Maxio Institute Q3 2024

B2B Growth Report: Private Company Benchmarks & Analysis

Private B2B companies continue to flourish in Q2 2024. The Maxio Institute’s B2B Growth Report provides an in-depth exploration of the private B2B market, analyzing the diverse growth patterns across the sector during the first half of the year.

Table of contents

- Key Takeaways

- The State of the B2B Market

- Defining Pricing Models – Usage-Based Pricing vs. Fixed-Rate Pricing

- Part 1: Growth Rates

- Part 2: Invoice Amounts

- Part 3: Industries

- Points to remember

- About the Maxio Institute

The State of the B2B Market

In our Q1 report, we discussed the dual nature of the US economy, a theme that has continued throughout Q2. Many quantitative signals point towards improvement, but consumer sentiment lags behind. The issue has even become political as incumbent Democrats seek recognition for economic gains, and Republican challengers harken back to pre-COVID nostalgia.

The truth is somewhere in the middle. Certain forward-looking investments like the stock market indices have thrived on news of cooling inflation rates and what’s viewed as an increasingly likely soft landing for the economy. While consumers, whose spending makes up 68% of the economy, are grappling with baked-in inflation and high interest rates. When everything costs over 20% more than it did five years ago, housing is at an all-time high, and covering a median US mortgage payment of $2200 requires an income of nearly $95K, it’s hard for these consumers to feel “bullish” even if the S&P 500 hits another record close.

Businesses are affected by the same forces as consumers: high interest rates and cumulative inflation. To survive in a funding-scarce market, cost-cutting and cash conservation have become the CFO’s mantra. But that doesn’t mean the market has stalled.

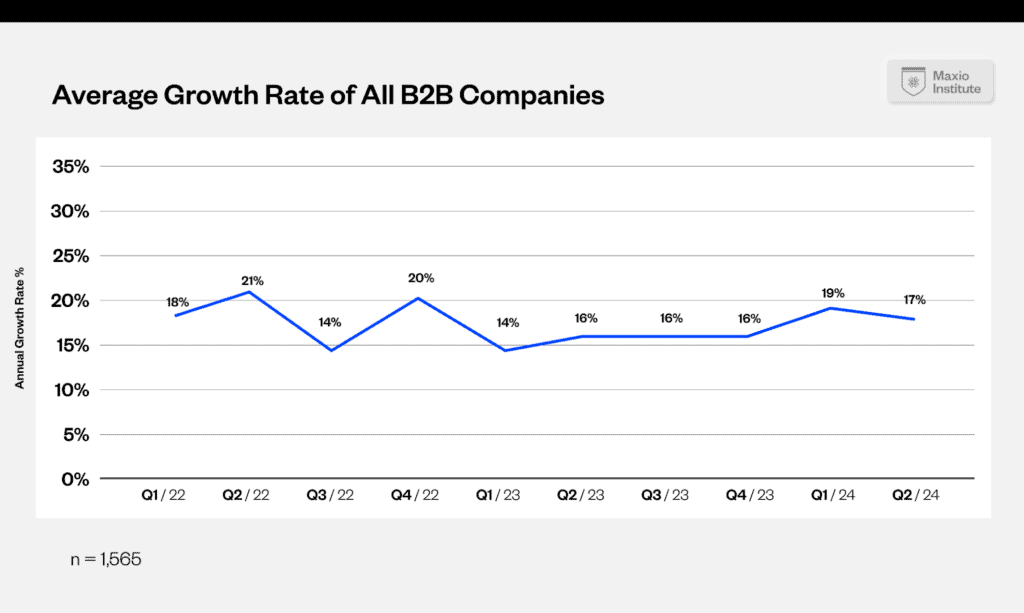

Encouragingly, the post-COVID B2B market is continuing to grow. Q2 was a slightly slower quarter than Q1, but viewing the trend across the last 10 quarters shows a remarkably consistent growth rate. The average growth rate for B2B companies since the beginning of 2022 is 17%, exactly equal to this quarter’s result.

