Maxio Payments

End-to-End Payments Lifecycle Management

Maxio Payments automates disputes, reconciles deposits, and ensures seamless payment operations—so you can close the books faster with less manual effort.

Why your current payment operations are holding you back

Managing payments isn’t as simple as sending an invoice and waiting for the funds. Payments can create more headaches than solutions between disputes, rejected payments, and manual reconciliations.

Wasted time

Hours spent manually reconciling deposits and resolving discrepancies between systems.

Lost revenue

Chargebacks and unrecorded payments result in missed income and revenue leakage.

Frustrated teams

When systems don’t sync, finance and customer-facing teams spend more time troubleshooting than adding value.

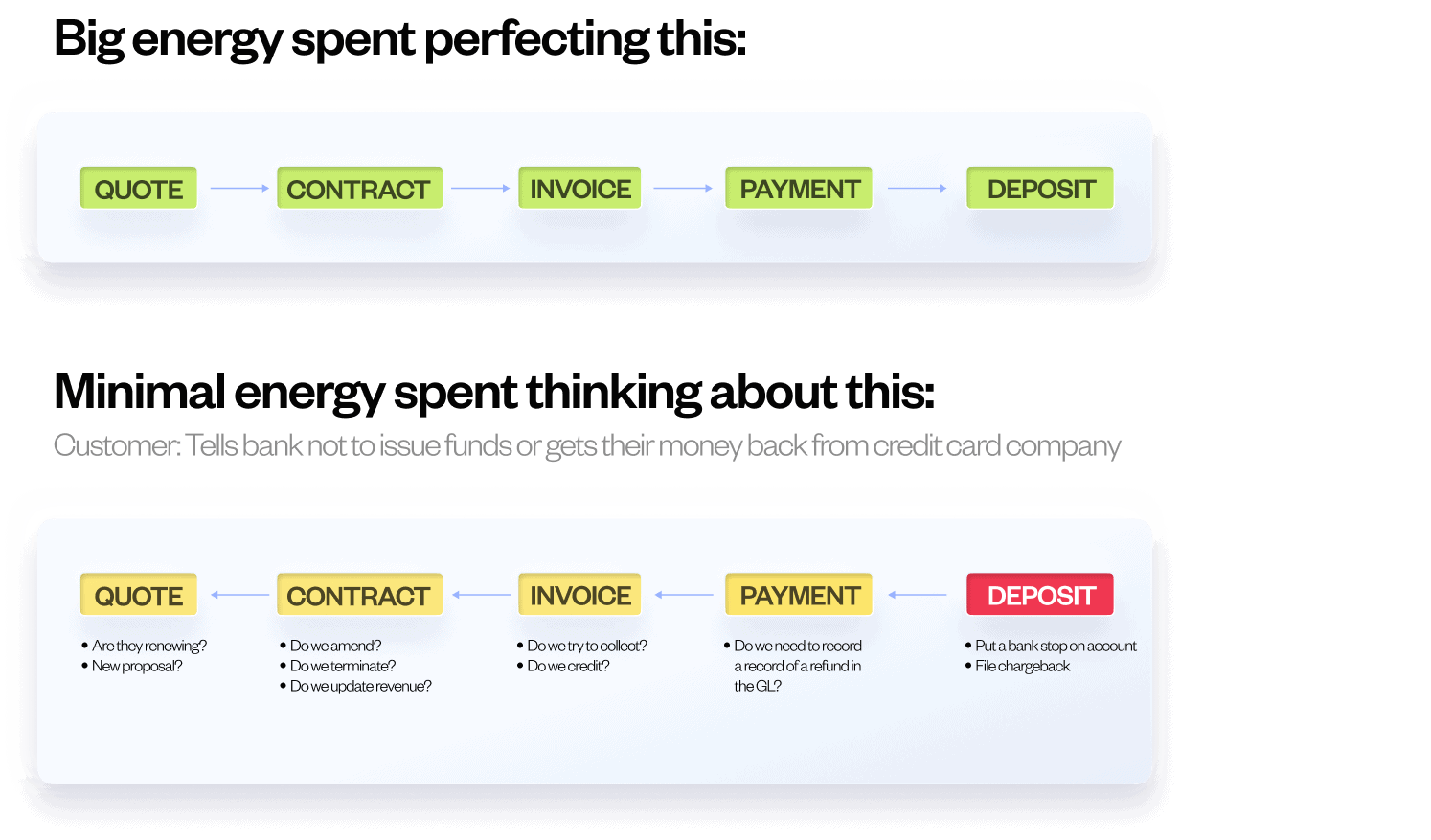

When the payments flow reverses, will you be ready?

