more than two months each year, to complete a financial forecast. The Revenue Forecasting Tool cuts two months down to two minutes.

Maxio’s Revenue Forecasting Tool

If you want to see these reports for yourself, or if you have any questions about calculating MRR, reach out to one of our billing experts.