Maxio Institute Report

The Growth State of B2B SaaS Businesses in June 2024

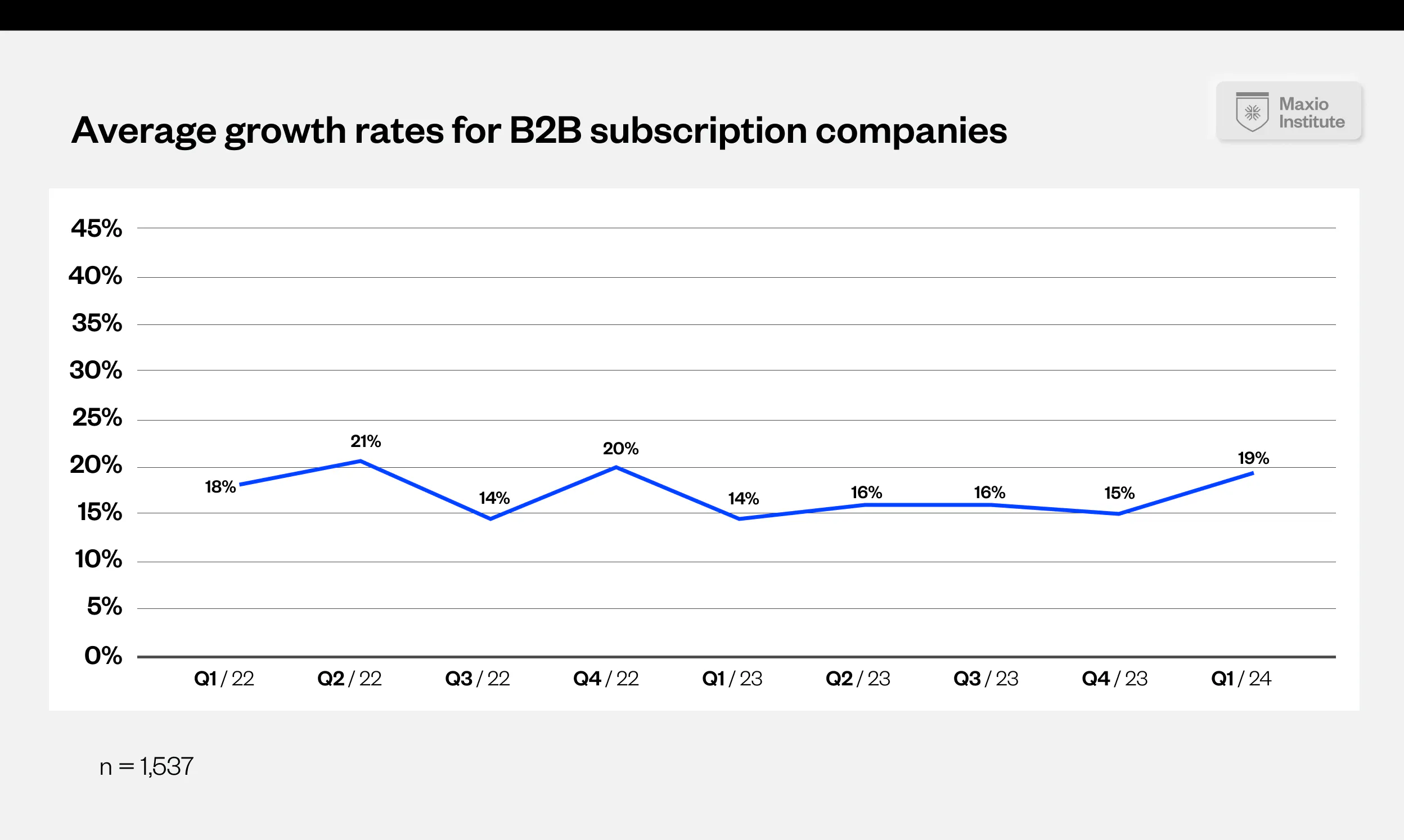

According to the anonymous billing and pricing data from Maxio, the average growth rate across our customer base has improved to 19% in Q1 2024 from 15% in Q4 2023. In this report, we’ll delve into who is experiencing this positive trend, based on pricing model, size, and industry, and which are still struggling.