Most finance teams focus on perfecting the quote-to-deposit cycle, but what about when things go in the opposite direction? Chargebacks, refunds, and disputes create reconciliation and revenue recognition nightmares.

Chargebacks immediately come out of your bank account. To reconcile the deposit, you need to connect the chargeback to a negative payment.

With a negative payment, the question now arises: Is this a credit or a refund? You’ll need to ensure the proper object is created to match payments to billings.

Depending on whether it’s a credit or refund directly impacts your contract and revenue recognition. Do you simply credit and rebill? Or do you need to adjust revenue and/or your bad debt expense?

Maxio Payments — Controller-approved automation and insights

With Maxio Payments, finance and accounting teams no longer have to compromise between accuracy and efficiency. Every feature is designed to reduce manual effort, improve visibility, and keep your financial engine running smoothly.

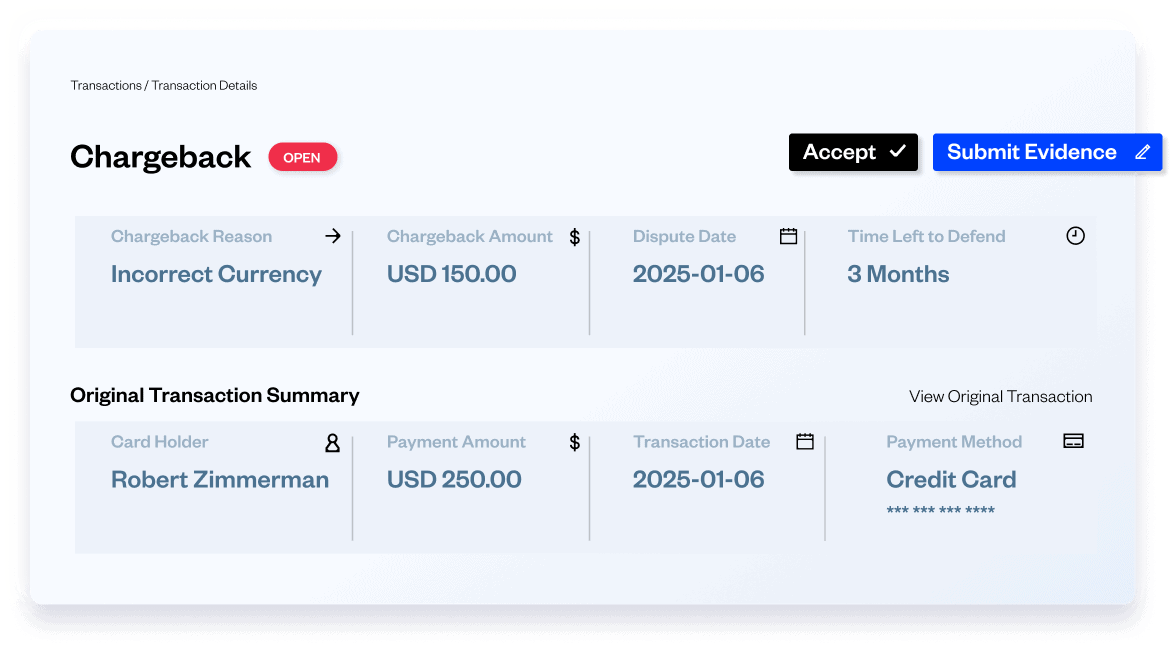

Dispute automations

Cut down on the time spent managing disputes with automated workflows that identify, track, and process chargebacks. Recover revenue faster without getting bogged down in administrative overhead.