While this growth trajectory has been the norm at smaller B2B firms, it would be the envy of many larger, public companies. The member of the S&P 500, for example, have an average revenue growth rate of 6.9% over the last 5 years and are projected to grow by 5.5% in 2024.

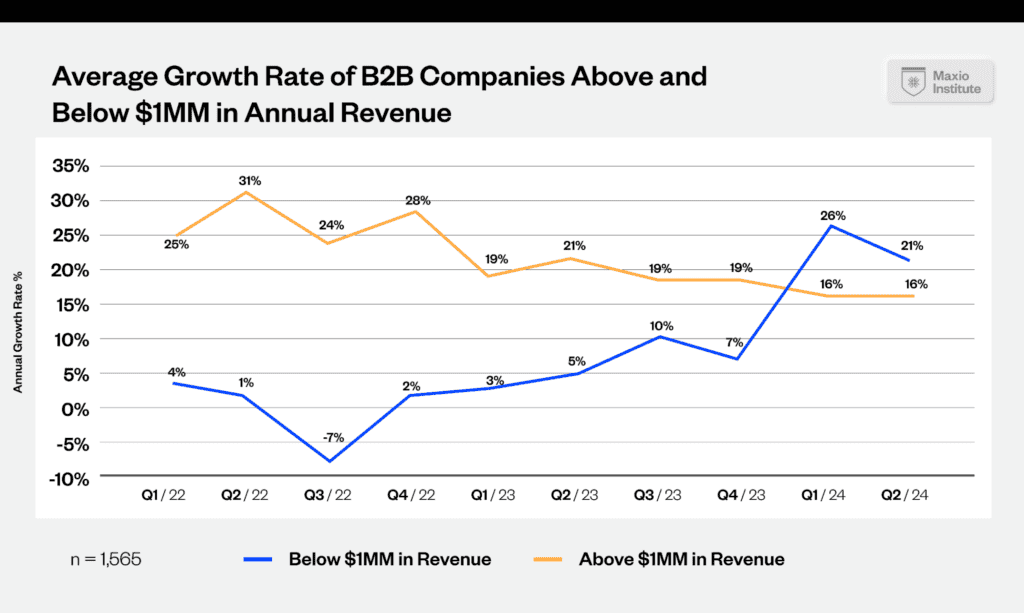

Although the overall B2B market is showing consistent performance, segmenting the B2B market into two groups, businesses with over $1MM in annual revenue and businesses with under $1MM in annual revenue, provides additional insights, both positive and negative.

First, the bad news: unfortunately, larger businesses over $1MM are growing more slowly. While they had previously outperformed their smaller counterparts, they now appear to be mirroring the overall market’s consistent, but moderate, growth pattern.

The good news is that small businesses, which had suffered relatively anemic growth during 2022 and 2023, have begun to outperform their larger counterparts in 2024. We noticed the dramatic jump in sub-$1MM growth rates in Q1 but were unsure whether that data was an outlier or a new trend. We are excited to see those businesses continue to succeed in Q2 and believe that a second quarter of strong growth for them makes it much more likely that this is an actual trend.

This report continues with a detailed analysis of billing data from over 2,000 of Maxio’s B2B customers, representing around $16 billion in annualized billings for Q2 2024. We’ll take a closer look at critical growth insights, segmented by:

- Growth Rates

- Invoice Amounts

- Industries

B2B Growth Report: Private Company Benchmarks & Analysis Q2 2024

In this edition, we will cover:

- State of the B2B Market: Current trends and forecasts.

- Pricing Models: Deep dive into usage-based vs. fixed-rate pricing.

- Growth Rates: Analyze growth across various revenue levels and pricing models.

- Invoice Amounts: Understand the invoicing trends for usage-based and fixed-rate companies.

- Industry Insights: Detailed analysis of booming and struggling sectors, with a special focus on AI.

Get the full report

About the Maxio Institute

The Maxio Institute is a research arm of Maxio, the #1 billing and financial operations platform for B2B SaaS businesses. Through our work with over 2,000 subscription businesses, we’re uniquely positioned to provide data-backed insights and benchmarks. Our goal is to help B2B SaaS businesses of all sizes gain an accurate picture of the current market, so they can make informed decisions about their future.