Table of Contents

- The State of the B2B SaaS Market

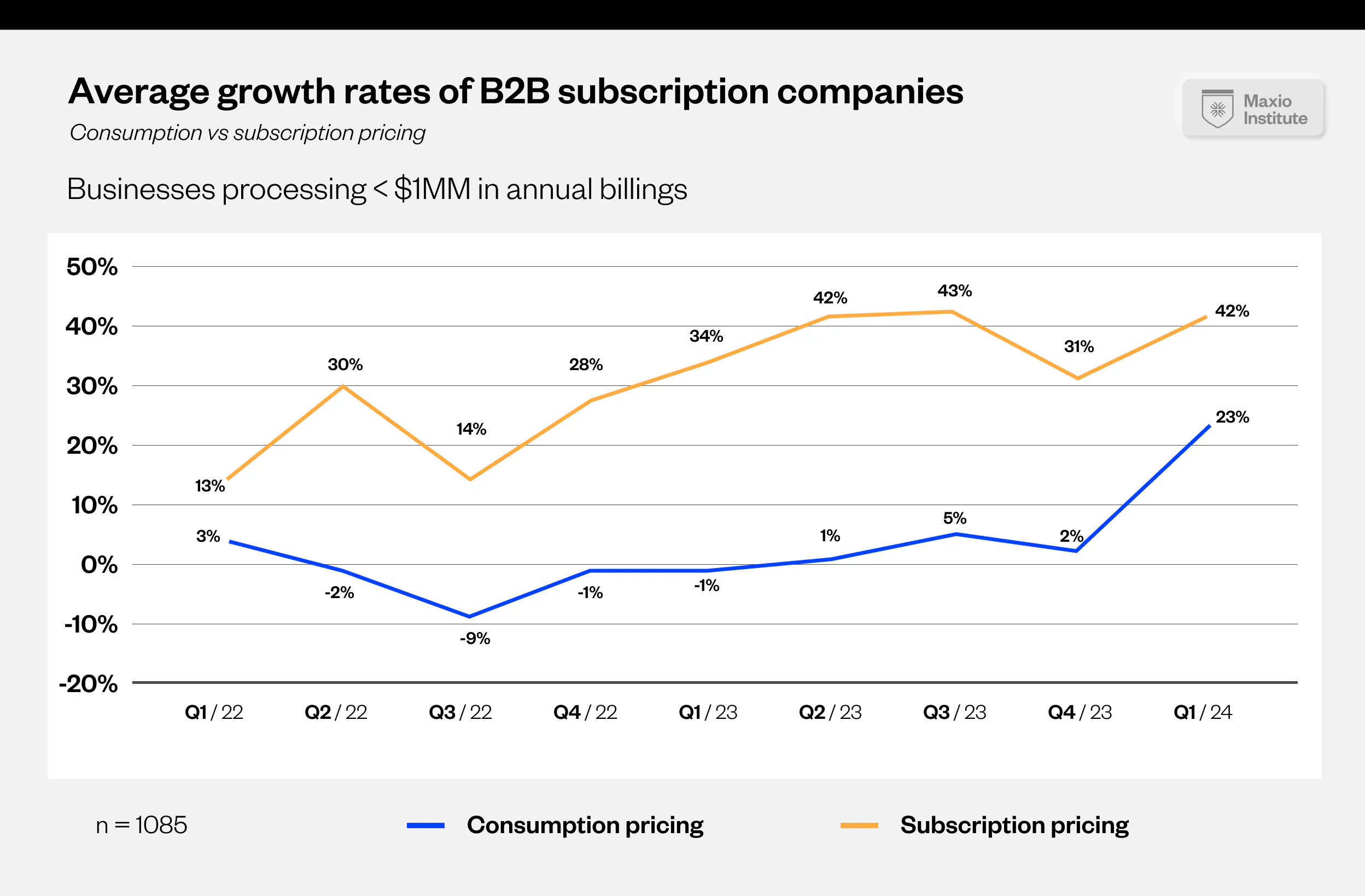

- Consumption vs. Subscription Pricing Models at B2B SaaS Companies Below $1MM in Revenue

- Consumption vs. Subscription Pricing Models at B2B SaaS Companies Above $1MM in Revenue

- Growth Rates by Company Size

- Industry Analysis

- Industries Booming in Q1 2024

- Industries Struggling in Q1 2024

The State of the B2B SaaS Market

2024 has brought a complex and somewhat contradictory economic landscape. On one hand, the labor market has proven surprisingly resilient, with unemployment rates remaining remarkably low. The robust employment situation contributes to strong consumer spending and economic stability. However, the specter of persistent inflation looms large, eroding purchasing power and prompting central banks to maintain elevated interest rates. These high interest rates, while intended to curb inflation, are also placing a significant burden on borrowers, increasing the cost of capital for businesses and consumers alike.

In the B2B sector, this economic duality is reflected in a similar divergence of outcomes. Our data reveals that while the overall average growth rate for all B2B SaaS companies has experienced an uptick (from 15% in Q4 2023 to 19% in Q1 2024), a closer examination reveals a more nuanced picture. The overall growth is primarily attributable to the improved performance of smaller businesses, specifically those with annual revenues under $1 million.

The Current State of SaaS Growth

In this report, we present an update on the overall state of today’s B2B subscription marketplace based on the actual billing data of over 2,000 B2B SaaS companies. We discuss:

- We may be emerging from the B2B SaaS recession, with the average growth rate across our customer base improving to 19% in Q1 2024.

- Much of the observed growth is driven by companies with under $1MM in annual revenue.

- Larger companies with consumption billing models showed increasing growth rates, indicating a preference for variable, consumption-based investments during economic uncertainty.

Get the full report

About the Maxio Institute

The Maxio Institute is a research arm of Maxio, the #1 billing and financial operations platform for B2B SaaS businesses. Through our work with over 2,000 subscription businesses, we’re uniquely positioned to provide data-backed insights and benchmarks. Our goal is to help B2B SaaS businesses of all sizes gain an accurate picture of the current market, so they can make informed decisions about their future.