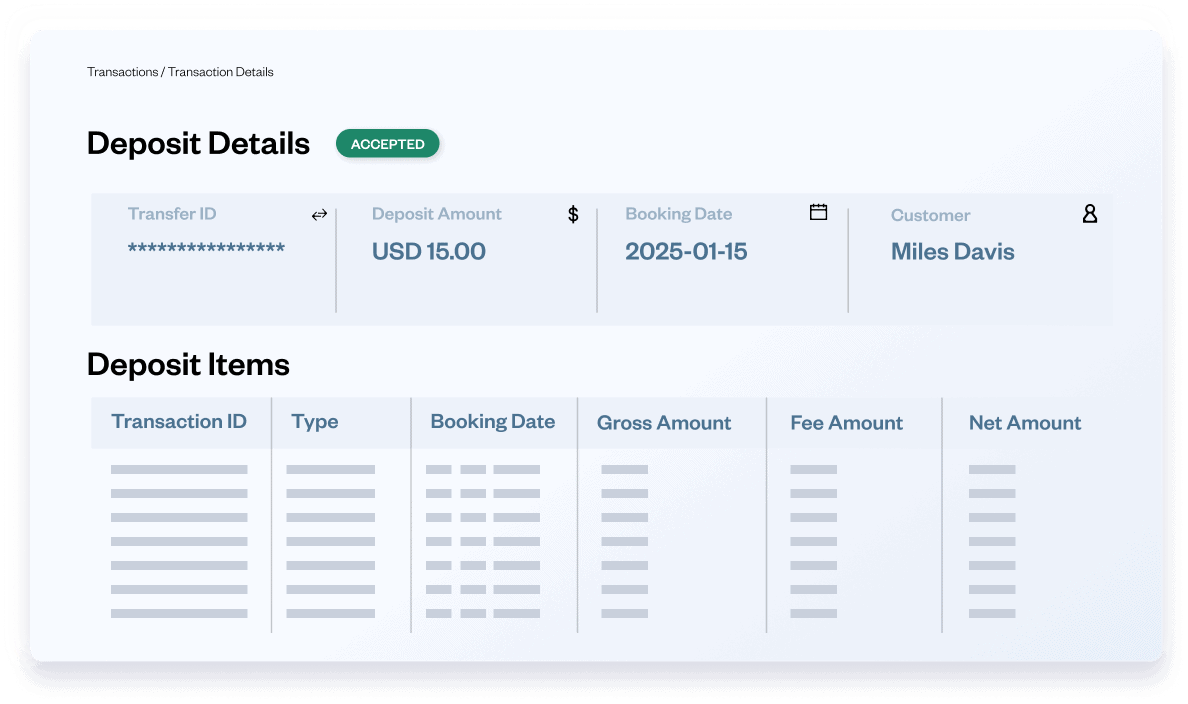

Automated reconciliations

Sync deposits with your GL in real time so you can spot and resolve discrepancies instantly. This will reduce manual reconciliations and accelerate your month-end close with confidence.

Two-way links across systems

Navigate between payment records, invoices, and contracts with ease, creating a unified view of your financial operations. Eliminate silos and ensure every payment is accounted for without spending hours in spreadsheets.

There is no better time than the present to get into a system like Maxio. If you want to continue to grow, you will need a system in place, do it now before your historical data becomes overwhelming. The devil you know is not always better than the devil you don’t.

Trevor Swim, Ninjacat

Director of Finance

Maxio Payments FAQs

Maxio Payments offers seamless two-way links with your CRM and GL. This ensures deposits, invoices, and payment records sync in real time, reducing manual updates and eliminating discrepancies between systems.

Maxio uses Interchange Plus Pricing for its Payments product. Interchange Plus Pricing is transparent. It separates card network fees from Maxio’s service fees, so you only pay for what you use. This helps you save on high-cost transactions, such as international cards or manually entered payments.

Yes! Maxio Payments includes built-in dispute automation. We streamline the entire process—from identifying disputes to notifying you of outcomes—so you can recover revenue faster while minimizing time spent on manual tasks.

Maxio makes migrations seamless. We use a secure, step-by-step process to transfer payment tokens from your existing gateway using PCI-compliant best practices. This ensures uninterrupted service for your customers while validating active cards for accuracy.

Yes, we are expanding support for international currencies and payment methods. Maxio Payments helps you scale globally by ensuring compliance with regional requirements so you can confidently transact in multiple currencies.

