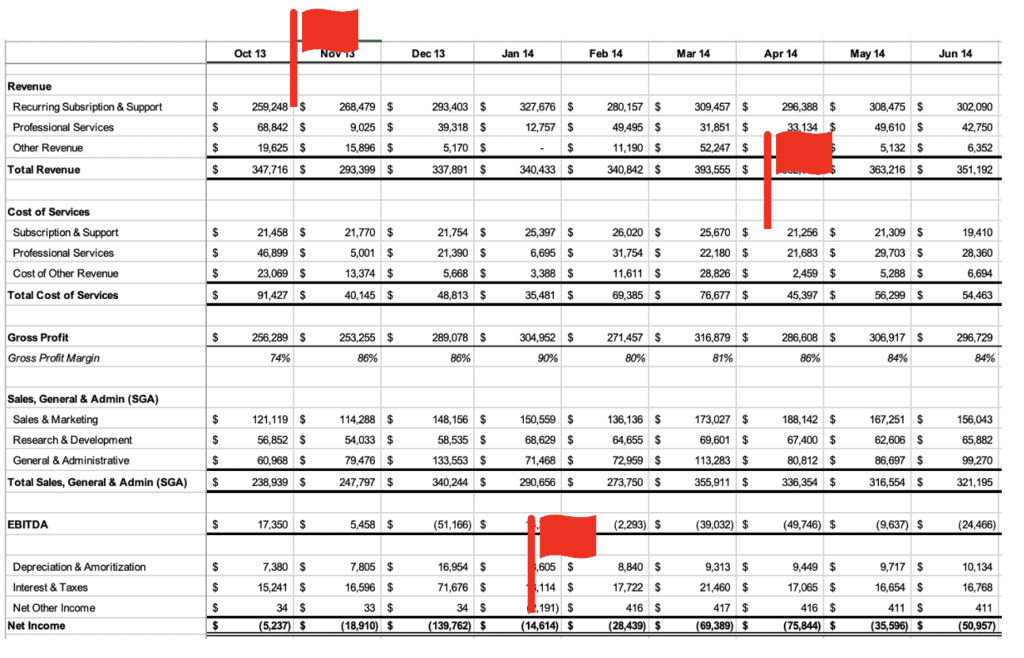

I have reviewed the financial statements of over a thousand SaaS companies, and certain red flags consistently stand out. These issues often stem from poor financial practices, insufficient processes, or a lack of experienced professionals in key accounting roles. Here are the most critical red flags to watch out for.

- A “mix” of cash and accrual accounting

- No bank reconciliations

- Inability to generate a connected income statement, balance sheet, and cash flow

- A separate MRR report

Mixing Cash and Accrual Accounting: A Recipe for Confusion

Cash accounting in SaaS makes revenue data noisy and calculating metrics difficult, but it can be manageable if managers and investors have reliable monthly data for year-over-year comparisons. However, the real problems arise when companies use a mix of cash and accrual accounting, particularly for revenue.

For instance, I recently had a client who deferred revenue on some contracts but not others. This inconsistency created uncertainty, and while the company initially received three investment term sheets, all deals fell apart during due diligence as investors struggled to understand the financials. Mixing accounting methods undermines trust and complicates decision-making.

Why Bank Reconciliations Matter: Cash Is King

Bank reconciliations validate the integrity of financial statements. Cash is the lifeblood of any business, and the bank knows exactly how much you have. Double-entry accounting ensures every debit and credit aligns with cash balances—but only if reconciliations are performed regularly.

I’ve seen two portfolio companies fall behind on reconciling cash, resulting in disastrous consequences. Both had to restate their financials, and investments were lost as a result. CEOs and investors should request to see reconciliations even if they don’t fully understand them—it’s a key indicator of financial discipline.

Disconnected Financial Statements: A Sign of Trouble

Generating a complete set of financial statements—income statement, balance sheet, and cash flow—is essential. These reports must connect seamlessly to provide a coherent picture of the company’s financial health. Companies relying on ad-hoc methods often struggle to produce accurate and integrated statements, which can raise red flags.

The cash flow statement, in particular, is an underutilized but vital tool in SaaS. For companies with pay-in-advance contracts, seasonality, or debt, it’s indispensable for understanding cash dynamics and operational sustainability. If a company can’t generate all three statements, it signals deeper issues in financial management.

Check out Todd Gardner’s on demand webinar with Maxio

Learn more about financial reporting red flags and how to avoid them.

The Danger of Separate MRR Reports

Monthly recurring revenue (MRR) is fundamental to SaaS business models, but it must be integrated into the accounting system. A separate MRR report, disconnected from the income statement, is a significant red flag. Managers and investors should rely on validated numbers from the income statement, not isolated spreadsheets.

I’ve seen companies use disconnected MRR reports that lead to conflicting data and decision-making challenges. The income statement’s recurring revenue figure ties directly to cash and is validated within the broader financial system. Separate reports introduce unnecessary risk and complexity.

Tools and Talent: The Backbone of Financial Hygiene

While tools and systems are essential for accurate and timely financial reporting, they require skilled professionals to use them effectively. Some of the worst financial reporting I’ve encountered came from companies using sophisticated tools like NetSuite without the necessary expertise.

SaaS companies don’t need to scale their finance teams dramatically. With a few experienced professionals and the right tools, finance functions can scale efficiently and effectively to meet the needs of a growing business.

Final Thoughts

Maintaining financial hygiene is critical for SaaS companies aiming to scale and attract investment. Red flags like mixed accounting methods, missing reconciliations, disconnected financial statements, and separate MRR reports can erode trust and derail growth opportunities.

What other red flags have you seen in SaaS financial reporting? Let’s discuss and learn from one another’s experiences.