Bank Payments are the most effective way to reduce your overall processing fees. Most card fees come from card brands (ex: VISA, Mastercard, AMEX, etc.). Maxio helps you qualify for the lowest card fees possible by sending Level 2 & 3 information (e.g., tax details, item descriptions) to the networks which can save you considerable amounts on eligible transactions.

Additionally, Maxio offers volume-based discounts which can help you save more as you grow on the Maxio platform.

Absolutely! Maxio Payments provides detailed insights into failed payments, such as reasons for rejection (e.g., exceeded card limits). This allows you to take immediate corrective action, like retrying payments or contacting customers.

Maxio offers in-house support with a dedicated payments team. Whether you’re onboarding, managing disputes, or troubleshooting integrations, you’ll work directly with our experts—not a third-party service.

Explore the #1 finance & billing platform for B2B SaaS

Subscription management

Streamline every step of your customer’s lifecycle, from onboarding to renewal and beyond

Revenue recognition

Help your finance team sleep at night with revenue recognition built for the complexity of B2B SaaS.

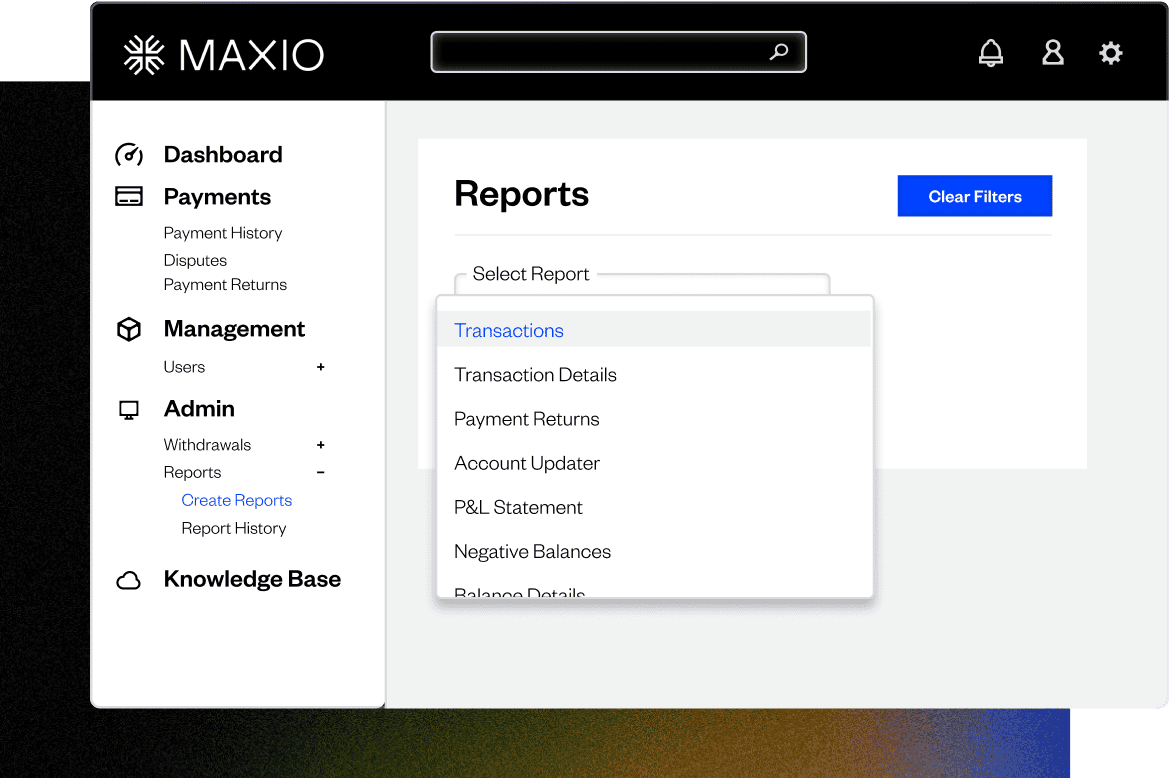

Reporting and SaaS metrics

Never lose sight of your business performance with accurate, reportable SaaS metrics.